Answered step by step

Verified Expert Solution

Question

1 Approved Answer

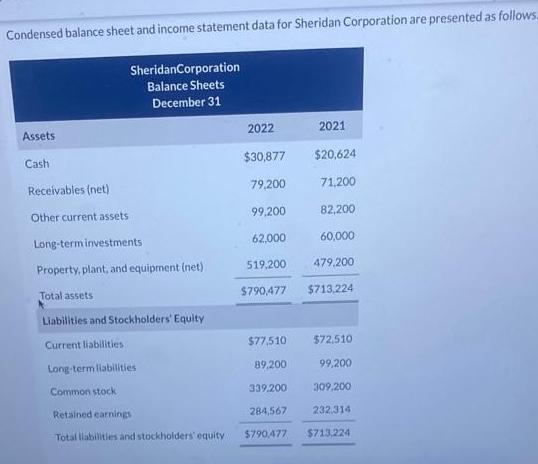

Condensed balance sheet and income statement data for Sheridan Corporation are presented as follows. Assets Cash SheridanCorporation Balance Sheets December 31 Receivables (net) Other

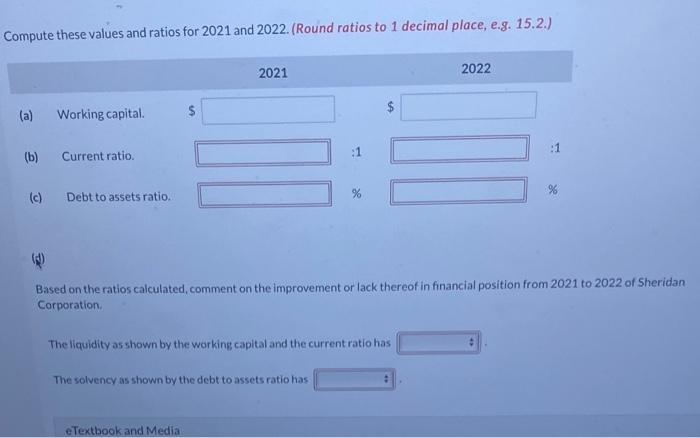

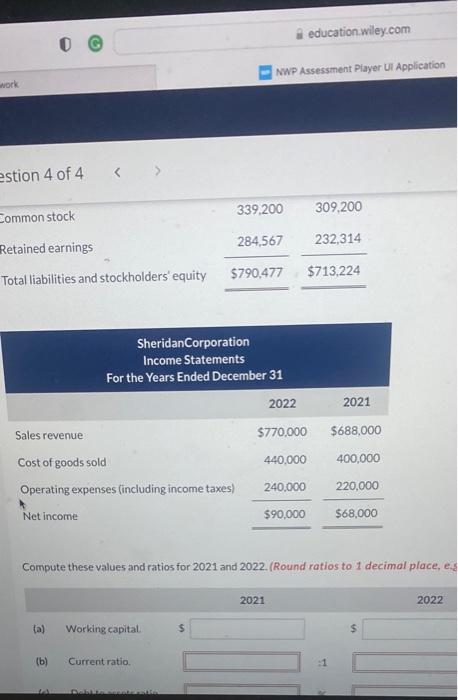

Condensed balance sheet and income statement data for Sheridan Corporation are presented as follows. Assets Cash SheridanCorporation Balance Sheets December 31 Receivables (net) Other current assets. Long-term investments Property, plant, and equipment (net) Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders equity 2021 $30,877 $20,624 79,200 71,200 99,200 82,200 62,000 60,000 519,200 479,200 $790,477 $713,224 2022 $77,510 89,200 339.200 284,567 $790,477 $72,510 99,200 309.200 232,314 $713,224 Compute these values and ratios for 2021 and 2022. (Round ratios to 1 decimal place, e.g. 15.2.) (a) Working capital. (b) (c) Current ratio. Debt to assets ratio. 2021 % Based on the ratios calculated, comment on the improvement or lack thereof in financial position from 2021 to 2022 of Sheridan Corporation, The liquidity as shown by the working capital and the current ratio has The solvency as shown by the debt to assets ratio has eTextbook and Media 2022 work estion 4 of 4 < > Common stock Retained earnings Total liabilities and stockholders' equity Net income Sales revenue Cost of goods sold Operating expenses (including income taxes) (a) (b) A SheridanCorporation Income Statements For the Years Ended December 31 Working capital. Current ratio. Debt to seenteratio $ NWP Assessment Player Ul Application 339,200 284,567 $790,477 $713,224 2022 $770,000 440,000 240,000 Compute these values and ratios for 2021 and 2022. (Round ratios to 1 decimal place, es education.wiley.com $90,000 2021 309,200 232,314 2021 $688,000 :1 400,000 220,000 $68,000 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ratios a Working Capital 2021 Current Assets Current Liabilities 713224 72510 640714 2022 Current As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started