Answered step by step

Verified Expert Solution

Question

1 Approved Answer

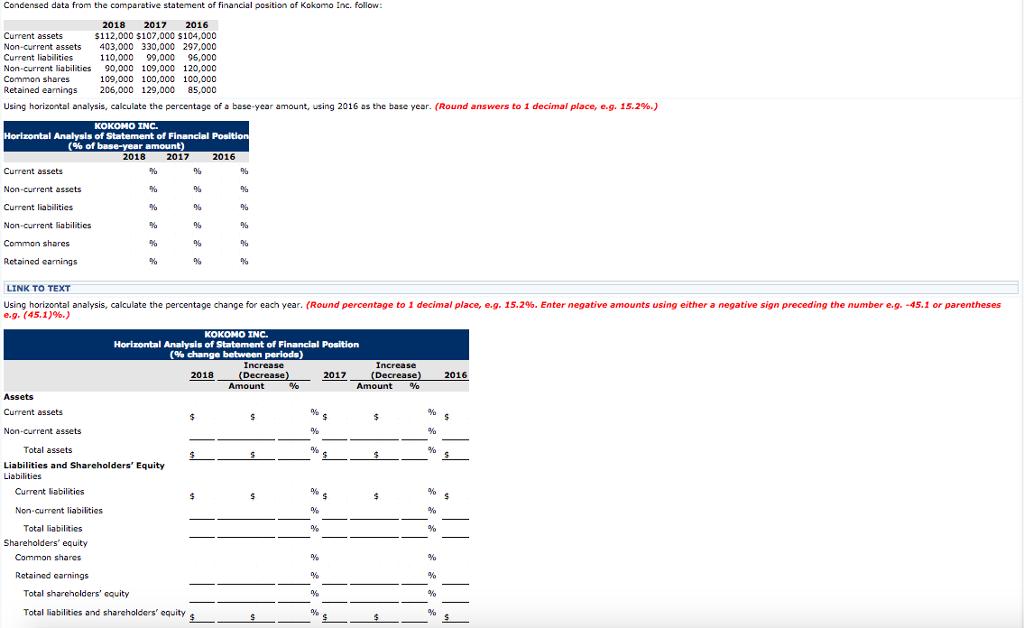

Condensed data from the comparative statement of financial position of Kokomo Inc. follow: Current assets Non-current assets Current liabilities Non-current liabilities Common shares 2018

Condensed data from the comparative statement of financial position of Kokomo Inc. follow: Current assets Non-current assets Current liabilities Non-current liabilities Common shares 2018 2017 2016 $112,000 $107,000 $104,000 403,000 330,000 297,000 110,000 99,000 96,000 90,000 109,000 120,000 109,000 100,000 100,000 Retained earnings 206,000 129,000 85,000 Using horizontal analysis, calculate the percentage of a base-year amount, using 2016 as the base year. (Round answers to 1 decimal place, e.g. 15.2%.) KOKOMO INC. Horizontal Analysis of Statement of Financial Position (% of base-year amount) 2018 2017 2016 Current assets Non-current assets Current liabilities Non-current liabilities Common shares Retained earnings % Assets Current assets % % % % % 06 96 Non-current assets Total assets Liabilities and Shareholders' Equity Liabilities Current liabilities Non-current liabilities Total liabilities Shareholders' equity Common shares 96 % 96 96 9 96 $ % Retained earnings Total shareholders' equity Total liabilities and shareholders' equity s % LINK TO TEXT Using horizontal analysis, calculate the percentage change for each year. (Round percentage to 1 decimal place, e.g. 15.2%. Enter negative amounts using either a negative sign preceding the number e.g. -45.1 or parentheses e.g. (45.1) %.) 9 % KOKOMO INC. Horizontal Analysis of Statement of Financial Position (% change between periods) 2018 % Increase (Decrease) Amount S $ % % % % % % % % 2017 $ $ Increase (Decrease) 2016 Amount % % % % % % % % % % S $

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

For First part of the answer Base year will be taken as Year 2016 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started