Answered step by step

Verified Expert Solution

Question

1 Approved Answer

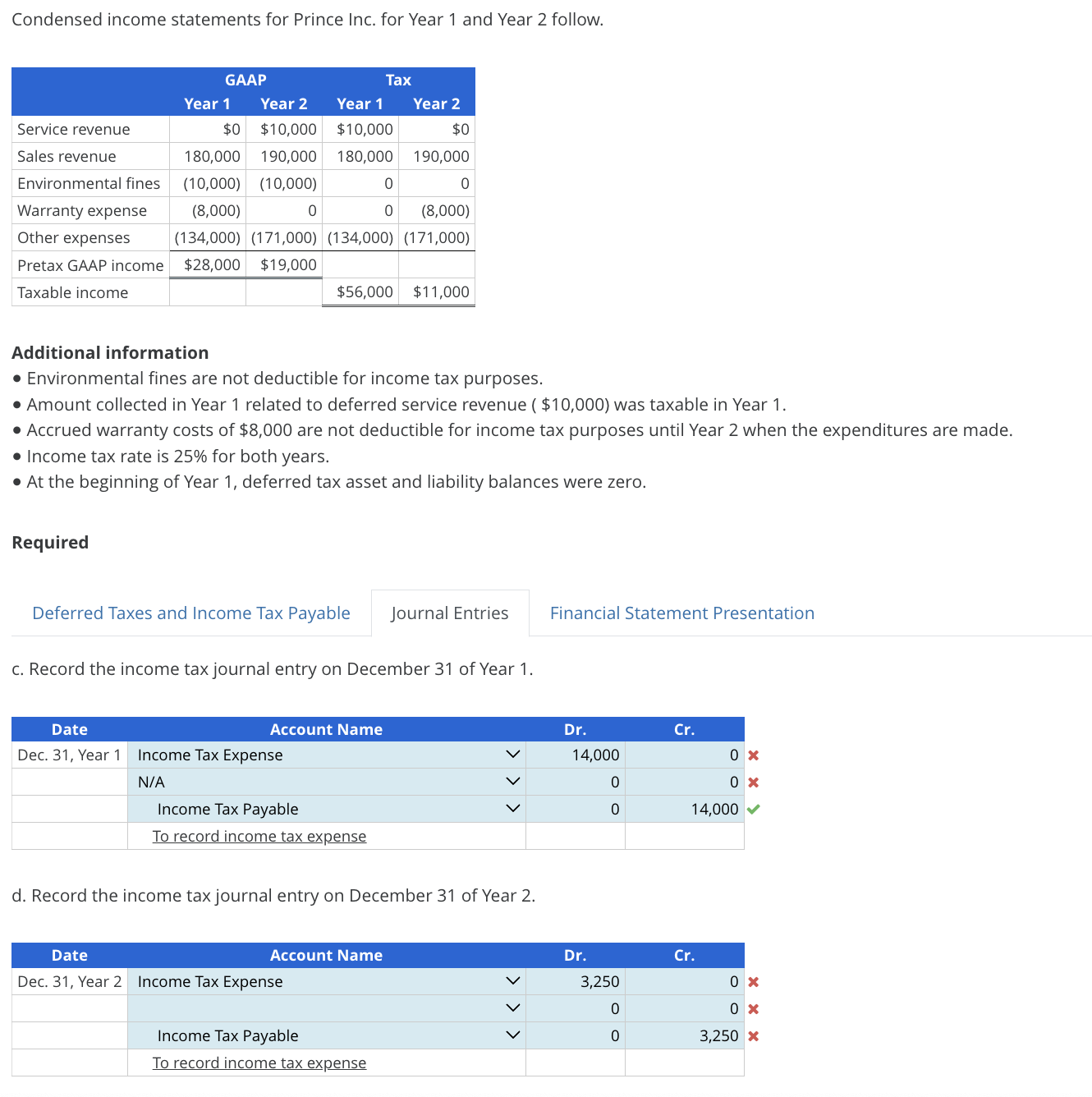

Condensed income statements for Prince Inc. for Year 1 and Year 2 follow. GAAP Tax Year 1 Year 2 Year 1 Year 2 Service

Condensed income statements for Prince Inc. for Year 1 and Year 2 follow. GAAP Tax Year 1 Year 2 Year 1 Year 2 Service revenue $0 $10,000 $10,000 $0 Sales revenue 180,000 190,000 180,000 190,000 Environmental fines (10,000) (10,000) 0 0 Warranty expense (8,000) 0 0 (8,000) Other expenses (134,000) (171,000) (134,000) (171,000) Pretax GAAP income $28,000 $19,000 Taxable income $56,000 $11,000 Additional information Environmental fines are not deductible for income tax purposes. Amount collected in Year 1 related to deferred service revenue ($10,000) was taxable in Year 1. Accrued warranty costs of $8,000 are not deductible for income tax purposes until Year 2 when the expenditures are made. Income tax rate is 25% for both years. At the beginning of Year 1, deferred tax asset and liability balances were zero. Required Deferred Taxes and Income Tax Payable Journal Entries Financial Statement Presentation c. Record the income tax journal entry on December 31 of Year 1. Date Account Name Dec. 31, Year 1 Income Tax Expense N/A Income Tax Payable To record income tax expense d. Record the income tax journal entry on December 31 of Year 2. Date Account Name Dec. 31, Year 2 Income Tax Expense Income Tax Payable To record income tax expense > > > Dr. Cr. 14,000 0 0 0 0 14,000 Dr. Cr. 3,250 0 0 0 0 3,250 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started