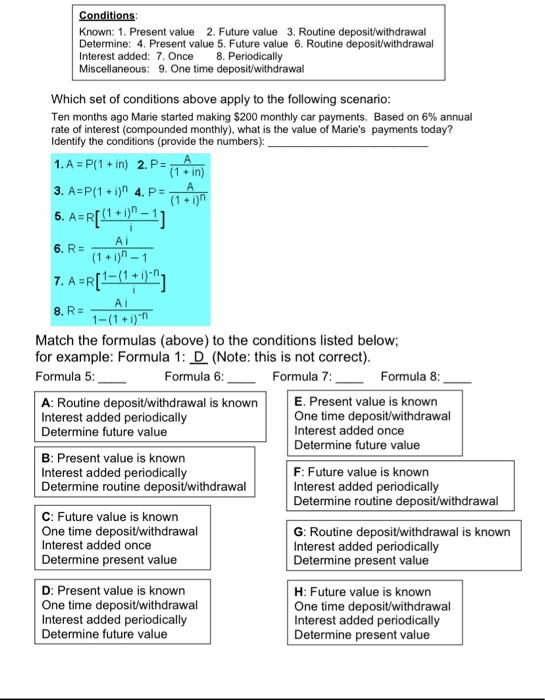

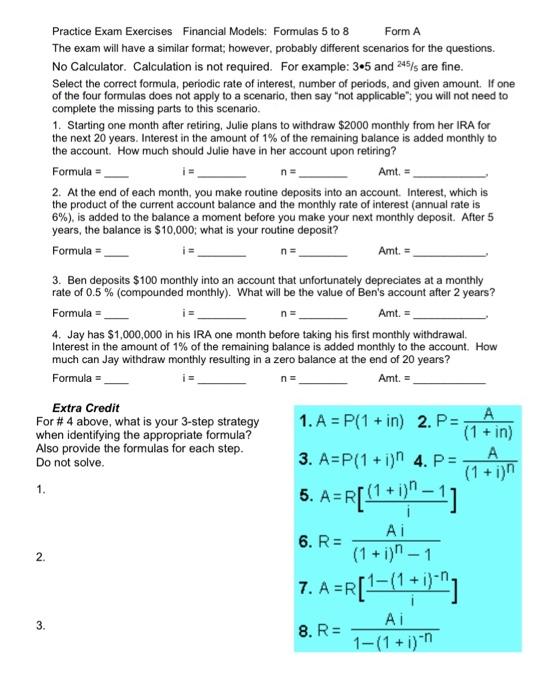

Conditions: Known: 1. Present value 2 . Future value 3 . Routine deposit/withdrawal Determine: 4. Present value 5. Future value 6. Routine depositwithdrawal Interest added: 7. Once 8. Periodically Miscellaneous: 9. One time deposit/withdrawal Which set of conditions above apply to the following scenario: Ten months ago Marie started making $200 monthly car payments. Based on 6% annual rate of interest (compounded monthly), what is the value of Marie's payments today? Identify the conditions (provide the numbers): 1. A=P(1+in) 2. P=(1+in)A 3. A=P(1+i)n 4. P=(1+1)nA 5. A=R[i(1+i)n1] 6. R=(1+i)n1Ai 7. A=R[11(1+1)n] 8. R=1(1+i)Ai Match the formulas (above) to the conditions listed below; Practice Exam Exercises Financial Models: Formulas 5 to 8 Form A The exam will have a similar format; however, probably different scenarios for the questions. No Calculator. Calculation is not required. For example: 35 and 245/5 are fine. Select the correct formula, periodic rate of interest, number of periods, and given amount. If one of the four formulas does not apply to a scenario, then say "not applicable"; you will not need to complete the missing parts to this scenario. 1. Starting one month after retiring. Julie plans to withdraw $2000 monthly from her IRA for the next 20 years. Interest in the amount of 1% of the remaining balance is added monthly to the account. How much should Julie have in her account upon retiring? Formula = i= n=Amt.= 2. At the end of each month, you make routine deposits into an account. Interest, which is the product of the current account balance and the monthly rate of interest (annual rate is 6% ), is added to the balance a moment before you make your next monthly deposit. After 5 years, the balance is $10,000; what is your routine deposit? Formula = i= n=Amt.= 3. Ben deposits $100 monthly into an account that unfortunately depreciates at a monthly rate of 0.5% (compounded monthly). What will be the value of Ben's account after 2 years? Formula = i= n=Amt.= 4. Jay has $1,000,000 in his IRA one month before taking his first monthly withdrawal. Interest in the amount of 1% of the remaining balance is added monthly to the account. How much can Jay withdraw monthly resulting in a zero balance at the end of 20 years? Formula = i= n=Amt= Extra Credit For \# 4 above, what is your 3-step strategy when identifying the appropriate formula? Also provide the formulas for each step. Do not solve. 1. 2. 1. A=P(1+in) 2. P=(1+in)A 3. A=P(1+i)n 4. P=(1+i)nA 5. A=R[i(1+i)n1] 6. R=(1+i)n1Ai 7. A=R[i1(1+i)n] 8. R=1(1+i)nAi