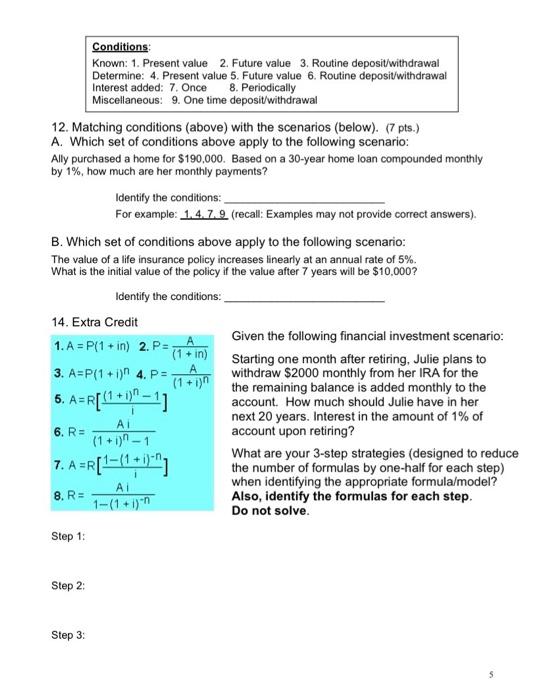

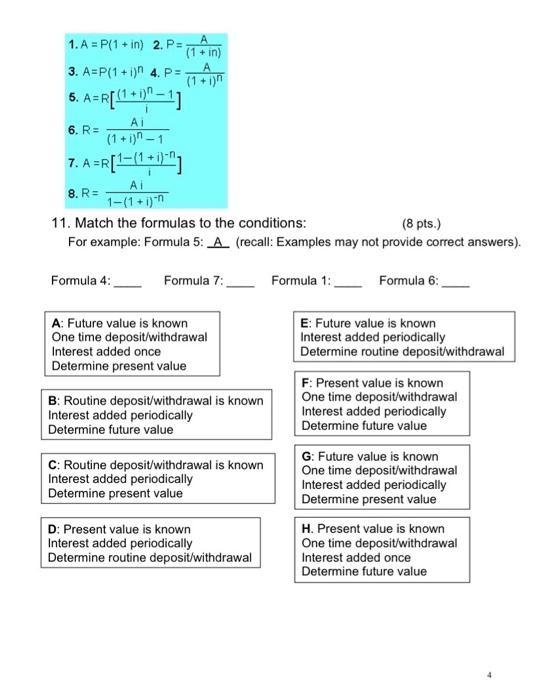

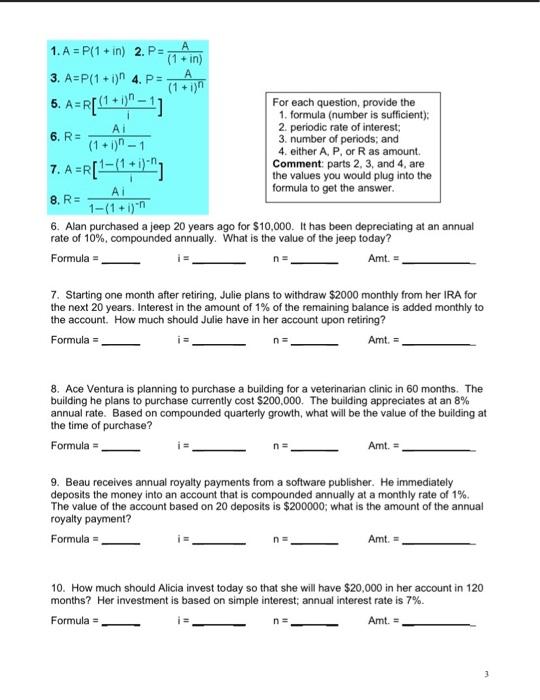

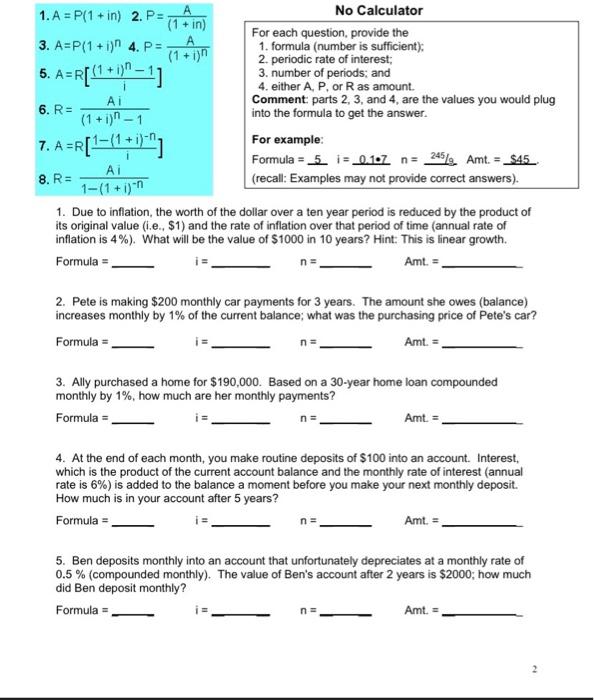

Conditions: Known: 1. Present value 2. Future value 3. Routine deposit/withdrawal Determine: 4. Present value 5. Future value 6 . Routine deposit/withdrawal Interest added: 7. Once 8. Periodically Miscellaneous: 9. One time deposit/withdrawal 12. Matching conditions (above) with the scenarios (below). (7 pts.) A. Which set of conditions above apply to the following scenario: Ally purchased a home for $190,000. Based on a 30-year home loan compounded monthly by 1%, how much are her monthly payments? Identify the conditions: For example: 1,4,7,9 (recall: Examples may not provide correct answers). B. Which set of conditions above apply to the following scenario: The value of a life insurance policy increases linearly at an annual rate of 5%. What is the initial value of the policy if the value after 7 years will be $10,000 ? Identify the conditions: 14. Extra Credit 1. A=P(1+in) 2. P=(1+in)A Given the following financial investment scenario: Starting one month after retiring, Julie plans to 3. A=P(1+i)n 4. P=(1+i)nA withdraw $2000 monthly from her IRA for the 5. A=R[(1+i)n1 the remaining balance is added monthly to the account. How much should Julie have in her next 20 years. Interest in the amount of 1% of 6. R=(1+1)n1Ai account upon retiring? 7. A=R[i1(1+i)n] What are your 3 -step strategies (designed to reduce the number of formulas by one-half for each step) 8. R=1(1+i)Al when identifying the appropriate formula/mode Do not solve. Step 1: Step 2: Step 3: 1. A=P(1+in) 2. P=(1+in)A 3. A=P(1+1)n 4. P=(1+1)nA 5. A=R[i(1+i)n1] 6. R=(1+i)n1Ai 7. A=R[i1(1+i)n] 8. R=1(1+i)nAi 11. Match the formulas to the conditions: (8 pts.) For example: Formula 5: A (recall: Examples may not provide correct answers). Formula 4: Formula 7: Formula 1: Formula 6: \begin{tabular}{|l|} \hline A: Future value is known \\ One time deposit/withdrawal \\ Interest added once \\ Determine present value \\ \hline \end{tabular} E: Future value is known Interest added periodically Determine routine deposit/withdrawal \begin{tabular}{l} B: Routine deposit/withdrawal is known \\ Interest added periodically \\ Determine future value \\ \hline C: Routine deposit/withdrawal is known \\ Interest added periodically \\ Determine present value \\ \hline \end{tabular} F: Present value is known One time deposit/withdrawal Interest added periodically Determine future value \begin{tabular}{|l|} \hline D: Present value is known \\ Interest added periodically \\ Determine routine deposit/withdrawal \end{tabular}\begin{tabular}{|l|} \hline H. Present value is known \\ One time deposit/withdrawal \\ Interest added once \\ Determine future value \\ \hline \end{tabular} 1. A=P(1+ in ) 2. P=(1+in)A 3. A=P(1+i)n 4. P=(1+i)nA 5. A=R[i(1+i)n1] For each question, provide the 6. R=(1+i)n1Ai 1. formula (number is sufficient); 2. periodic rate of interest; 3. number of periods; and 4. either A,P, or R as amount. 7. A=R[i1(1+i)n] Comment: parts 2, 3, and 4, are the values you would plug into the 8. R=1(1+i)nAi formula to get the answer. 6. Alan purchased a jeep 20 years ago for $10,000. It has been depreciating at an annual rate of 10%, compounded annually. What is the value of the jeep today? Formula = i= n= Amt. = 7. Starting one month after retiring. Julie plans to withdraw $2000 monthly from her IRA for the next 20 years. Interest in the amount of 1% of the remaining balance is added monthly to the account. How much should Julie have in her account upon retiring? Formula = i= n= Amt. = 8. Ace Ventura is planning to purchase a building for a veterinarian clinic in 60 months. The building he plans to purchase currently cost $200,000. The building appreciates at an 8% annual rate. Based on compounded quarterly growth, what will be the value of the building at the time of purchase? Formula = i= n= Amt.= 9. Beau receives annual royalty payments from a software publisher. He immediately deposits the money into an account that is compounded annually at a monthly rate of 1%. The value of the account based on 20 deposits is $200000; what is the amount of the annual royalty payment? Formula = i= n= Amt. = 10. How much should Alicia invest today so that she will have $20,000 in her account in 120 months? Her investment is based on simple interest; annual interest rate is 7%. Formula = i= n= Amt. = 1. A=P(1+in) 2. P=(1+in)A No Calculator 3. A=P(1+i)n 4. P=(1+i)nA For each question, provide the 1. formula (number is sufficient); 2. periodic rate of interest; 5. A=R[i(1+i)n1] 3. number of periods; and 4. either A,P, or R as amount. 6. R=(1+i)n1Ai Comment: parts 2,3 , and 4 , are the values you would plug into the formula to get the answer. 7. A=R[i1(1+i)n] For example: 8.R=1(1+i)nAi1.Duetoinflation,theworthofthedollaroveratenyearperiodisreducedbytheproductofFormula=(r5i=0.17(recall:Examplesmaynotprovidecorrectanswers). its original value (i.e., \$1) and the rate of inflation over that period of time (annual rate of inflation is 4% ). What will be the value of $1000 in 10 years? Hint: This is linear growth. Formula = i= n= Amt. = 2. Pete is making $200 monthly car payments for 3 years. The amount she owes (balance) increases monthly by 1% of the current balance; what was the purchasing price of Pete's car? Formula = i= n= Amt. = 3. Ally purchased a home for $190,000. Based on a 30 -year home loan compounded monthly by 1%, how much are her monthly payments? Formula = i= n= 4. At the end of each month, you make routine deposits of $100 into an account. Interest, which is the product of the current account balance and the monthly rate of interest (annual rate is 6% ) is added to the balance a moment before you make your next monthly deposit. How much is in your account after 5 years? Formula = i= n= Amt. = 5. Ben deposits monthly into an account that unfortunately depreciates at a monthly rate of 0.5% (compounded monthly). The value of Ben's account after 2 years is $2000; how much did Ben deposit monthly? Formula = i= n= Amt. =