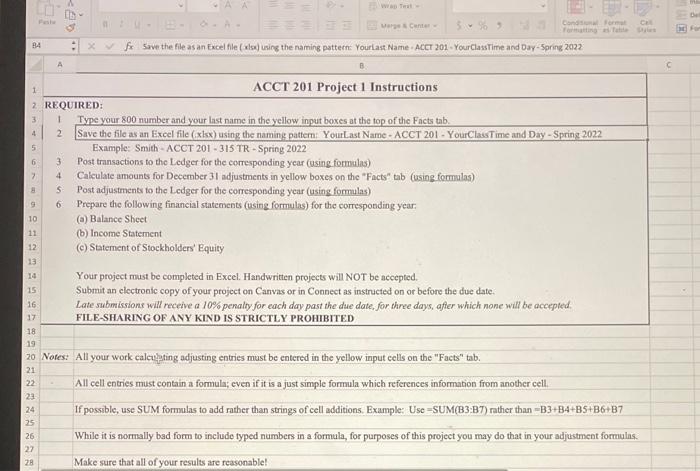

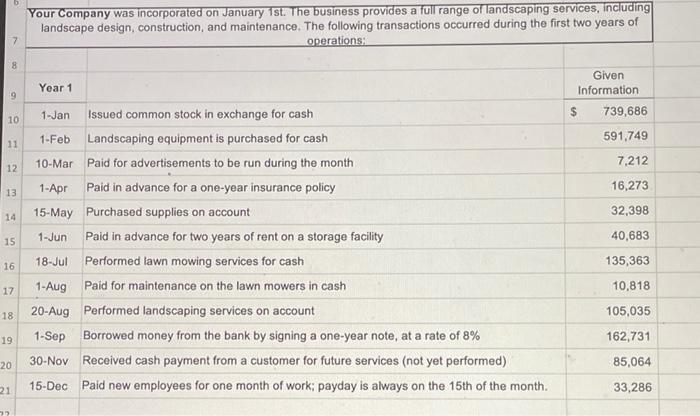

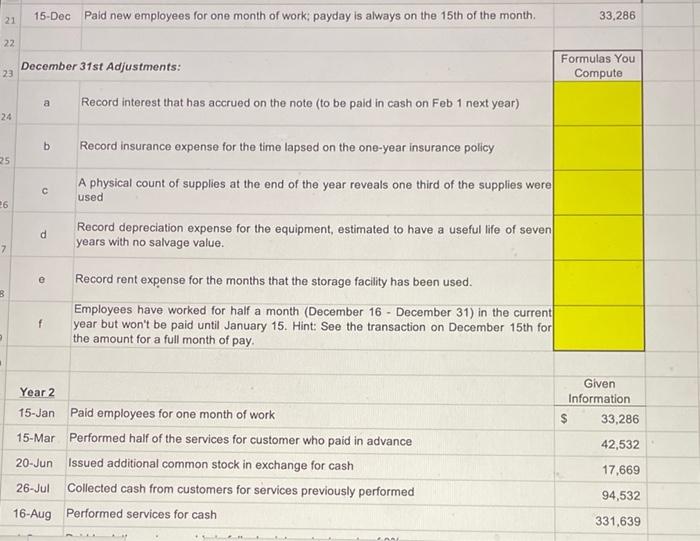

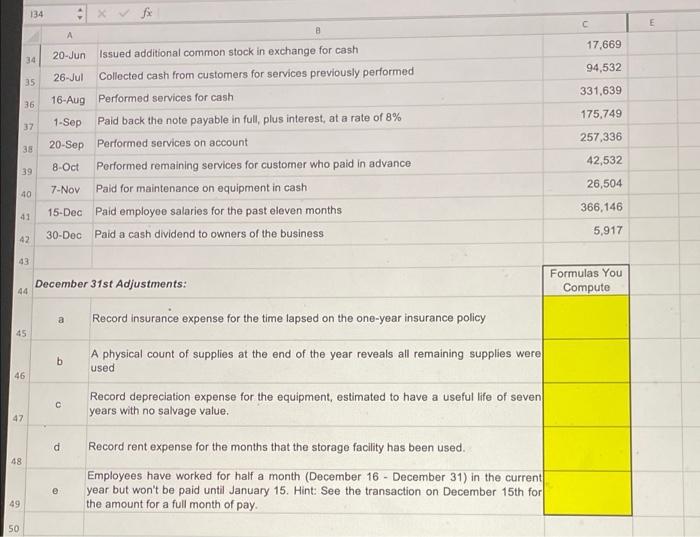

Condom CE Cente B4 of Save the file as an Excel file (xlsx) using the naming pattern. YourLast Name: ACCT 201 - Your Class Time and Day Spring 2022 3 4 5 6 1 ACCT 201 Project 1 Instructions 2 REQUIRED: 1 Type your 800 number and your last name in the yellow input boxes at the top of the Facts tub. 2 Save the file as an Excel file (.xlsx) using the naming pattern: YoutLast Name - ACCT 201 - YourClass Time and Day - Spring 2022 Example: Smith - ACCT 201-315 TR - Spring 2022 Post transactions to the Ledger for the corresponding year (using formulas) Calculate amounts for December 31 ndjustments in yellow boxes on the "Facts" tab (using formulas) Post adjustments to the Ledger for the corresponding year (using formulas) Prepare the following financial statements (using formulas) for the corresponding year @) Balance Sheet (b) Income Statement (C) Statement of Stockholders' Equity 3 4 > 3 S 9 6 10 11 12 13 14 15 16 17 Your project must be completed in Excel. Handwritten projects will NOT be accepted. Submit an electronic copy of your project on Canvas or in Connect as instructed on or before the due date. Late submissions will receive a 10% penalty for each day past the due date, for three days after which none will be accepted. FILE-SHARING OF ANY KIND IS STRICTLY PROHIBITED 18 19 21 22 22 20 Notes: All your work calculating adjusting entries must be entered in the yellow input cells on the "Facts" tabi All cell entries must contain a formula; even if it is a just simple formula which references information from another cell. If possible, use SUM formulas to add rather than strings of cell additions. Example: Use =SUM(B3-B7) rather than --B3-B4+BS+B6+B7 While it is normally bad form to include typed numbers in a formula, for purposes of this project you may do that in your adjustment formulas. 24 25 26 27 28 Make sure that all of your results are reasonable! b Your Company was incorporated on January 1st. The business provides a full range of landscaping services, including landscape design, construction, and maintenance. The following transactions occurred during the first two years of operations: 7 8 Year 1 9 Given Information $ 739,686 10 11 591,749 7,212 12 16,273 13 32,398 14 15 40,683 1-Jan Issued common stock in exchange for cash 1-Feb Landscaping equipment is purchased for cash 10-Mar Paid for advertisements to be run during the month 1-Apr Paid in advance for a one-year insurance policy 15-May Purchased supplies on account 1-Jun Paid in advance for two years of rent on a storage facility 18-Jul Performed lawn mowing services for cash 1-Aug Paid for maintenance on the lawn mowers in cash 20-Aug Performed landscaping services on account 1-Sep Borrowed money from the bank by signing a one-year note, at a rate of 8% 30-Nov Received cash payment from a customer for future services (not yet performed) 15-Dec Paid new employees for one month of work; payday is always on the 15th of the month. 16 135,363 17 10,818 18 105,035 19 162,731 20 85,064 21 33,286 9 21 15-Dec Pald new employees for one month of work: payday is always on the 15th of the month. 33,286 22 December 31st Adjustments: 23 Formulas You Compute a Record interest that has accrued on the note (to be paid in cash on Feb 1 next year) 24 b Record insurance expense for the time lapsed on the one-year insurance policy 25 A physical count of supplies at the end of the year reveals one third of the supplies were used 26 d Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. e B Record rent expense for the months that the storage facility has been used. Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. f Given Information 33,286 42,532 Year 2 15-Jan Paid employees for one month of work 15-Mar Performed half of the services for customer who paid in advance 20-Jun Issued additional common stock in exchange for cash 26-Jul Collected cash from customers for services previously performed 16-Aug Performed services for cash 17,669 94,532 331,639 RA 134 E A 17,669 94,532 35 331,639 36 175,749 37 B 20-Jun Issued additional common stock in exchange for cash 26-Jul Collected cash from customers for services previously performed 16-Aug Performed services for cash 1-Sep Paid back the note payable in full, plus interest, at a rate of 8% 20-Sep Performed services on account 8 Oct Performed remaining services for customer who paid in advance 7-Nov Paid for maintenance on equipment in cash 15-Dec Paid employee salaries for the past eleven months 30-Dec Paid a cash dividend to owners of the business 38 257,336 42,532 26,504 39 40 366.146 41 5,917 42 43 December 31st Adjustments: Formulas You Compute 44 a Record insurance expense for the time lapsed on the one-year insurance policy 45 A physical count of supplies at the end of the year reveals all remaining supplies were b b used 46 c Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. 47 d Record rent expense for the months that the storage facility has been used. 48 e Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. 49 50 Condom CE Cente B4 of Save the file as an Excel file (xlsx) using the naming pattern. YourLast Name: ACCT 201 - Your Class Time and Day Spring 2022 3 4 5 6 1 ACCT 201 Project 1 Instructions 2 REQUIRED: 1 Type your 800 number and your last name in the yellow input boxes at the top of the Facts tub. 2 Save the file as an Excel file (.xlsx) using the naming pattern: YoutLast Name - ACCT 201 - YourClass Time and Day - Spring 2022 Example: Smith - ACCT 201-315 TR - Spring 2022 Post transactions to the Ledger for the corresponding year (using formulas) Calculate amounts for December 31 ndjustments in yellow boxes on the "Facts" tab (using formulas) Post adjustments to the Ledger for the corresponding year (using formulas) Prepare the following financial statements (using formulas) for the corresponding year @) Balance Sheet (b) Income Statement (C) Statement of Stockholders' Equity 3 4 > 3 S 9 6 10 11 12 13 14 15 16 17 Your project must be completed in Excel. Handwritten projects will NOT be accepted. Submit an electronic copy of your project on Canvas or in Connect as instructed on or before the due date. Late submissions will receive a 10% penalty for each day past the due date, for three days after which none will be accepted. FILE-SHARING OF ANY KIND IS STRICTLY PROHIBITED 18 19 21 22 22 20 Notes: All your work calculating adjusting entries must be entered in the yellow input cells on the "Facts" tabi All cell entries must contain a formula; even if it is a just simple formula which references information from another cell. If possible, use SUM formulas to add rather than strings of cell additions. Example: Use =SUM(B3-B7) rather than --B3-B4+BS+B6+B7 While it is normally bad form to include typed numbers in a formula, for purposes of this project you may do that in your adjustment formulas. 24 25 26 27 28 Make sure that all of your results are reasonable! b Your Company was incorporated on January 1st. The business provides a full range of landscaping services, including landscape design, construction, and maintenance. The following transactions occurred during the first two years of operations: 7 8 Year 1 9 Given Information $ 739,686 10 11 591,749 7,212 12 16,273 13 32,398 14 15 40,683 1-Jan Issued common stock in exchange for cash 1-Feb Landscaping equipment is purchased for cash 10-Mar Paid for advertisements to be run during the month 1-Apr Paid in advance for a one-year insurance policy 15-May Purchased supplies on account 1-Jun Paid in advance for two years of rent on a storage facility 18-Jul Performed lawn mowing services for cash 1-Aug Paid for maintenance on the lawn mowers in cash 20-Aug Performed landscaping services on account 1-Sep Borrowed money from the bank by signing a one-year note, at a rate of 8% 30-Nov Received cash payment from a customer for future services (not yet performed) 15-Dec Paid new employees for one month of work; payday is always on the 15th of the month. 16 135,363 17 10,818 18 105,035 19 162,731 20 85,064 21 33,286 9 21 15-Dec Pald new employees for one month of work: payday is always on the 15th of the month. 33,286 22 December 31st Adjustments: 23 Formulas You Compute a Record interest that has accrued on the note (to be paid in cash on Feb 1 next year) 24 b Record insurance expense for the time lapsed on the one-year insurance policy 25 A physical count of supplies at the end of the year reveals one third of the supplies were used 26 d Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. e B Record rent expense for the months that the storage facility has been used. Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. f Given Information 33,286 42,532 Year 2 15-Jan Paid employees for one month of work 15-Mar Performed half of the services for customer who paid in advance 20-Jun Issued additional common stock in exchange for cash 26-Jul Collected cash from customers for services previously performed 16-Aug Performed services for cash 17,669 94,532 331,639 RA 134 E A 17,669 94,532 35 331,639 36 175,749 37 B 20-Jun Issued additional common stock in exchange for cash 26-Jul Collected cash from customers for services previously performed 16-Aug Performed services for cash 1-Sep Paid back the note payable in full, plus interest, at a rate of 8% 20-Sep Performed services on account 8 Oct Performed remaining services for customer who paid in advance 7-Nov Paid for maintenance on equipment in cash 15-Dec Paid employee salaries for the past eleven months 30-Dec Paid a cash dividend to owners of the business 38 257,336 42,532 26,504 39 40 366.146 41 5,917 42 43 December 31st Adjustments: Formulas You Compute 44 a Record insurance expense for the time lapsed on the one-year insurance policy 45 A physical count of supplies at the end of the year reveals all remaining supplies were b b used 46 c Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. 47 d Record rent expense for the months that the storage facility has been used. 48 e Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. 49 50