Answered step by step

Verified Expert Solution

Question

1 Approved Answer

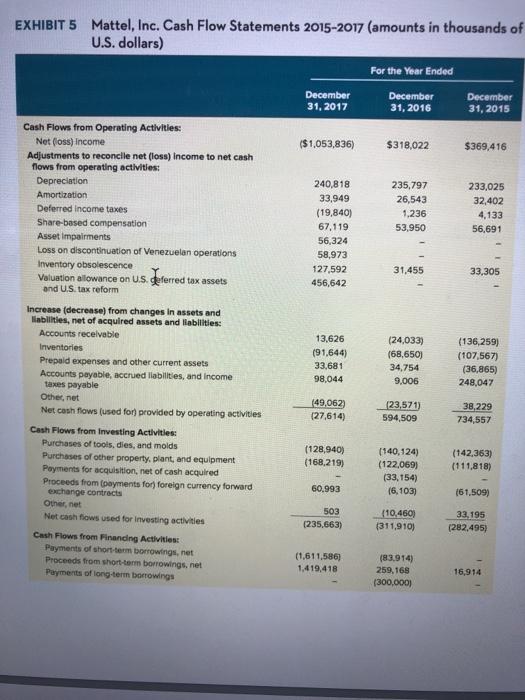

Conduct financial analysis for Mattel for 2017, 2016, and 2015 using any six of the following financial ratios: the current ratio, return on equity, operating

Conduct financial analysis for Mattel for 2017, 2016, and 2015 using any six of the following financial ratios:

the current ratio, return on equity, operating profit margin, coverage ratio, net profit margin, debt asset ratio, and debt to equity. show your work. tabulate your result.

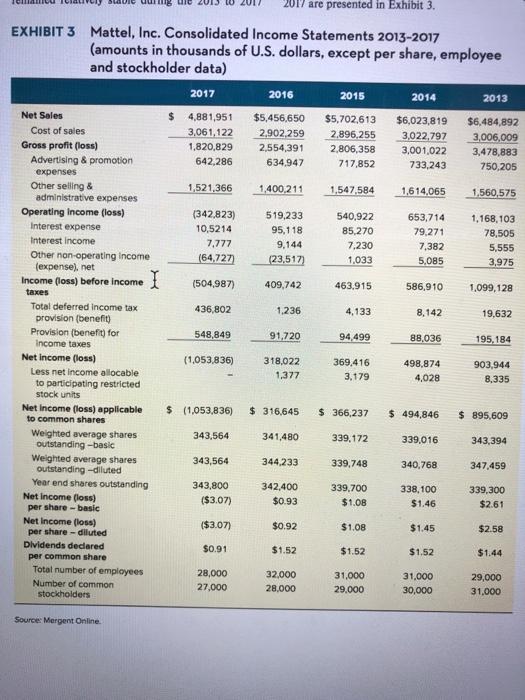

EXHIBIT 3 Net Sales 2017 are presented in Exhibit 3. Mattel, Inc. Consolidated Income Statements 2013-2017 (amounts in thousands of U.S. dollars, except per share, employee and stockholder data) 2017 $ 4,881,951 3,061,122 1,820,829 642,286 Cost of sales Gross profit (loss) Advertising & promotion expenses Other selling & administrative expenses Operating Income (loss) Interest expense Interest income Other non-operating income (expense), net Income (loss) before income I taxes Total deferred Income tax provision (benefit) Provision (benefit) for Income taxes Net Income (loss) Less net income allocable to participating restricted stock units Net Income (loss) applicable to common shares Weighted average shares outstanding-basic Weighted average shares outstanding-diluted Year end shares outstanding Net Income (loss) per share-basic Net Income (loss) per share-diluted Dividends declared per common share Total number of employees Number of common stockholders Source: Mergent Online. 1,521,366 (342,823) 10,5214 7,777 (64,727) (504,987) 436,802 548,849 (1,053,836) $ (1,053,836) 343,564 343,564 343,800 ($3.07) ($3.07) $0.91 28,000 27,000 2016 $5,456,650 2,902,259 2,554,391 634,947 1,400,211 519,233 95,118 9,144 (23,517) 409,742 1,236 91,720 318,022 1,377 $316,645 341,480 344,233 342,400 $0.93 $0.92 $1.52 32,000 28,000 2015 2014 $5,702,613 $6,023,819 2,896,255 2,806,358 717,852 1,547,584 540,922 85,270 7,230 1,033 463,915 4,133 94,499 369,416 3,179 $366,237 339,172 339,748 339,700 $1.08 $1.08 $1.52 31,000 29,000 3,022,797 3,001,022 733,243 1,614,065 653,714 79,271 7,382 5,085 586,910 8,142 88,036 498,874 4,028 $ 494,846 339,016 340,768 338,100 $1.46 $1.45 $1.52 31,000 30,000 2013 $6,484,892 3,006,009 3,478,883 750,205 1,560,575 1,168,103 78,505 5,555 3,975 1,099,128 19,632 195,184 903,944 8,335 $ 895,609 343,394 347,459 339,300 $2.61 $2.58 $1.44 29,000 31,000

Step by Step Solution

★★★★★

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To conduct a financial analysis for Mattel for the years 2017 2016 and 2015 we will use the following six financial ratios Current Ratio This ratio measures the companys ability to cover shortterm lia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started