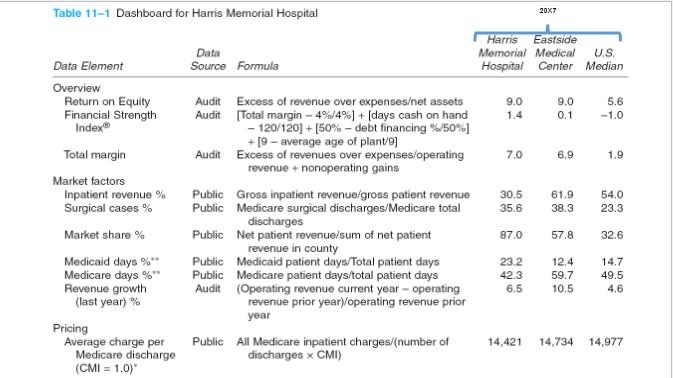

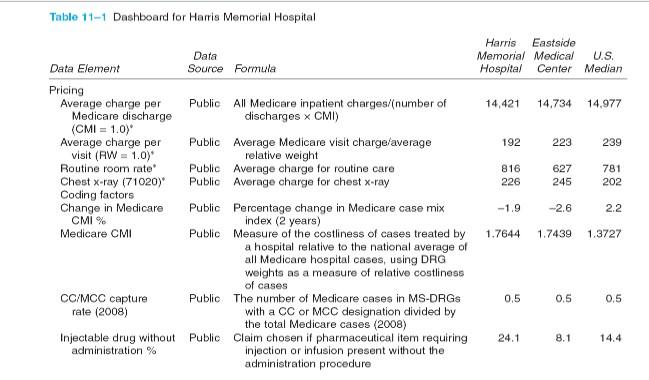

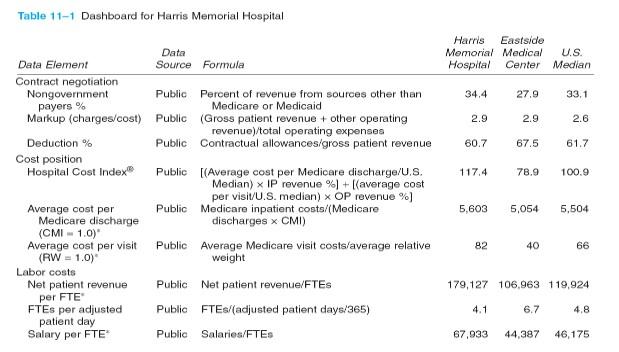

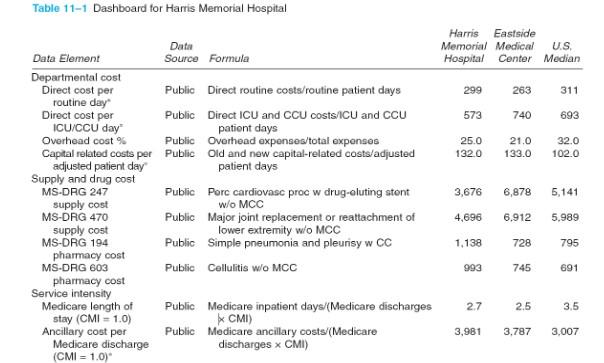

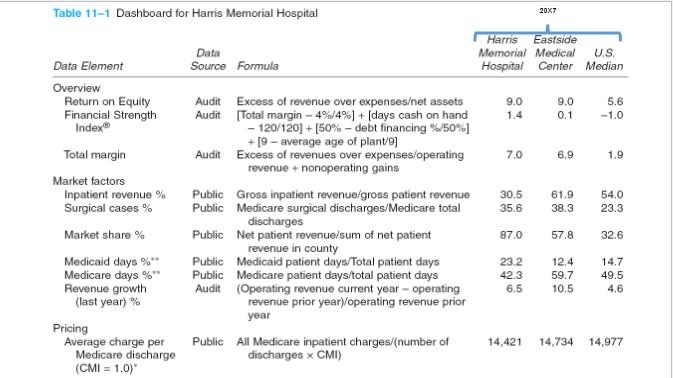

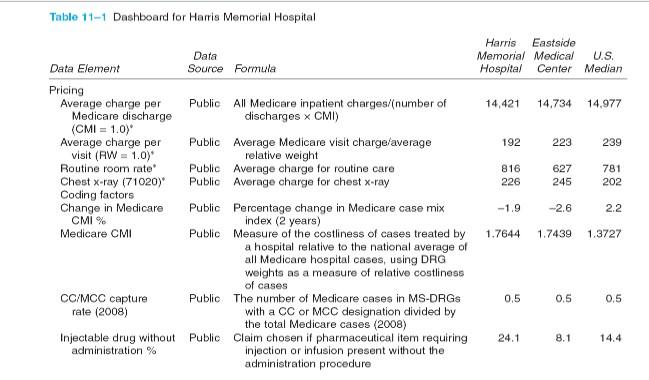

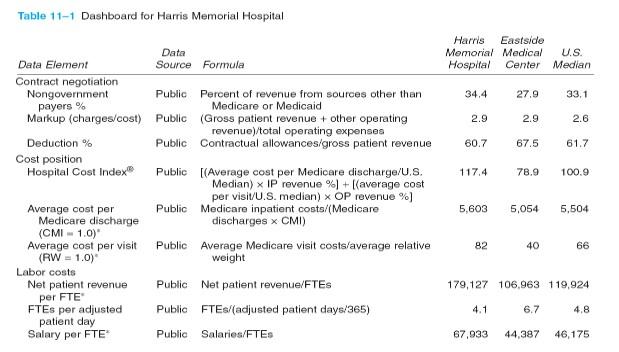

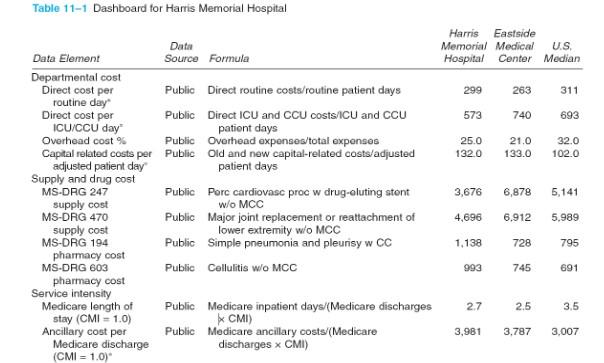

Conduct a financial and operations analysis using the Harris Memorial Hospital financial statements and information provided in the dashboard for Harris Memorial Hospital. You must include information provided regarding its nearest competitor, Eastside Medical Center and U.S. Medians. You must address at least 10 of the following 13 Critical Performance Drivers: A. Market Factors B. Pricing C. Coding D. Contract Negotiation E. Overall Cost F. Labor Costs G. Departmental Costs H. Supply and Drug Costs I. Service Intensity J. Non-operating Income K. Investment Efficiency L. Plant Obsolescence M. Capital Position

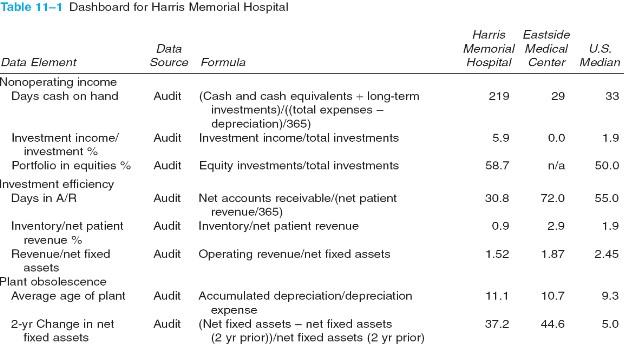

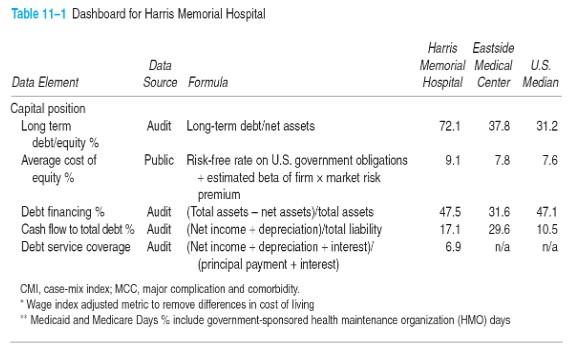

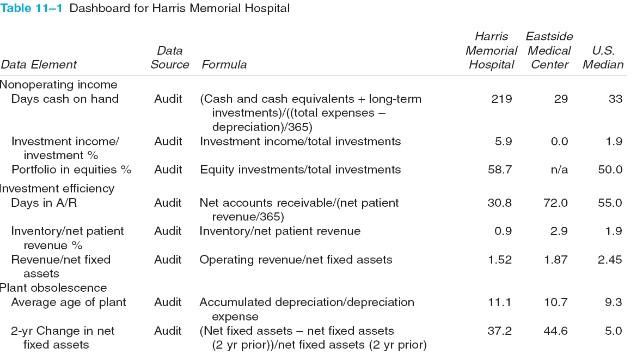

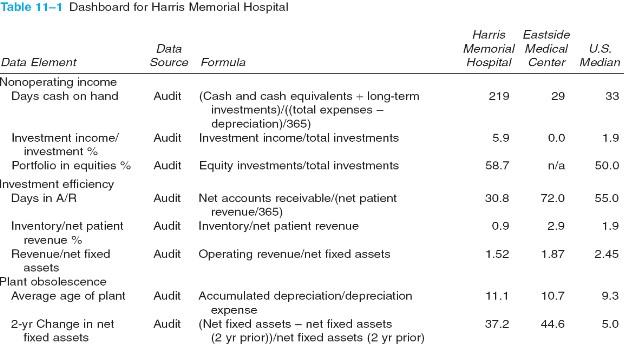

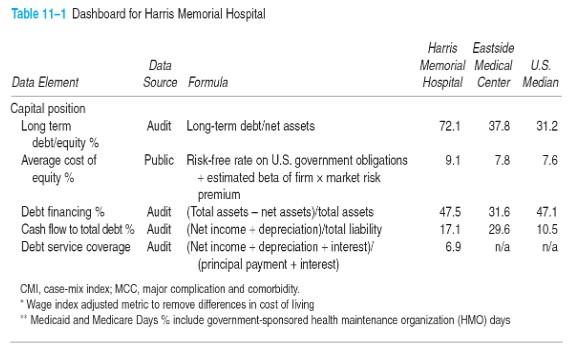

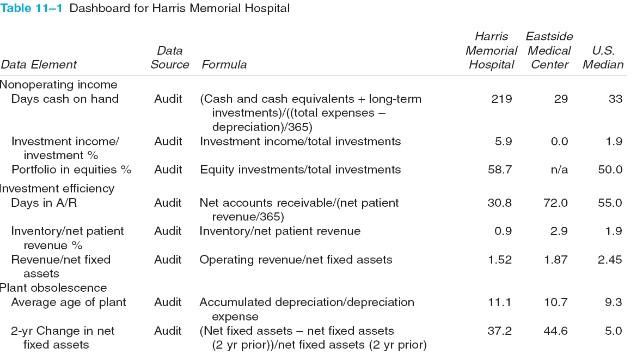

20x7 Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical U.S. Hospital Center Median 9.0 1.4 9.0 0.1 5.6 -1.0 7.0 6.9 1.9 30.5 35.6 61.9 38.3 54.0 23.3 Data Element Overview Return on Equity Financial Strength Index Total margin Market factors Inpatient revenue % Surgical cases % Market share % Medicaid days%" Medicare days % Revenue growth (last year) % Pricing Average charge per Medicare discharge (CMI = 1.0) Audit Excess of revenue over expenseset assets Audit (Total margin-4%/4%] + [days cash on hand - 120/120] + [50% - debt financing%/50%] + [9 - average age of plant/9] Audit Excess of revenues over expenses/operating revenue + nonoperating gains Public Gross inpatient revenue/gross patient revenue Public Medicare surgical discharges/Medicare total discharges Public Net patient revenue/sum of net patient revenue in county Public Medicaid patient days/Total patient days Public Medicare patient days/total patient days Audit (Operating revenue current year-operating revenue prior year)/operating revenue prior year Public All Medicare inpatient charges/(number of discharges x CMI) 87.0 57.8 32.6 23.2 42.3 6.5 12.4 59.7 10.5 14.7 49.5 4.6 14,421 14.734 14,977 Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical U.S. Hospital Center Median 14,421 14.734 14.977 192 223 239 Data Element Pricing Average charge per Medicare discharge (CMI = 1.0) Average charge per visit (RW - 1.0) Routine room rate Chest x-ray (71020) Coding factors Change in Medicare CMI % Medicare CMI 816 226 627 245 781 202 -1.9 -2.6 2.2 Public All Medicare inpatient charges/(number of discharges X CMI) Public Average Medicare visit charge average relative weight Public Average charge for routine care Public Average charge for chest x-ray Public Percentage change in Medicare case mix index (2 years) Public Measure of the costliness of cases treated by a hospital relative to the national average of all Medicare hospital cases, using DRG weights as a measure of relative costliness of cases Public The number of Medicare cases in MS-DRGs with a CC or MCC designation divided by the total Medicare cases (2008) Public Claim chosen if pharmaceutical item requiring injection or infusion present without the administration procedure 1.7644 1.7439 1.3727 0,5 0.5 0,5 CC/MCC capture rale (2008) 24.1 8.1 14.4 Injectable drug without administration % Table 11-1 Dashboard for Harris Memorial Hospital Harris Eastside Memorial Medical U.S. Hospital Center Median 34.4 27.9 33.1 2.9 2.9 2.6 60.7 67.5 61.7 117.4 78.9 100.9 Data Data Element Source Formula Contract negotiation Nongovernment Public Percent of revenue from sources other than payers % Medicare or Medicaid Markup (charges/cost) Public (Gross patient revenue + other operating revenue)/total operating expenses Deduction% Public Contractual allowances/gross patient revenue Cost position Hospital Cost Index Public [(Average cost per Medicare discharge/U.S. Median) IP revenue %] +((average cost per visit/U.S. median) X OP revenue %) Average cost per Public Medicare inpatient costs/(Medicare Medicare discharge discharges x CMI) (CMI - 1.0) Average cost per visit Public Average Medicare visit costs/average relative (RW = 1.0) weight Labor costs Net patient revenue Public Net patient revenue/FTES per FTE FTEs per adjusted Public FTE/(adjusted patient days/365) patient day Salary per FTE Public Salaries/FTES 5,603 5,054 5,504 82 40 66 179,127 106,963 119,924 4.1 6.7 4.8 67,933 44,387 46,175 Table 11-1 Dashboard for Harris Memorial Hospital Harris Eastside Memorial Medical US Hospital Center Median 299 263 311 573 740 693 25.0 132.0 21.0 133.0 32.0 102.0 3,676 6,878 5,141 Data Data Element Source Formula Departmental cost Direct cost per Public Direct routine costs/routine patient days routine day Direct cost per Public Direct ICU and CCU costs ICU and CCU ICU/CCU day pationt days Overhead cost Public Overhead expenses/total expenses Capital related costs per Public Old and new capital-related costs/adjusted adjusted patient day patient days Supply and drug cost MS-DAG 247 Public Porc cardiovasc proc w drug-cluting stont supply cost w/o MCC MS-DRG 470 Public Major joint replacement or reattachment of supply cost lower extremity wo MCC MS-DRG 194 Public Simple pneumonia and pleurisy w CC pharmacy cost MS-DRG 603 Public Cellulitis wo MCC pharmacy cost Service intensity Medicare length of Public Medicare inpatient days/(Medicare discharges stay (CMI - 1.0) ) Ancillary cost per Public Medicare ancillary costs/(Medicare Medicare discharge discharges x CMI) (CMI = 1.0) 4,696 6.912 5,989 1,138 728 795 993 745 691 2.7 2.5 3.5 3,981 3,787 3.007 Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical Hospital Center U.S. Median Data Element Nonoperating income Days cash on hand 219 29 33 Audit (Cash and cash equivalents + long-term investments)/((total expenses - depreciation)/365) Audit Investment income/total investments Audit Equity investments/total investments 5.9 0.0 Investment income/ investments Portfolio in equities % Investment efficiency Days in A/R 1.9 58.7 n/a 50.0 30.8 72.0 55.0 Audit Net accounts receivable/(net patient revenue/365) Audit Inventoryet patient revenue Audit Operating revenueet fixed assets 0.9 2.9 1.9 1.52 1.87 Inventoryet patient revenue % Revenueet fixed assets Plant obsolescence Average age of plant 2.45 Audit 11.1 10.7 9.3 Accumulated depreciation/depreciation expense (Net fixed assets - net fixed assets (2 yr prior))et fixed assets (2 yr prior) Audit 37.2 2-yr Change in net fixed assets 44.6 5.0 Table 11-1 Dashboard for Harris Memorial Hospital 9.1 Harris Eastside Data Memorial Medical U.S. Data Element Source Formula Hospital Center Median Capital position Long term Audit Long-term debtinet assets 72.1 37.8 31.2 debt/equity % Average cost of Public Risk-free rate on U.S. government obligations 7.8 7.6 equity% + estimated beta of firm x market risk premium Debt financing % Audit (Total assets - net assetsytotal assets 47.5 31.6 47.1 Cash flow to total debt % Audit (Net income-depreciation) total liability 17.1 29.6 10.5 Debt service coverage Audit (Net income - depreciation +interest 6.9 na (principal payment + interest) CMI, case-mix index: MCC, major complication and comorbidity. Wage index adjusted metric to remove differences in cost of living * Medicaid and Medicare Days % include government-sponsored health maintenance organization (HMO) days na Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical U.S. Hospital Center Median Data Element Nonoperating income Days cash on hand Audit 219 29 33 (Cash and cash equivalents + long-term investments)/((total expenses - depreciation/365) Investment incomo/total investments Equity investments/total investments Audit 5.9 0.0 1.9 Audit 58.7 n/a 50.0 30.8 72.0 55.0 Investment income! investment % Portfolio in equities % Investment efficiency Days in A/R Inventoryet patient revenue % Revenueet fixed assets Plant obsolescence Average age of plant Audit Net accounts receivable/(net patient revenue/365) Audit Inventoryet patient revenue 0.9 2.9 1.9 Audit Operating revenueet fixed assets 1.52 1.87 2.45 Audit 11.1 10.7 9.3 Audit Accumulated depreciation/depreciation expense (Net fixed assets - net fixed assets (2 yr prior))et fixed assets (2 yr prior) 37.2 44.6 2-yr Change in net fixed assets 5.0 20x7 Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical U.S. Hospital Center Median 9.0 1.4 9.0 0.1 5.6 -1.0 7.0 6.9 1.9 30.5 35.6 61.9 38.3 54.0 23.3 Data Element Overview Return on Equity Financial Strength Index Total margin Market factors Inpatient revenue % Surgical cases % Market share % Medicaid days%" Medicare days % Revenue growth (last year) % Pricing Average charge per Medicare discharge (CMI = 1.0) Audit Excess of revenue over expenseset assets Audit (Total margin-4%/4%] + [days cash on hand - 120/120] + [50% - debt financing%/50%] + [9 - average age of plant/9] Audit Excess of revenues over expenses/operating revenue + nonoperating gains Public Gross inpatient revenue/gross patient revenue Public Medicare surgical discharges/Medicare total discharges Public Net patient revenue/sum of net patient revenue in county Public Medicaid patient days/Total patient days Public Medicare patient days/total patient days Audit (Operating revenue current year-operating revenue prior year)/operating revenue prior year Public All Medicare inpatient charges/(number of discharges x CMI) 87.0 57.8 32.6 23.2 42.3 6.5 12.4 59.7 10.5 14.7 49.5 4.6 14,421 14.734 14,977 Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical U.S. Hospital Center Median 14,421 14.734 14.977 192 223 239 Data Element Pricing Average charge per Medicare discharge (CMI = 1.0) Average charge per visit (RW - 1.0) Routine room rate Chest x-ray (71020) Coding factors Change in Medicare CMI % Medicare CMI 816 226 627 245 781 202 -1.9 -2.6 2.2 Public All Medicare inpatient charges/(number of discharges X CMI) Public Average Medicare visit charge average relative weight Public Average charge for routine care Public Average charge for chest x-ray Public Percentage change in Medicare case mix index (2 years) Public Measure of the costliness of cases treated by a hospital relative to the national average of all Medicare hospital cases, using DRG weights as a measure of relative costliness of cases Public The number of Medicare cases in MS-DRGs with a CC or MCC designation divided by the total Medicare cases (2008) Public Claim chosen if pharmaceutical item requiring injection or infusion present without the administration procedure 1.7644 1.7439 1.3727 0,5 0.5 0,5 CC/MCC capture rale (2008) 24.1 8.1 14.4 Injectable drug without administration % Table 11-1 Dashboard for Harris Memorial Hospital Harris Eastside Memorial Medical U.S. Hospital Center Median 34.4 27.9 33.1 2.9 2.9 2.6 60.7 67.5 61.7 117.4 78.9 100.9 Data Data Element Source Formula Contract negotiation Nongovernment Public Percent of revenue from sources other than payers % Medicare or Medicaid Markup (charges/cost) Public (Gross patient revenue + other operating revenue)/total operating expenses Deduction% Public Contractual allowances/gross patient revenue Cost position Hospital Cost Index Public [(Average cost per Medicare discharge/U.S. Median) IP revenue %] +((average cost per visit/U.S. median) X OP revenue %) Average cost per Public Medicare inpatient costs/(Medicare Medicare discharge discharges x CMI) (CMI - 1.0) Average cost per visit Public Average Medicare visit costs/average relative (RW = 1.0) weight Labor costs Net patient revenue Public Net patient revenue/FTES per FTE FTEs per adjusted Public FTE/(adjusted patient days/365) patient day Salary per FTE Public Salaries/FTES 5,603 5,054 5,504 82 40 66 179,127 106,963 119,924 4.1 6.7 4.8 67,933 44,387 46,175 Table 11-1 Dashboard for Harris Memorial Hospital Harris Eastside Memorial Medical US Hospital Center Median 299 263 311 573 740 693 25.0 132.0 21.0 133.0 32.0 102.0 3,676 6,878 5,141 Data Data Element Source Formula Departmental cost Direct cost per Public Direct routine costs/routine patient days routine day Direct cost per Public Direct ICU and CCU costs ICU and CCU ICU/CCU day pationt days Overhead cost Public Overhead expenses/total expenses Capital related costs per Public Old and new capital-related costs/adjusted adjusted patient day patient days Supply and drug cost MS-DAG 247 Public Porc cardiovasc proc w drug-cluting stont supply cost w/o MCC MS-DRG 470 Public Major joint replacement or reattachment of supply cost lower extremity wo MCC MS-DRG 194 Public Simple pneumonia and pleurisy w CC pharmacy cost MS-DRG 603 Public Cellulitis wo MCC pharmacy cost Service intensity Medicare length of Public Medicare inpatient days/(Medicare discharges stay (CMI - 1.0) ) Ancillary cost per Public Medicare ancillary costs/(Medicare Medicare discharge discharges x CMI) (CMI = 1.0) 4,696 6.912 5,989 1,138 728 795 993 745 691 2.7 2.5 3.5 3,981 3,787 3.007 Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical Hospital Center U.S. Median Data Element Nonoperating income Days cash on hand 219 29 33 Audit (Cash and cash equivalents + long-term investments)/((total expenses - depreciation)/365) Audit Investment income/total investments Audit Equity investments/total investments 5.9 0.0 Investment income/ investments Portfolio in equities % Investment efficiency Days in A/R 1.9 58.7 n/a 50.0 30.8 72.0 55.0 Audit Net accounts receivable/(net patient revenue/365) Audit Inventoryet patient revenue Audit Operating revenueet fixed assets 0.9 2.9 1.9 1.52 1.87 Inventoryet patient revenue % Revenueet fixed assets Plant obsolescence Average age of plant 2.45 Audit 11.1 10.7 9.3 Accumulated depreciation/depreciation expense (Net fixed assets - net fixed assets (2 yr prior))et fixed assets (2 yr prior) Audit 37.2 2-yr Change in net fixed assets 44.6 5.0 Table 11-1 Dashboard for Harris Memorial Hospital 9.1 Harris Eastside Data Memorial Medical U.S. Data Element Source Formula Hospital Center Median Capital position Long term Audit Long-term debtinet assets 72.1 37.8 31.2 debt/equity % Average cost of Public Risk-free rate on U.S. government obligations 7.8 7.6 equity% + estimated beta of firm x market risk premium Debt financing % Audit (Total assets - net assetsytotal assets 47.5 31.6 47.1 Cash flow to total debt % Audit (Net income-depreciation) total liability 17.1 29.6 10.5 Debt service coverage Audit (Net income - depreciation +interest 6.9 na (principal payment + interest) CMI, case-mix index: MCC, major complication and comorbidity. Wage index adjusted metric to remove differences in cost of living * Medicaid and Medicare Days % include government-sponsored health maintenance organization (HMO) days na Table 11-1 Dashboard for Harris Memorial Hospital Data Source Formula Harris Eastside Memorial Medical U.S. Hospital Center Median Data Element Nonoperating income Days cash on hand Audit 219 29 33 (Cash and cash equivalents + long-term investments)/((total expenses - depreciation/365) Investment incomo/total investments Equity investments/total investments Audit 5.9 0.0 1.9 Audit 58.7 n/a 50.0 30.8 72.0 55.0 Investment income! investment % Portfolio in equities % Investment efficiency Days in A/R Inventoryet patient revenue % Revenueet fixed assets Plant obsolescence Average age of plant Audit Net accounts receivable/(net patient revenue/365) Audit Inventoryet patient revenue 0.9 2.9 1.9 Audit Operating revenueet fixed assets 1.52 1.87 2.45 Audit 11.1 10.7 9.3 Audit Accumulated depreciation/depreciation expense (Net fixed assets - net fixed assets (2 yr prior))et fixed assets (2 yr prior) 37.2 44.6 2-yr Change in net fixed assets 5.0