Question

Conduct a horizontal analysis by calculating the year-over-year changes in each line item, expressed in dollars and in percentages for the income statement of

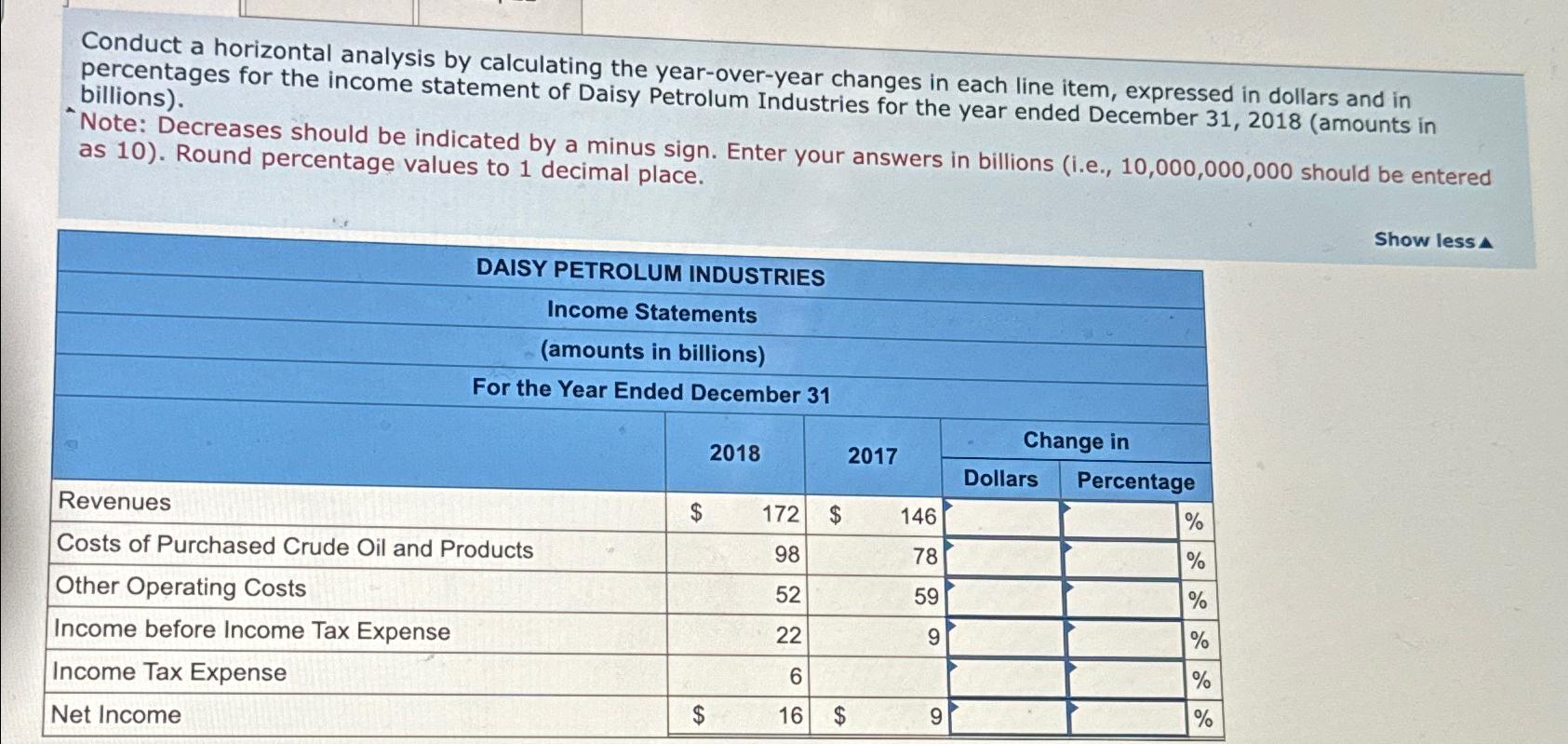

Conduct a horizontal analysis by calculating the year-over-year changes in each line item, expressed in dollars and in percentages for the income statement of Daisy Petrolum Industries for the year ended December 31, 2018 (amounts in billions). Note: Decreases should be indicated by a minus sign. Enter your answers in billions (i.e., 10,000,000,000 should be entered as 10). Round percentage values to 1 decimal place. DAISY PETROLUM INDUSTRIES Income Statements (amounts in billions) For the Year Ended December 31 2018 2017 Change in Dollars Percentage Revenues $ 172 $ 146 % Costs of Purchased Crude Oil and Products 98 78 200 % Other Operating Costs 52 59 100 % Income before Income Tax Expense 22 9 % Income Tax Expense 6 % Net Income $ 16 $ 9 % Show lessA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh

4th Canadian edition

978-1259269868, 978-1259103292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App