Answered step by step

Verified Expert Solution

Question

1 Approved Answer

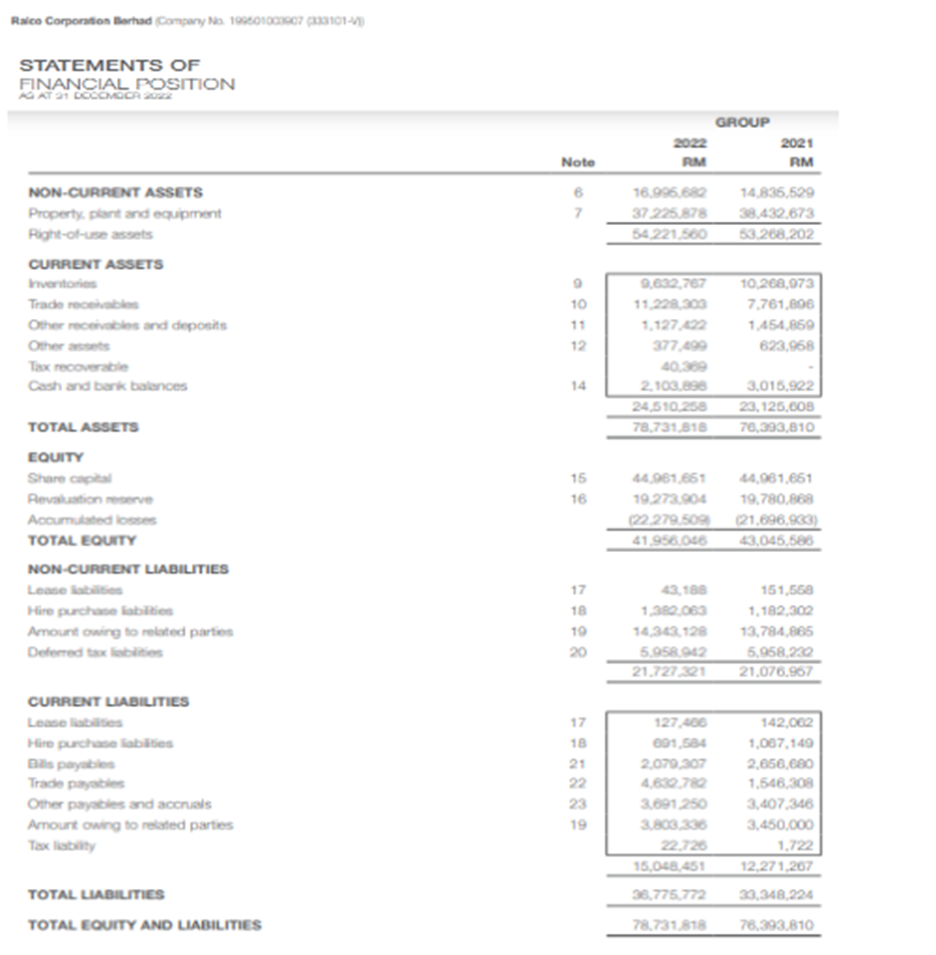

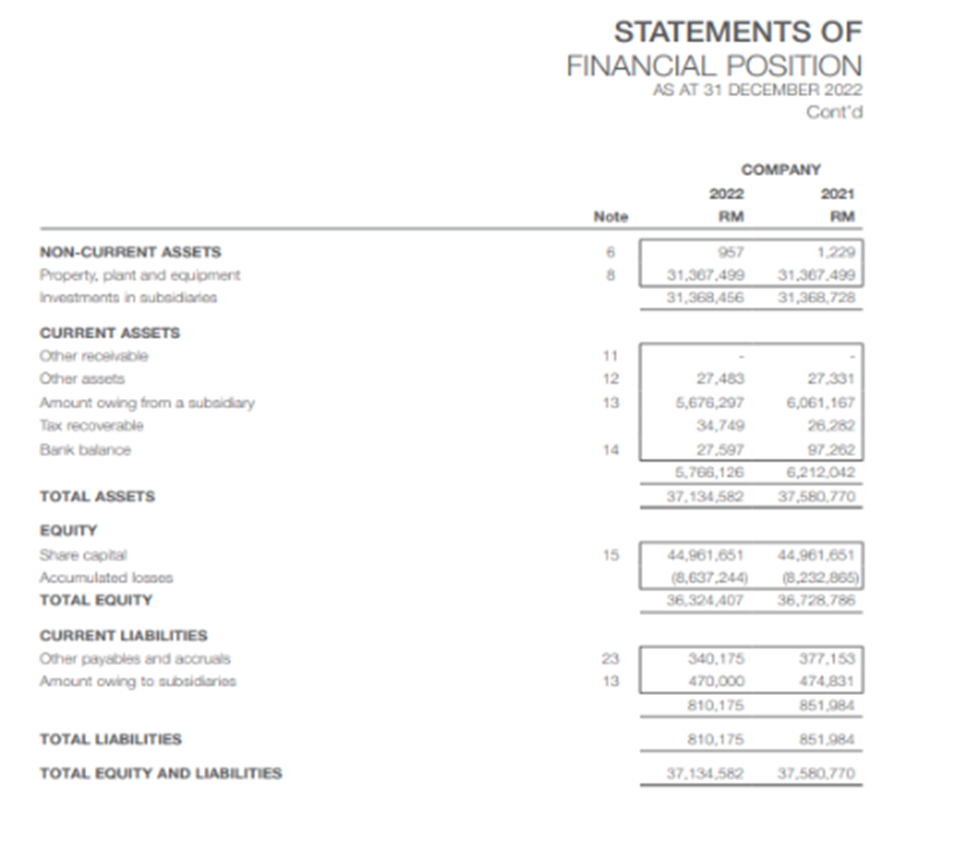

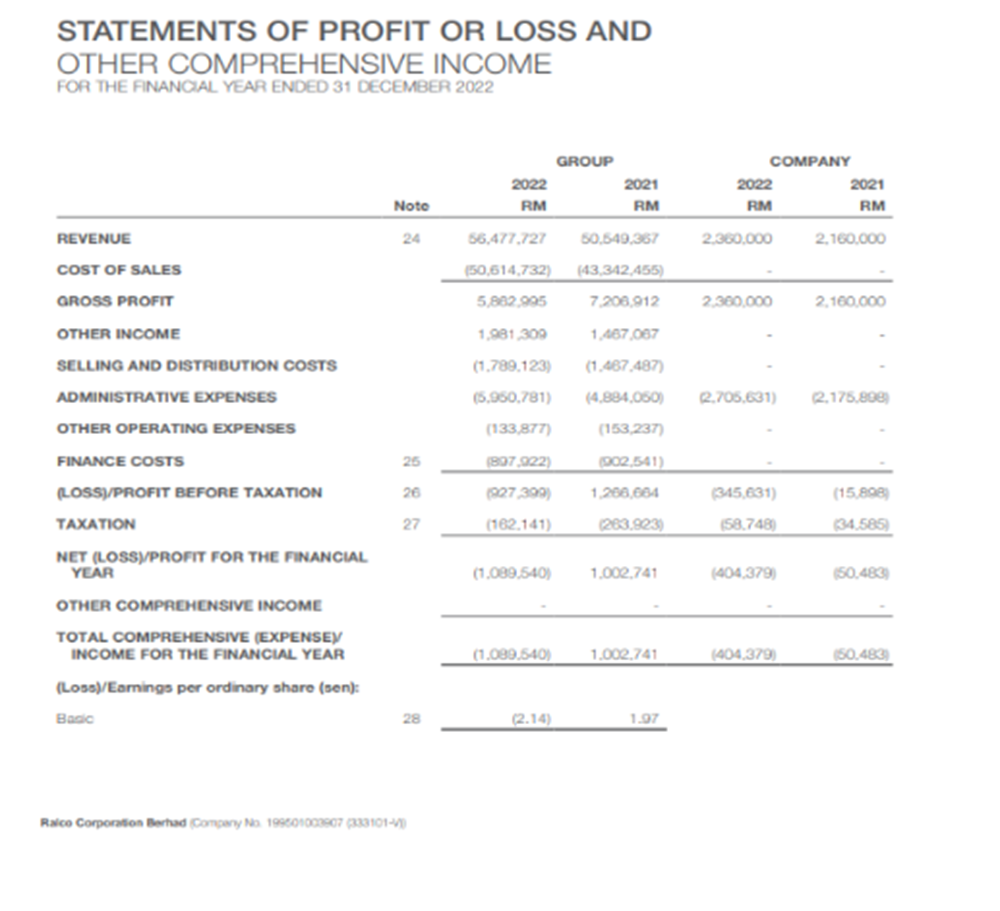

Conduct a Profitability, Liquidity, Efficiency and Gearing ratios on Ralco. What is your diagnosis? B.Based on (a) above, what is your prognosis? C.Based on (a)

Conduct a Profitability, Liquidity, Efficiency and Gearing ratios on Ralco. What is your diagnosis?

B.Based on (a) above, what is your prognosis?

C.Based on (a) and (b) above, what do you recommend Ralco to do?

D.Summarise the situation in Ralco based on your answers above.

Raico Corporation Berhad (Company No. 199601003907 (333101- STATEMENTS OF FINANCIAL POSITION AG AT 21 DOCOMOCA 2022 NON-CURRENT ASSETS Property, plant and equipment Right-of-use assets CURRENT ASSETS Inventories Trade receivables Other receivables and deposits Other assets Tax recoverable Cash and bank balances TOTAL ASSETS EQUITY Share capital Revaluation reserve Accumulated losses TOTAL EQUITY GROUP 2022 2021 Note RM RM 6 16,996,682 14,835,529 7 37.225.878 38,432,673 54,221,560 53,268,202 1212 9,632,767 10,268,973 10 11,228,303 7,761,806 1,127,422 1,454,859 377,499 623,968 40,369 14 2,103,896 3,015,922 24,510,258 23,125,608 78,731,818 76,393,810 15 16 66 44,961,6651 44,961,651 19,273,904 19,780,868 (22,279,509) (21,696,933) 41,956,046 43,045,586 NON-CURRENT LIABILITIES Lease abilities Hire purchase labities Amount owing to related parties Deferred tax liabilities 8553 17 43,188 18 1,382,063 151,568 1,182,302 19 14,343,128 13,784,865 20 5,958,942 5,958,232 21,727,321 21,076,967 CURRENT LIABILITIES Lease liabilities Hire purchase liabilities Bills payables Trade payables 17 127,406 142,002 18 091,584 1,007,149 21 2,079,307 2,656,680 22 4,632,782 1,546,308 Other payables and accruals 23 3,691,250 3,407,346 Amount owing to related parties 19 3,803,336 3,450,000 Tax liability 22,726 1,722 15,048,451 12,271,267 TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES 36,775,772 33,348,224 78,731,818 76,393,810

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started