Question

Use 'IA Q4 data.xlsx' file. A company is considering whether to market a new product. Assume, for simplicity, that if this product is marketed, there

Use 'IA Q4 data.xlsx' file.

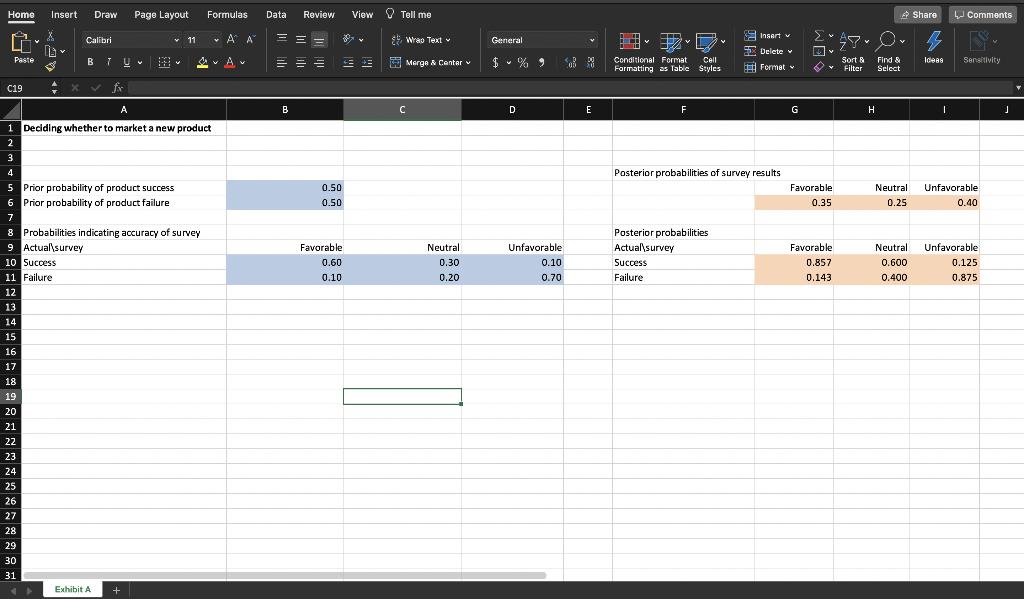

A company is considering whether to market a new product. Assume, for simplicity, that if this product is marketed, there are only two possible outcomes: success or failure. The company assesses that the probabilities of these two outcomes are ???? and 1 − ????, respectively. If the product is marketed and it proves to be a failure, the company will have a net loss of $450,000. If the product is marketed and it proves to be a success, the company will have a net gain of $750,000. If the company decides not to market the product, there is no gain or loss.

The company can first survey prospective buyers of this new product. The results of the consumer survey can be classified as favorable, neutral, or unfavorable. Based on similar survey for previous products, the company assesses these probabilities of favorable, neutral, or unfavorable results to be 0.6, 0.3, and 0.1 for product that will eventually be a success, and it assesses these probabilities to be 0.1, 0.2, and 0.7 for a product that will eventually be a failure. The total cost of administering this survey is ???? dollars. Let ???? = 0.5 and ???? = $15, 000. The company wants to construct a decision tree for this problem. The first step is to compute the posterior probabilities that the product will be eventually success and failure using the result from the consumer survey. The probabilities are given in Exhibit A. The company would like to find the strategy that maximizes the company’s expected net earnings (EMV).

a. (8 pts) Construct a decision tree for this problem (Exhibit A). Generate the optimal decision strategy tree and paste the copy on your word document. Does the optimal strategy involve conducting the survey? What is the EMV under the optimal strategy?

b. (3 pts) Suppose that the total cost of administering this survey is $50,000. Does this change the company’s decision? What is the maximum amount that the company is willing to pay for the survey?

c. (3 pts) Conduct a sensitivity analysis on ????: between 0.3 and 0.9 with 10 steps. Attached the strategy graph (Exhibit B) and paste the copy on your word document. What is the approximate value of ???? that changes the optimal strategy? Explain the results in detail.

Home Insert Draw Page Layout X G. Calibri 11 I DA Paste B TU # 2 C19 x for A 1 Deciding whether to market a new product 2 3 4 5 Prior probability of product success 6 Prior probability of product failure 7 8 Probabilities indicating accuracy of survey 9 Actual\survey 10 Success 11 Failure. 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Exhibit A + Formulas Data A A = A === B Review View BO 0.50 0.50 Favorable 0.60 0.10 * Tell me Wrap Text Merge & Center C Neutral 0.30 0.20 General $% 9 D Unfavorable 0.10 0.70 E Insert v Delete Format H 1. D.D. Cell Conditional Format Formatting as Table Styles F Posterior probabilities of survey results Posterior probabilities Actual survey Success Failure G su v Favorable 0.35 Favorable 0.857 0.143 Share Comments P Sensitivity 48 0. Y Sort & Find & Filter Select H I Neutral Unfavorable 0.25 0.40 Neutral 0.600 Unfavorable 0.125 0.400 0.875 Ideas J

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Find the percentage change in the output and the percentage change in the input The sensitivity is c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3af65589e_182590.pdf

180 KBs PDF File

635e3af65589e_182590.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started