Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Conduct a sensitivity analysis on the NPV of the project with respect to the discount rate. (NPV is $521,030. Discount rate used was WACC) Adlcorp

Conduct a sensitivity analysis on the NPV of the project with respect to the discount rate. (NPV is $521,030. Discount rate used was WACC)

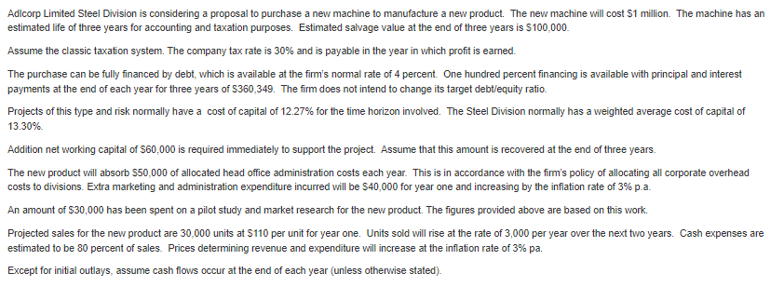

Adlcorp Limited Steel Division is considering a proposal to purchase a new machine to manufacture a new product. The new machine will cost $1 million. The machine has an estimated life of three years for accounting and taxation purposes. Estimated salvage value at the end of three years is $100,000. Assume the classic taxation system. The company tax rate is 30% and is payable in the year in which profit is earned. The purchase can be fully financed by debt, which is available at the firm's normal rate of 4 percent. One hundred percent financing is available with principal and interest payments at the end of each year for three years of $360,349. The firm does not intend to change its target debt/equity ratio. Projects of this type and risk normally have a cost of capital of 12.27% for the time horizon involved. The Steel Division normally has a weighted average cost of capital of 13.30% Addition net working capital of $60,000 is required immediately to support the project. Assume that this amount is recovered at the end of three years. The new product vill absorb $50,000 of allocated head office administration costs each year. This is in accordance with the firm's policy of allocating all corporate overhead costs to divisions. Extra marketing and administration expenditure incurred will be $40,000 for year one and increasing by the inflation rate of 3% p. a. An amount of $30,000 has been spent on a pilot study and market research for the new product. The figures provided above are based on this work. Projected sales for the new product are 30,000 units at $110 per unit for year one. Units sold will rise at the rate of 3,000 per year over the next two years. Cash expenses are estimated to be 80 percent of sales. Prices determining revenue and expenditure will increase at the inflation rate of 3% pa. Except for initial outlays, assume cash flows occur at the end of each year (unless otherwise stated)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started