Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Conduct a sensitivity check on the project's NPV by estimating a 95% confidence interval for Asados' cost of equity capital (hint: the critical t-value for

Conduct a sensitivity check on the project's NPV by estimating a 95% confidence interval for Asados' cost of equity capital (hint: the critical t-value for a 95% confidence level is 1.96)

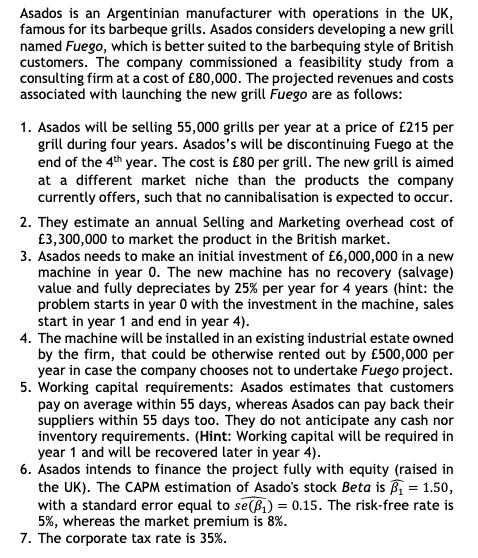

Asados is an Argentinian manufacturer with operations in the UK, famous for its barbeque grills. Asados considers developing a new grill named Fuego, which is better suited to the barbequing style of British customers. The company commissioned a feasibility study from a consulting firm at a cost of 80,000. The projected revenues and costs associated with launching the new grill Fuego are as follows: 1. Asados will be selling 55,000 grills per year at a price of 215 per grill during four years. Asados's will be discontinuing Fuego at the end of the 4th year. The cost is 80 per grill. The new grill is aimed at a different market niche than the products the company currently offers, such that no cannibalisation is expected to occur. 2. They estimate an annual Selling and Marketing overhead cost of 3,300,000 to market the product in the British market. 3. Asados needs to make an initial investment of 6,000,000 in a new machine in year 0. The new machine has no recovery (salvage) value and fully depreciates by 25% per year for 4 years (hint: the problem starts in year 0 with the investment in the machine, sales start in year 1 and end in year 4). 4. The machine will be installed in an existing industrial estate owned by the firm, that could be otherwise rented out by 500,000 per year in case the company chooses not to undertake Fuego project. 5. Working capital requirements: Asados estimates that customers pay on average within 55 days, whereas Asados can pay back their suppliers within 55 days too. They do not anticipate any cash nor inventory requirements. (Hint: Working capital will be required in year 1 and will be recovered later in year 4). 6. Asados intends to finance the project fully with equity (raised in the UK). The CAPM estimation of Asado's stock Beta is Bi = 1.50, with a standard error equal to se(B) = 0.15. The risk-free rate is 5%, whereas the market premium is 8%. 7. The corporate tax rate is 35%. %3D

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started