Conducting planning and substantive analytical procedures for accounts in the acquisition and payment cycle. When analyzing the financial data, you may assume that the 2015 information is unaudited, while prior-year data are audited. As you complete this case, consider the following features of and trends in the pharmaceutical industry and for PharmaCorp specifically:

After a long period of industry dominance by companies in the United States, the United Kingdom, and Europe, these companies are facing increasing competition from companies domiciled in emerging economies, such as Brazil, India, and China.

There exists significant uncertainty in the market because of recent regulation covering health care and government payouts for certain procedures and related pharmaceuticals

. Health care policymakers and the government are increasingly mandating what physicians can prescribe to patients

. Health care policymakers and the government are increasingly focusing on prevention regimes rather than treatment regimes, thereby leading to shifts in the demand for various pharmaceuticals

. The global pharmaceutical market is anticipated to grow by 57% in 2016 compared with a 45% growth rate in 2015, according to a leading industry analyst publication. Beginning in 2014, PharmaCorp initiated and executed a significant company-wide cost reduction initiative aimed at improving manufacturing efficiency, cutting back on research and development expenses, and eliminating unnecessary corporate overhead

. PharmaCorps policies for extending credit to customers have remained stable over the last three years. PharmaCorps credit-granting policies are considered stringent within the industry, and analysts have sometimes criticized the company for this, contending that such policies have hindered the companys revenue growth relative to industry peers

. Two of PharmaCorps popular pharmaceuticals, Selebrax and Vyvox, came off patent during the fourth quarter of FYE 2015. These pharmaceuticals now face competition in the generic drug portion of the overall industry market.Information specific to the PharmaCorps debt activities

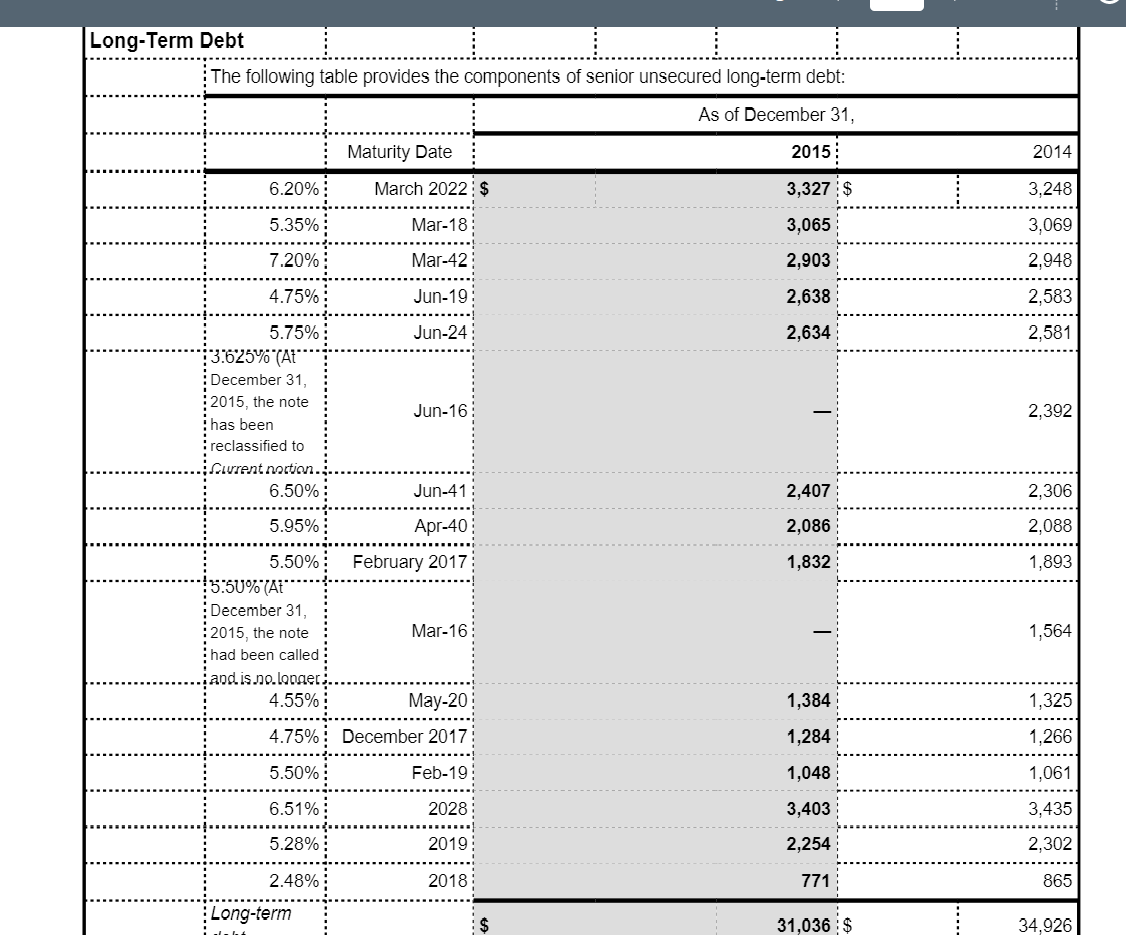

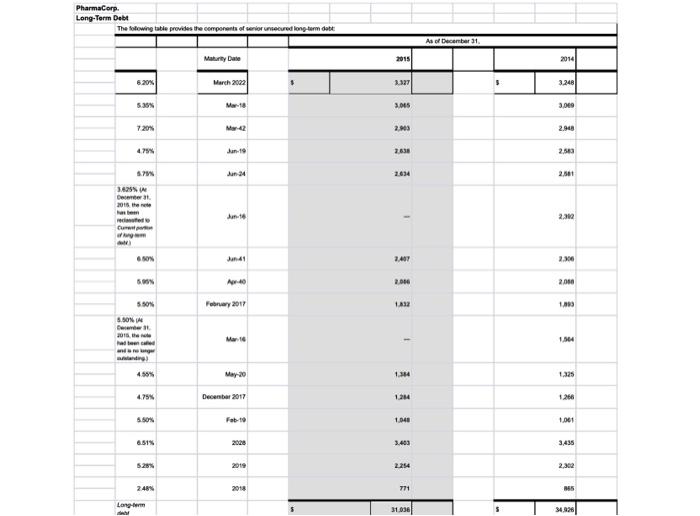

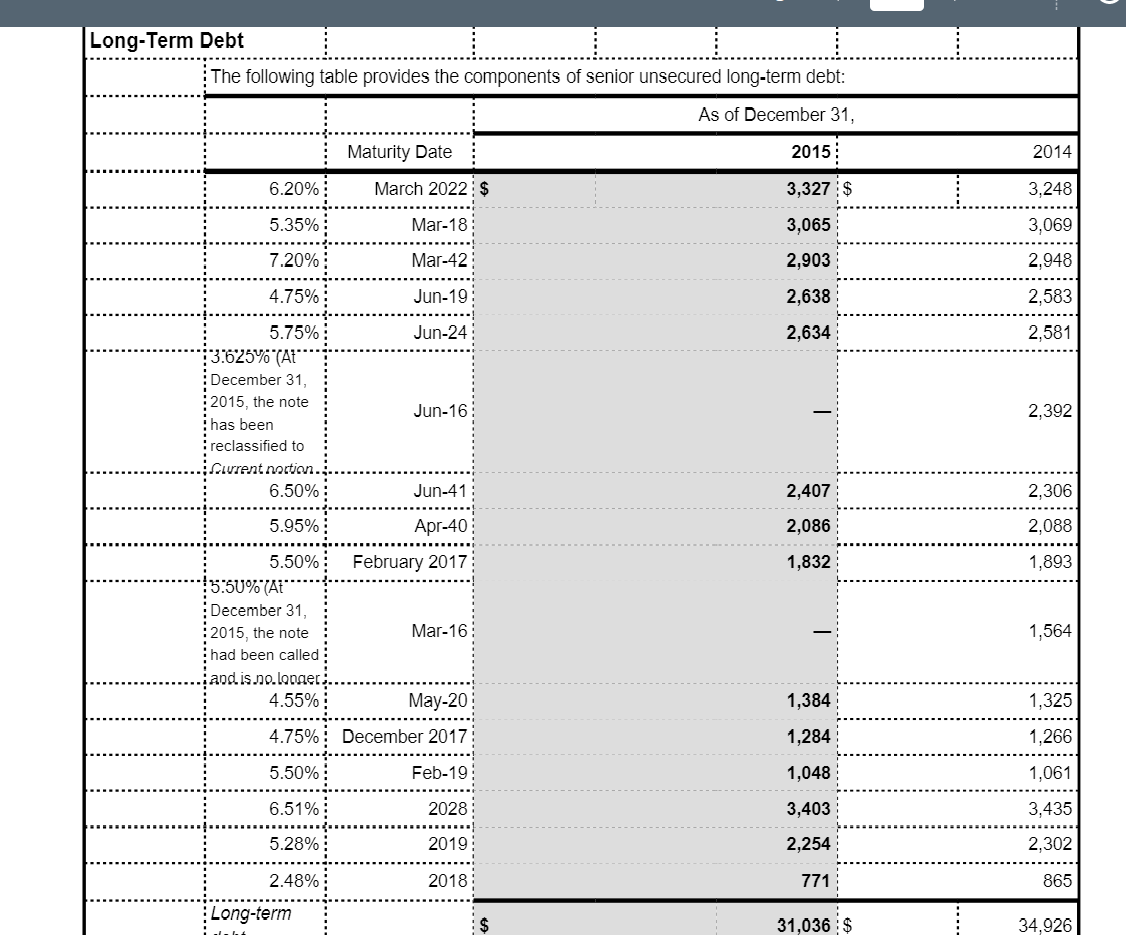

: Long-term debt balances (in the millions) for 2015 (unaudited) and 2014 (audited) were $31,036 and $34,926, respectively

. The primary financing activity related to debt was net repayments of just over $1,500,000.

Approximately $2,500,000 of long-term debt was reclassified as current in 2015. The average interest rate on the long-term debt (based on the high and low rates of PharmaCorps debt instruments) was 5.34%

. Interest expense in 2014 (audited) was approximately $2,000,000

.Part I: Planning Analytical Procedures

a. Step 1: Identify Suitable Analytical Procedures. Your audit senior has suggested that the following ratio (on an overall financial statement level) will be used for planning analytical procedures related to debt activities at PharmaCorp: Estimate interest expense (related to long-term debt) based on average long-term debt interest rates and average long-term debt outstanding. As part of Step 1, identify any other relevant relationships or trend analyses that would be useful to consider as part of planning analytics. Explain your reasoning

b, Step 2: Evaluate the Reliability of Data Used to Develop Expectations. The audit team has determined that the data you will be used to develop expectations in relation to long-term interest expense is reliable. Indicate the factors that the audit team likely considered in making that determination

.c. Step 3: Develop Expectation. Complete Step 3 of planning analytical procedures by developing an expectation for interest expense for long-term debt. Even before you develop a point estimate, what is the nature of the change of the interest expense account that you expect (from the prior year)? Using only the information provided here, what is your point estimate of interest expense.

d. Step 4 and Step 5: Define and Identify Significant Unexpected Differences. Refer to the guidance in Chapter 7 on performance materiality, tolerable misstatement, and clearly trivial amounts. Apply those materiality guidelines to Step 4 of planning analytical procedures to define what is meant by a significant difference. Explain your reasoning. Also, comment on qualitative materiality considerations in this context. Now that you have determined what amount of difference would be considered significant, indicate whether there was a significant unexpected difference, assuming that the client recorded $1,800,000 of interest expense related to long-term debt

.e. Step 6 and Step 7: Investigate Significant Unexpected Differences and Ensure Proper Documentation. Complete Step 6 of planning analytical procedures by describing how your results will affect your substantive audit procedures. Explain your reasoning. To complete Step 7, describe what information should be included in the auditors work papers

.Part II: Substantive Analytical Procedures.

f. As you talk with your audit senior, you realize that your estimate during planning was not very precise because it was based on data that were highly aggregated. While this approach would be appropriate for planning analytics, it is likely not appropriate for substantive analytics. How could you improve the precision of your estimate so that it would be precise enough to constitute evidence as a substantive analytical procedure?

g. Access the PharmaCorp Excel file at the text website. Refer to the worksheet labeled PharmaCorp Long Term Debt. Use that information to develop a more precise estimate for interest expense for long-term debt. Given the estimate that you developed, what is your conclusion regarding the clients asserted amount of interest expense for long-term debt?

Long-Term Debt The following table provides the components of senior unsecured long-term debt: As of December 31, Maturity Date 2015: 2014 6.20%; March 2022: $ 3,327 :$ 3,248 5.35% Mar-18 3,065 3,069 7.20% Mar-42 2,903 2,948 4.75% Jun-19 2,638 2,583 Jun-24 2,634 2.581 5.75% :3625% (At" December 31, 2015, the note has been reclassified to Suurent nation. 6.50% Jun-16 2,392 Jun-41 2,407 2,306 5.95%; Apr-40 2,086 2,088 1,832 1,893 1,564 5.50% February 2017 5.50% TAE December 31, :2015, the note Mar-16 had been called aod is no longer 4.55% May-20 4.75% December 2017 1,384 1,325 1,284 1,266 5.50%! Feb-19 1,048 1,061 6.51% 2028 3,403 3,435 5.28% 2019 2,254 2,302 2.48%; 2018: 771 865 : Long-term 31,036 :$ 34,926 PharmaCorp Operating Segments We manage our operations through five operating segments Primary Care; Specialty Care and Oncology; Established Products and Emerging Markets; Animal Health; and Consumer Health care. As of the third quarter of 2012, the Animal Health and Consumer Healthcare business units are no longer managed as a single operating segment. Each operating segment has responsibility for its commercial activities and for certain research and development activities related to in-line products and in-process research and development (IPR&D) projects that generally have achieved proof-of-concept. C on November 30, 2015, we completed the sale of our Nutrition business to Choco and recognized a gain on the sale of this business in Gain/(loss) on sale of discontinued operations net of tax in the consolidated statement of income for the year ended December 31, 2015. The operating results of this business are reported as Income/(loss) from discontinued operations net of tax in the consolidated statements of income for all periods presented. We regularly review our segments and the approach used by management to evaluate performance and allocate resources. Generally, products are transferred to the Established Products business unit in the beginning of the fiscal year following loss of patent protection or marketing exclusivity. A description of each of our five operating segments follows: Primary Care operating segment includes revenues from human prescription pharmaceutical products primarily prescribed by primary care physicians, and may include products in the following therapeutic and disease areas: Alzheimer's disease, cardiovascular (excluding pulmonary arterial hypertension), erectile dysfunction, genitourinary, major depressive disorder, pain, respiratory and smoking cessation. All revenues for these products are allocated to the Primary Care business unit, except those generated in emerging markets and those that are managed by the Established Products business unit. Specialty Care and Oncology operating segment comprises the Specialty Care business unit and the Oncology business unit. Specialty Care-includes revenues from human prescription pharmaceutical products primarily prescribed by physicians who are specialists, and may include products in the following therapeutic and disease areas: anti-infectives, endocrine disorders, hemophilia, inflammation, ophthalmology, pulmonary arterial hypertension, specialty neuroscience and vaccines. All revenues for these products are allocated to the Specialty Care business unit, except those generated in emerging markets and those that are managed by the Established Products business unit. Oncology-includes revenues from human prescription pharmaceutical products addressing oncology and oncology-related illnesses. All revenues for these products are allocated to the Oncology business unit, except those generated in emerging markets and those that are managed by the Established Products business unit. Established Products and Emerging Markets operating segment-comprises the Established Products business unit and the Emerging Markets business unit. Established Products-includes revenues from human prescription pharmaceutical products that have lost patent protection or marketing exclusivity in certain countries and/or regions. Typically, products are transferred to this business unit in the beginning of the fiscal year following loss of patent protection or marketing exclusivity. However, in certain situations, products may be transferred to this business unit at a different point than the beginning of the fiscal year following loss of patent protection or marketing exclusivity in order to maximize their value. This business unit also excludes revenues generated in emerging markets. Emerging Markets-includes revenues from all human prescription pharmaceutical products sold in emerging markets, including Asia (excluding Japan and South Korea), Latin America, the Middle East, Eastern Europe, Africa, Turkey and Central Europe. PharmaCorp Operating Segments We manage our operations through five operating segments --Primary Care; Specialty Care and Oncology, Established Products and Emerging Markets, Animal Health, and Consumer Healthcare. As of the third quarter of 2012, the Animal Health and Consumer Healthcare business units are no longer managed as a single operating segment. Each operating segment has responsibility for its commercial adivities and for certain research and development activities related to in-line products and in-process research and development (PRD) projects that generally have achieved proof-of-concept. On November 30, 2015, we completed the sale of our Nutrition business to Choco and recognized a gain on the sale of this business in Gain (loss) on sale of discontinued operations net of tax in the consolidated statement of income for the year ended December 31, 2015. The operating results of this business are reported as Income (loss) from discontinued operations,net of tax in the consolidated statements of income for all periods presented. We regularly review our segments and the approach used by management to evaluate performance and allocate resources Generally. products are transferred to the Established Produdsbusiness unit in the beginning of the fiscal year following loss of patent protection or marketing exdusivity. A description of each of our five operating segments follows Primary Care operating segment --indudes revenues from human prescription pharmaceutical produds primarily prescribed by primary care physicians and may indude products in the following therapeutic and disease areas Alzheimer's disease cardiovascular (excluding pulmonary arterial hypertension), erectile dysfunction, genitourinary, major depressive disorder, pain, respiratory and smoking cessation. All revenues for these products are allocated to the Primary Care business unit, except those generated in emerging markets and those that are managed by the Established Products business unit. Specialty Care and Oncology operating segment comprises the Specialty Care business unit and the Oncology business unit. Specialty Care-indudes revenues from human prescription pharmaceutical products primarily prescribed by physicians who are specialists, and may indude products in the following therapeutic and disease areas anti-infectives endocrine disorders, hemophilia, inflammation, ophthalmology, pulmonary arterial hypertension, specialty neuroscience and vaccines All revenues for th r these products are allocated to th o the Specialty Care business unit, except those generated in emerging markets and those that are managed by the Established Products business unit. Oncology-includes revenues from human prescription pharmaceutical products addressing oncology and oncology-related illnesses All revenues for these products are allocated to the Oncology business unit, except those generated in emerging markets and those that are managed by the Established poduds business unit. Established Products and Emerging Markets operating segment comprises the Established Products business unit and the Emerging Markets business unit. Established Produds-indudes revenues from human prescription pharmaceutical produds that have lost patent protection or marketing exdusivity in certain countries and/or regions. Typically, products are transferred to this business unit in the beginning of the fiscal year followingloss of patent protection or marketingexclusivity. However, in certain situations, products may be transferred to this business unit at a different point than the beginningof the fiscal year following loss of patent protection or marketing exclusivity in order to maximize their value. This business unit also exdudes revenues generated in emerging markets Emerging Markets-indudes revenues from all human prescription phmaceutical produds sold in emerging markets, induding Asia (excluding Japan and South Korea), Latin America the Middle East, Eastern Europe, Africa, Turkey and Central Europe PharmaCorp. Long-Term Debt The following table provides the components of senior secured long term date As of December 31 Maurity Date 2014 6.20% March 2022 3.248 5:39 18 3,069 7203 M. 2.800 2.948 079% Jan.19 3838 2.53 Jan 24 2634 2.1 3.625 J-16 - reciated 2.212 SON 41 2016 2010 February 2017 1012 1.000 55 5.SONIN December 2015 had to ing) -- 1.564 May 20 1.14 132 4.79 December 2017 1.200 5.50% Fab-10 1.040 1.061 6.51% 2020 3.463 3,436 5.28 2.254 2.302 2.489 2018 771 185 Long 31.036 34.926