Answered step by step

Verified Expert Solution

Question

1 Approved Answer

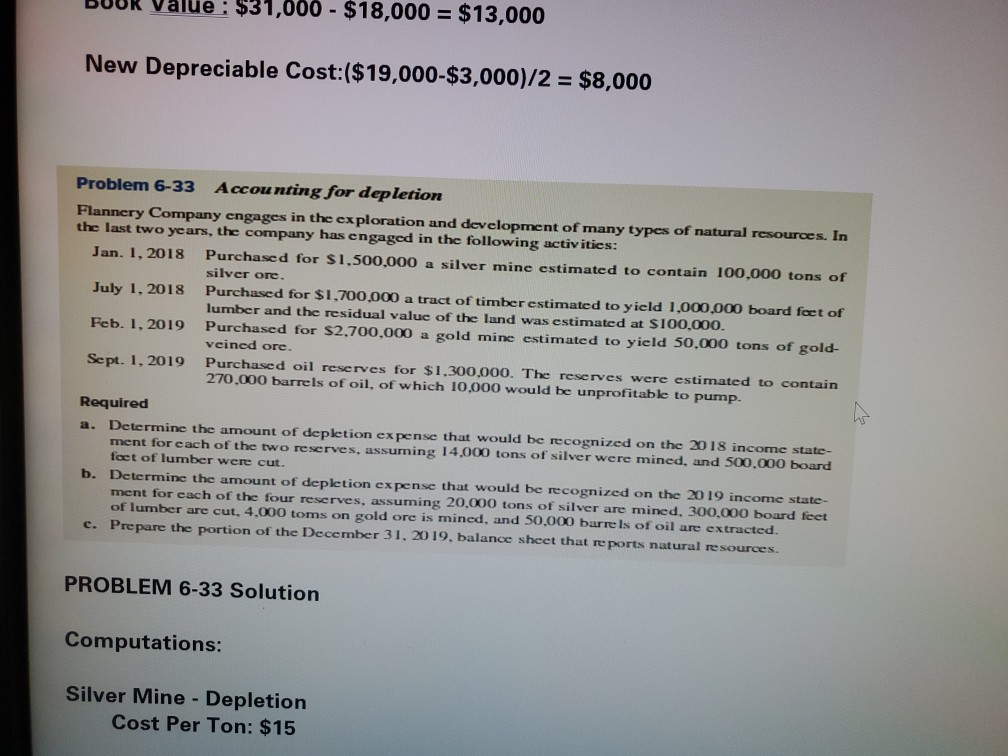

Confused on where to even start, and what to do. : $31,000 - $18,000 = $13,000 New Depreciable Cost:($19,000-$3,000)/2 = $8,000 Problem 6-33 Accounting for

Confused on where to even start, and what to do.

: $31,000 - $18,000 = $13,000 New Depreciable Cost:($19,000-$3,000)/2 = $8,000 Problem 6-33 Accounting for depletion Flannery Company engages in the exploration and development of many types of natural resources. In the last two years, the company has engaged in the following activities: Jan. 1, 2018 Purchased for $1,500,000 a silver mine estimated to contain 100.000 tons of silver ore. July 1, 2018 Purchased for $1.700.000 a tract of timber estimated to yield 1,000,000 board fot of lumber and the residual value of the land was estimated at $100,000. Feb. 1. 2019 Purchased for $2,700,000 a gold mine estimated to yield 50.000 tons of gold- veined ore. Sept. 1, 2019 Purchased oil reserves for $1,300,000. The reserves were estimated to contain 270.000 barrels of oil, of which 10,000 would be unprofitable to pump. Required a. Determine the amount of depletion expense that would be recognized on the 2018 income state- ment for each of the two reserves, assuming 14,000 tons of silver were mined, and 00.000 board feet of lumber were cut. b. Determine the amount of depletion expense that would be recognized on the 2019 income state- ment for each of the four reserves, assuming 20.000 tons of silver are mined, 300.000 board feet of lumber are cut. 4,000 toms on gold ore is mined, and 50,000 barrels of oil are extracted. c. Prepare the portion of the December 31, 2019. balance sheet that reports natural resources. PROBLEM 6-33 Solution Computations: Silver Mine - Depletion Cost Per Ton: $15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started