Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Conglomerate Inc. has 20 million shares outstanding and its stock is currently trading at $25 a share. The firm has two divisions: industrial electrical equipment

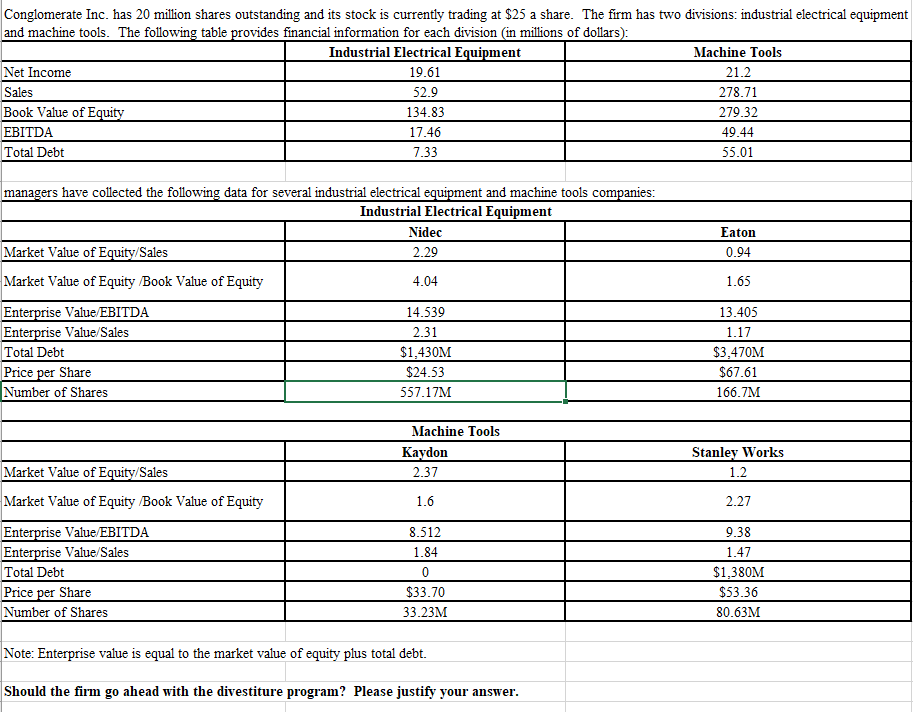

Conglomerate Inc. has 20 million shares outstanding and its stock is currently trading at $25 a share. The firm has two divisions: industrial electrical equipment and machine tools. The following table provides financial information for each division (in millions of dollars):

Conglomerate Inc. has 20 million shares outstanding and its stock is currently trading at $25 a share. The firm has two divisions: industrial electrical equipment and machine tools. The following table provides financial information for each division (in millions of dollars):

| Industrial Electrical Equipment | Machine Tools | |

| Net Income | 19.61 | 21.2 |

| Sales | 52.9 | 278.71 |

| Book Value of Equity | 134.83 | 279.32 |

| EBITDA | 17.46 | 49.44 |

| Total Debt | 7.33 | 55.01 |

| Since the managers believe that both divisions are being undervalued by investors, they are considering a divestiture program. To justify this program, the managers have collected the following data for several industrial electrical equipment and machine tools companies: | ||

| Industrial Electrical Equipment | ||

| Nidec | Eaton | |

| Market Value of Equity/Sales | 2.29 | 0.94 |

| Market Value of Equity /Book Value of Equity | 4.04 | 1.65 |

| Enterprise Value/EBITDA | 14.539 | 13.405 |

| Enterprise Value/Sales | 2.31 | 1.17 |

| Total Debt | $1,430M | $3,470M |

| Price per Share | $24.53 | $67.61 |

| Number of Shares | 557.17M | 166.7M |

| Machine Tools | ||

| Kaydon | Stanley Works | |

| Market Value of Equity/Sales | 2.37 | 1.2 |

| Market Value of Equity /Book Value of Equity | 1.6 | 2.27 |

| Enterprise Value/EBITDA | 8.512 | 9.38 |

| Enterprise Value/Sales | 1.84 | 1.47 |

| Total Debt | 0 | $1,380M |

| Price per Share | $33.70 | $53.36 |

| Number of Shares | 33.23M | 80.63M |

| Note: Enterprise value is equal to the market value of equity plus total debt. | ||

| Should the firm go ahead with the divestiture program? Please justify your answer. | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started