Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Congratulations! When you complete this project, you'll have completed your program is hands-on assignment is an opportunity for you to demonstrate your mastery of

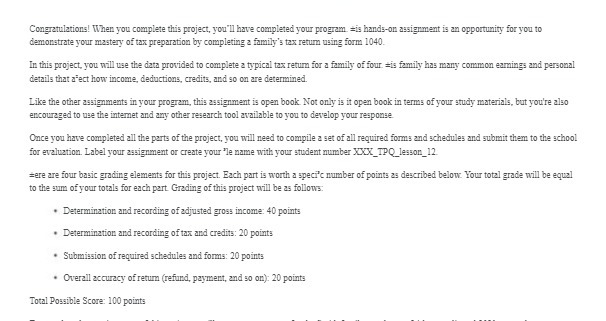

Congratulations! When you complete this project, you'll have completed your program is hands-on assignment is an opportunity for you to demonstrate your mastery of tax preparation by completing a family's tax return using form 1040. In this project, you will use the data provided to complete a typical tax return for a family of four is family has many common earnings and personal details that afect how income, deductions, credits, and so on are determined. Like the other assignments in your program, this assignment is open book. Not only is it open book in terms of your study materials, but you're also encouraged to use the internet and any other research tool available to you to develop your response Once you have completed all the parts of the project, you will need to compile a set of all required forms and schedules and submit them to the school for evaluation. Label your assignment or create your "le name with your student number XXX_TPQ_lesson_12 ere are four basic grading elements for this project. Each part is worth a speci'c number of points as described below. Your total grade will be equal to the sum of your totals for each part. Grading of this project will be as follows: Determination and recording of adjusted gross income: 40 points Determination and recording of tax and credits: 20 points Submission of required schedules and forms: 20 points Overall accuracy of return (refund, payment, and so on): 20 points Total Possible Score: 100 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started