.

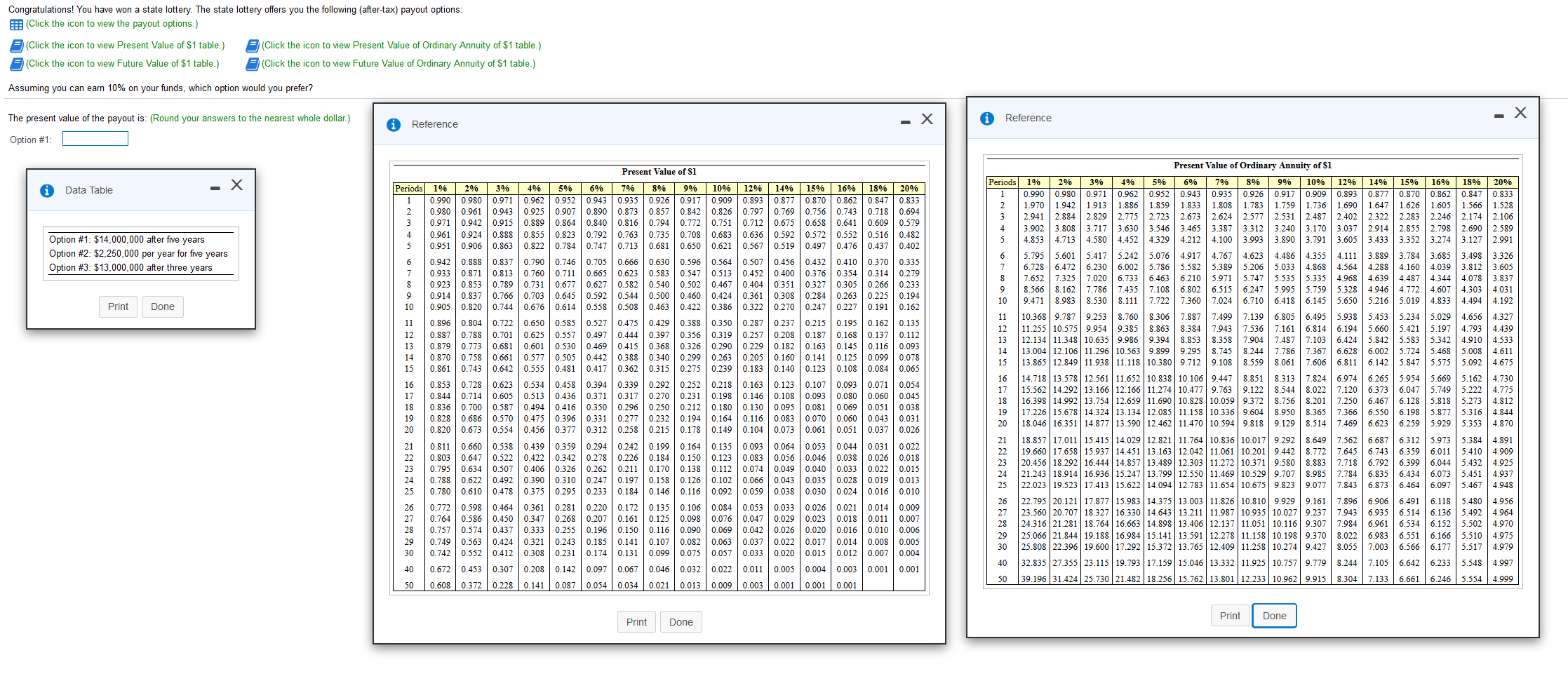

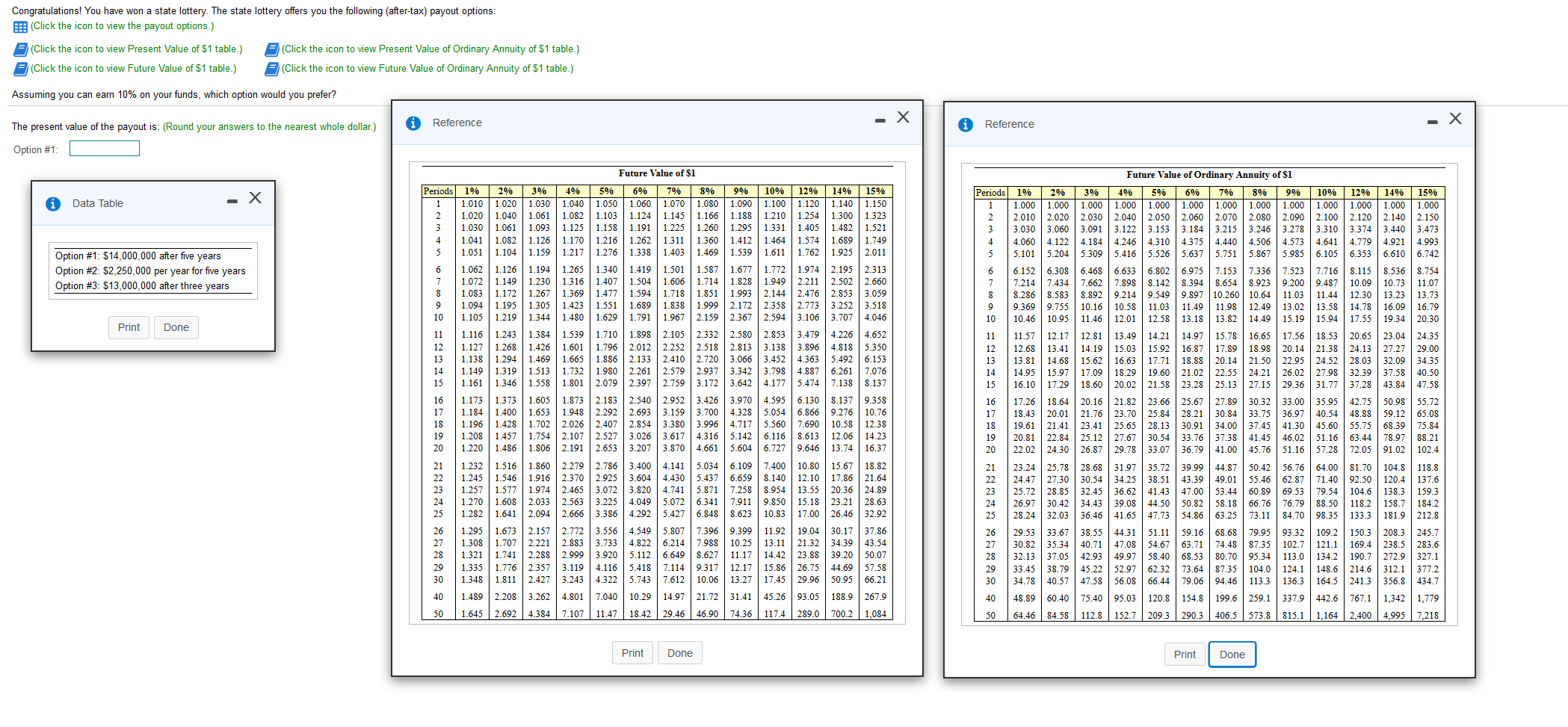

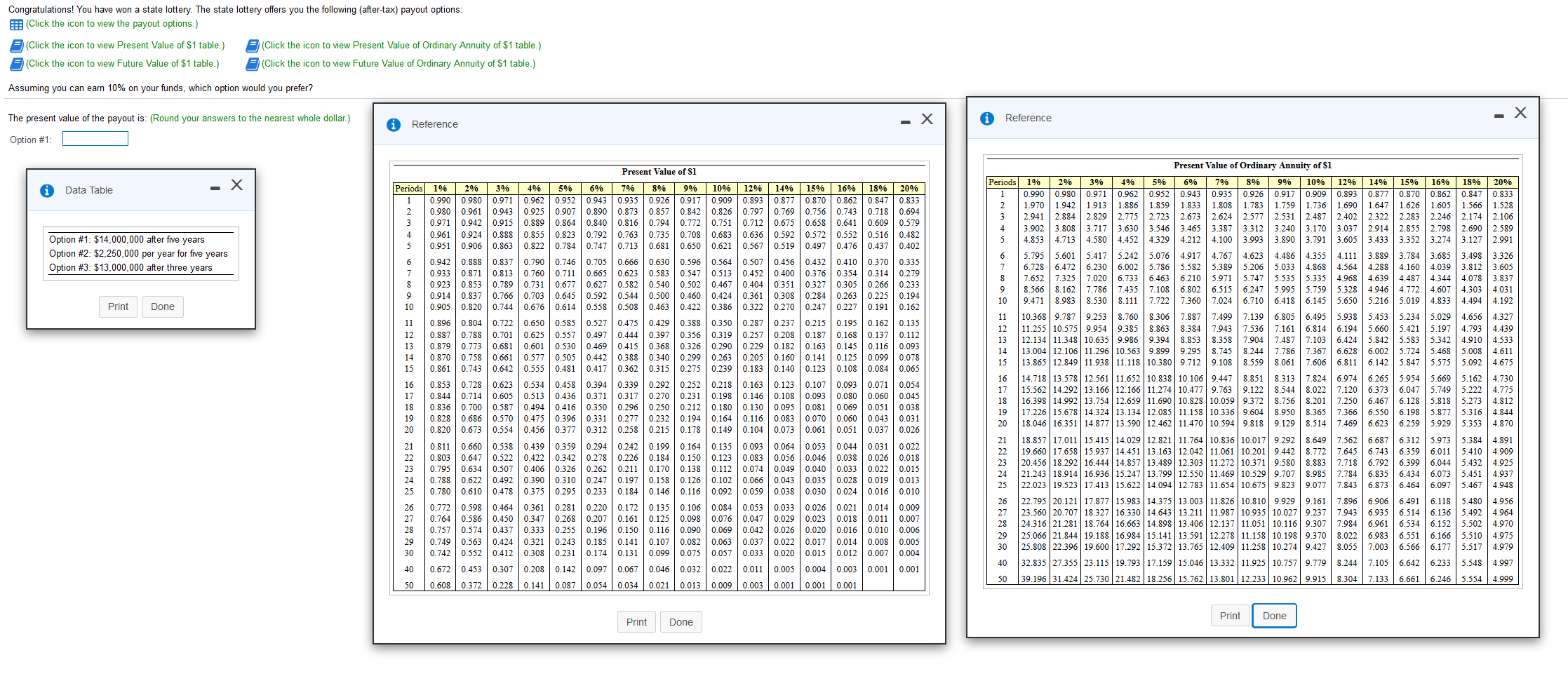

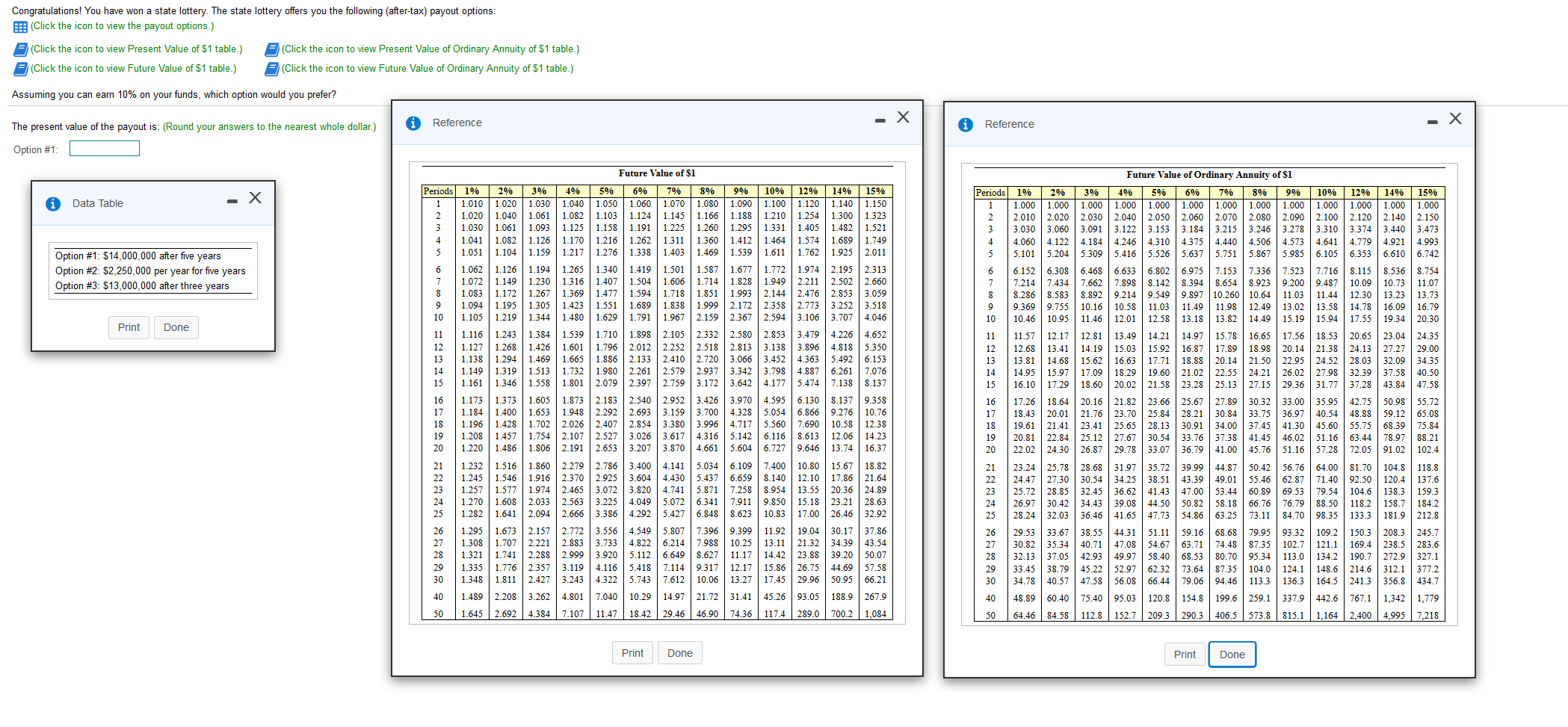

Congratulations! You have won a state lottery. The state lottery offers you the following (after-tax) payout options: (Click the icon to view the payout options.) Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Assuming you can earn 10% on your funds, which option would you prefer? 0 Reference The present value of the payout is: (Round your answers to the nearest whole dollar.) Option #1: Reference Periods 0 Data Table Option #1: $14,000,000 after five years Option #2: $2,250,000 per year for five years Option #3: $13,000,000 after three years Print Done 13 14 0.743 Present Value of S1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 0.990 0.980 0,971 0.962 0.9520.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.8570.842 0.826 0.797 0.769 0.756 0.743 0.7180.694 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.5830.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.4040.351 0.327 0.305 0.266 0.233 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.870 0.758 0.661 0.577 0.505 | 0.442 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.861 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.853 0.728 0.623 0.534 0.458 0.394 0.3390.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.811 0.660 0.538 0.439 0.359 0.294 0.242 0.199 0.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 0.803 0.647 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 0.795 0.634 0.507 0.4060.326 0.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.013 0.780 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.059 0.038 0.030 0.024 0.0160.010 0.772 0.598 0.464 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 0.764 0.586 0.450 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.047 0.029 0.023 0.018 0.0110.007 0.757 0.574 0.437 0.333 0.255 0.1960.150 0.116 0.090 0.069 0.042 0.026 0.020 0.016 0.010 0.006 0.7490.563 0.424 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.037 0.022 0.017 | 0.014 0.008 0.005 0.742 0.552 0.412 0.308 0.231 0.1740.131 0.099 0.075 0.057 0.033 0.020 0.015 0.012 0.007 0.004 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 | 0.022 0.0110.005 0.0040.003 0.001 0.001 50 10.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.003 0.001 0.001 0.001 Present Value of Ordinary Annuity of $1 1% 29% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 1.970 | 1.942 | 1.913 | 1.886 | 1.859 | 1.833 | 1.808 1.783 1.759 1.736 | 1.690 1.647 | 1.626 | 1.605 1.566 1.528 2.941 2.884 2.829 | 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 | 3.127 2.991 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.4864.355 4.111 3.889 3.784 3.685 3.498 3.326 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 3.812 3.605 7.652 7.325 7.020 6.733 6.463 6.210 5.971 | 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 8.566 8.162 7.786 7.435 7.108 6.8026.515 6.247 5.9955.759 5.328 4.9464.772 4.607 4.303 4.031 9.471 8.9838.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 10.368 9.7879.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.0294.656 4.327 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.5367.161 6.814 6.194 5.660 5.421 5.197 | 4.793 4.439 12.134 11.348 10.635 | 9.986 9.3948.8538.358 7.904 7.487 7.103 6.424 5.8425.583 5.342 4.910 4.533 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.0025.724 5.468 5.008 4.611 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.5598.061 7.6066.811 6.142 5.847 5.575 5.092 4.675 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.9746.265 5.954 5.6695.162 4.730 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.1206.373 6.047 5.749 5.222 4.775 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.4676.128 5.818 5.273 812 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.5506.1985.8775.316 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 8.514 7.469 6.623 6.259 5.929 5.353 4.870 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.5626.6876.312 5.9735.384 .891 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 7.645 6.7436.3596.011 5.410 4.909 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 | 7.718 6.792 6.3996.044 5.432 4.925 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.9857.784 6.835 6.4346.073 5.451 4.937 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 7.843 6.8736.464 6.097 5.467 4.948 22.795 20.121 17.87715.983 14.375 13.003 11.826 10.810 9.929 9.1617.896 6.906 6.491 6.118 5.480 4.956 23.560 20.707 18.327 16.330 14.643 | 13.211 | 11.987 10.935 10.027 9.237 7.943 6.935 6.514 6.136 5.492 4.964 24.316 21.281 18.764 16.663 14.898 13.406 12.13711.051 10.116 9.307 7.984 6.961 6.534 6.152 5.502 4.970 25.066 21.844 19.188 | 16.984 15.141 13.591 | 12.278 | 11.158 | 10.198 9.370 8.022 6.983 6.551 6.166 5.510 4.975 25.808 | 22.396 | 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.566 6.1775.517 4.979 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.244 7.105 6.642 6.233 5.548 4.997 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 6.246 5.554 4.999 19 40 Print [ Done] Print Done Congratulations! You have won a state lottery. The state lottery offers you the following (after-tax) payout options: (Click the icon to view the payout options.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) 3 (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Assuming you can earn 10% on your funds, which option would you prefer? Reference A Reference The present value of the payout is: (Round your answers to the nearest whole dollar.) Option #1: Future Value of Si Periods Periods G Data Table + 3 Option #1: $14,000,000 after five years Option #2: $2,250,000 per year for five years Option #3: $13,000,000 after three years Print Done 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1.010 | 1.020 | 1.030 | 1.040 | 1.050 1.060 | 1.070 | 1.080 1.090 1.100 1.020 1.040 1.061 | 1.082 1.103 | 1.124 | 1.145 | 1.166 | 1.188 1.210 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.041 1.0821.126 1.170 | 1.216 1.262 | 1.311 1.360 | 1.412 | 1.464 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 | 1.611 1.062 1.126 | 1.194 | 1.265 | 1.340 1.419 1.501 1.587 1.677 1.772 1.072 1.149 | 1.230 | 1.316 1.407 1.504 | 1.606 1.714 1.828 1.949 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 1.105 1.219 | 1.344 | 1.480 1.629 1.791 1.967 2.159 2.367 2.594 1.116 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 1.127 1.268 1.426 | 1.601 | 1.796 2.012 2.252 2.518 2.813 3.138 1.138 1.294 | 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.798 1.161 1.346 1.558 1.801 | 2.079 2.3972.759 3.172 3.642 4.177 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 4.3285.054 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.996 4.717 5.560 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 1.220 1.486 | 1.806 2.191 2.653 3.207 3.870 4.661 5.604 6.727 1.860 2.279 2.786 3.400 4.141 5.034 6.1097.400 1.916 2.370 2.925 3.604 4.430 5.4376.659 8.140 1.257 1.577 1.974 2.465 3.072 3.820 4.741 5.871 7.258 8.954 1.270 1.608 2.033 2.563 3.225 4.049 5.072 6.341 7.911 9.850 1.282 1.641 2.094 2.666 3.386 4.292 6.848 8.623 10.83 1.295 | 1.673 2.157 2.772 3.556 4.549 5.807 7.396 9.399 11.92 1.308 1.707 2.221 | 2.883 3.733 4.822 6.214 7.988 10.25 13.11 1.321 | 1.741 2.999 3.920 5.112 6.649 11.17 14.42 1.335 1.776 2.357 3.119 4.116 5.418 7.114 9.317 12.17 15.86 1.348 1.811 2.427 3.243 4.3225.743 7.612 10.06 13.27 17.45 1.489 2.208 3.262 4.801 7.040 10.29 14.97 21.72 31.41 45.26 1.645 2.692 4.384 7.107 11.47 18.42 29.46 46.90 74.36 117.4 12% 14% 15% 1.120 | 1.140 | 1.150 1.254 | 1.300 1.323 1.405 1.482 1.521 1.574 | 1.689 | 1.749 1.762 1.925 2.011 1.974 2.195 2.313 2.211 | 2.502 2.660 2.476 2.853 3.059 2.7733.252 3.518 3.106 3.707 4.046 3.479 4.226 4.652 3.896 4.818 5.350 4.363 5.492 6.153 4.8876.261 | 7.076 5.4747.138 8.137 6.130 8.137 9.358 6.866 9.276 10.76 7.690 10.58 12.38 8.613 12.06 14.23 9.646 13.74 16.37 10.80 15.67 18.82 12.10 17.86 21.64 13.55 20.36 24.89 15.18 23.21 28.63 17.00 26.46 32.92 19.04 30.17 37.86 21.32 34.39 43.54 23.88 39.20 50.07 26.75 44.69 57.58 29.96 50.95 | 66.21 93.05 188.9 267.9 289.0 700.2 1,084 Future Value of Ordinary Annuity of $1 1% 2% 3% 496 59% 696 796 896 99% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.120 2.140 2.150 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.374 3.440 3.473 4.0604.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 | 4.779 | 4.921 4.993 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.353 6.610 6.742 6.152 6.308 6.468 6.633 6.802 6.975 7.1537.3367.523 7.716 8.115 8.536 8.754 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.9239.2009.487 10.09 10.73 11.07 8.286 8.583 8.8929.214 9.549 9.897 10.260 10.64 11.03 | 11.44 12.30 13.23 13.73 9.369 9.755 10.16 10.58 | 11.03 | 11.49 11.98 12.49 13.02 13.58 14.78 16.09 16.79 10.46 10.95 | 11.46 12.01 | 12.58 | 13.18 13.82 14.49 15.19 15.94 | 17.55 19.34 20.30 11.57 12.17 12.81 13.49 14.21 14.97 15.78 16.65 17.56 18.53 20.65 23.04 24.35 12.68 13.41 | 14.19 15.03 15.92 16.87 17.8918.98 20.14 21.38 24.13 27.27 29.00 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34.35 14.95 15.97 17.09 18.29 19.60 21.02 22.55 24.21 26.02 27.98 32.39 37.58 40.50 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 31.77 37.28 43.84 47.58 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 35.95 42.75 50.98 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40.54 48.88 59.12 65.08 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41.30 45.60 55.75 68.39 75.84 20.81 22.84 25.12 27.67 30.54 33.76 37.38 41.45 46.02 51.16 63.44 78.97 88.21 22.02 24.30 26.87 29.78 33.07 36.79 41.00 45.76 51.16 57.28 72.05 91.02 102.4 23.24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8 24.47 27.30 30.54 34.25 38.51 43.39 49.01 55.46 62.87 71.40 92.50 120.4 137.6 25.72 28.85 32.45 36.62 41.43 47.00 53.44 60.89 69.53 79.54 | 104.6 138.3 159.3 26.97 30.42 34.43 39.08 44.50 50.82 58.18 66.76 76.79 88.50 118.2 158.7 1842 28.24 32.03 36.46 41.65 47.73 54.86 63.25 73.11 84.70 98.35 133.3 181.9 212.8 29.53 33.67 | 38.55 44.31 | 51.11 59.1668.68 79.95 93.32 109.2 150.3 2083 245.7 30.82 35.34 | 40.71 47.08 54.67 | 63.71 74.48 87.35 102.7 121.1 | 169.4 238.5 283.6 32.13 37.05 42.93 49.97 58.40 68.53 80.70 95.34 113.0 134.2 190.7 272.9 327.1 33.45 38.79 45.22 52.97 62.32 73.64 87.35 104.0 124.1 148.6 214.6 312.1 377.2 34.78 40.57 47.58 56.08 66.44 79.06 94.46 113.3 136.3 164.5 241.3 356.8 434.7 48.89 60.40 75.40 95.03 120.8 154.8 199.6 259.1 337.9 442.6 767.1 1,342 1,779 64.46 84.58 112.8 152.7 209.3 290.3 406.5 573.8 815.1 1,164 2,400 4,995 7,218 55.72 8.627 Print Done Print Done