Answered step by step

Verified Expert Solution

Question

1 Approved Answer

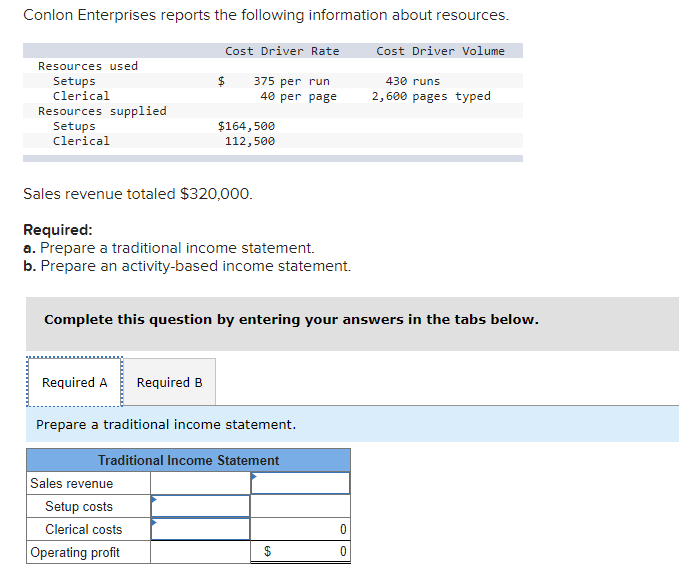

Conlon Enterprises reports the following information about resources. Cost Driver Rate Cost Driver Volume Resources used Setups Clerical $ 375 per run 40 per

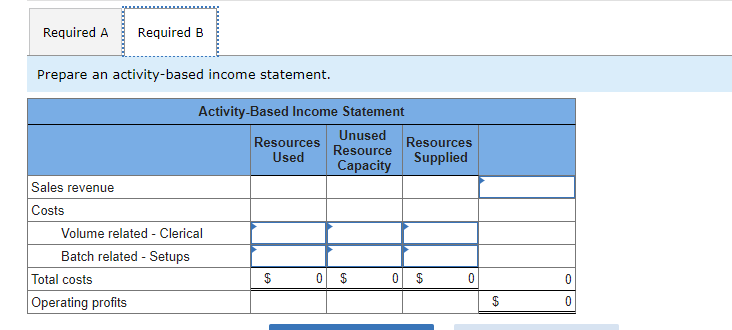

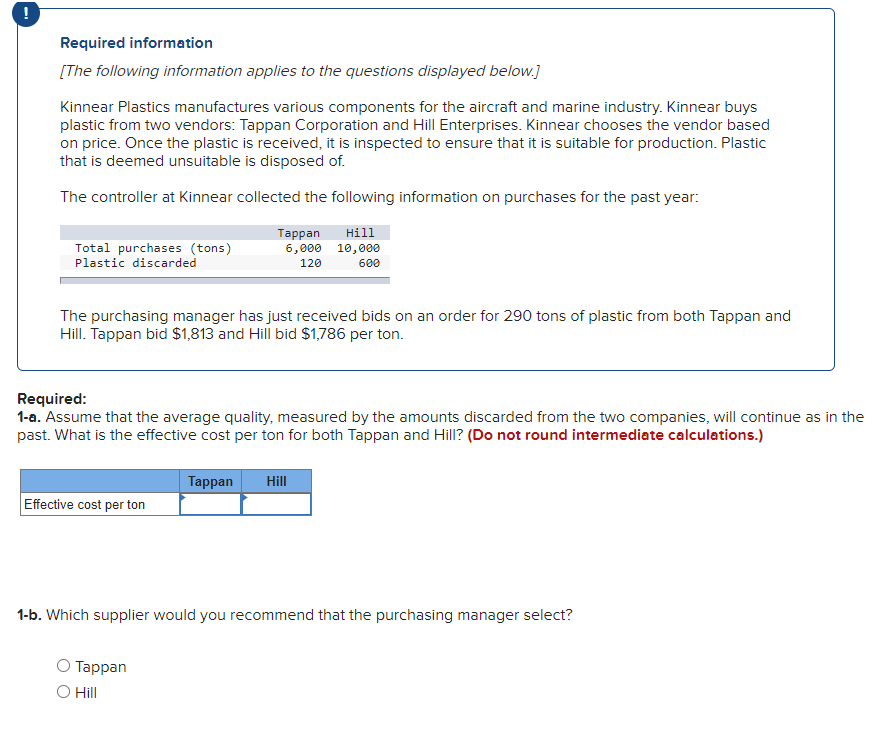

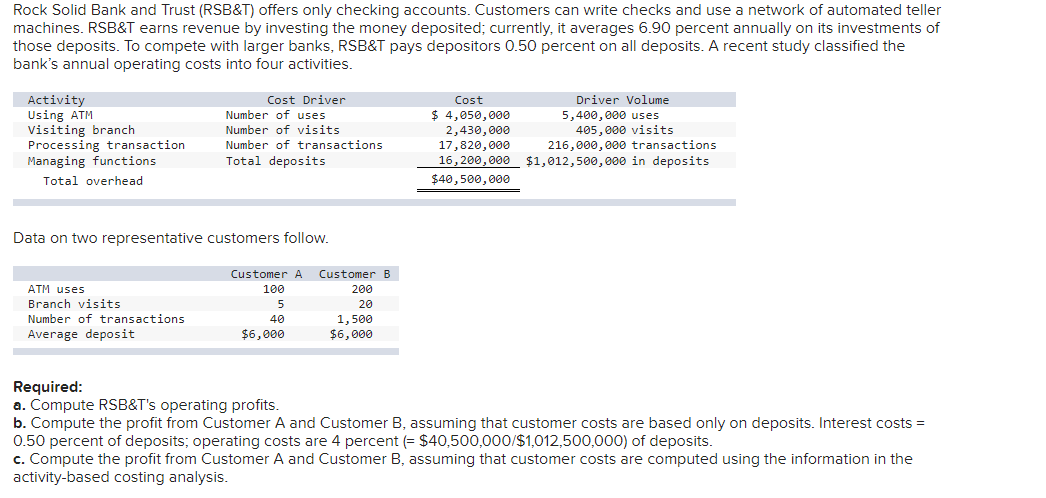

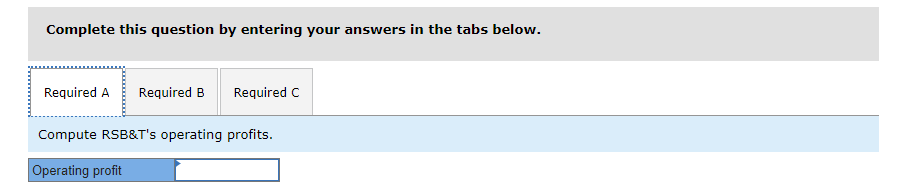

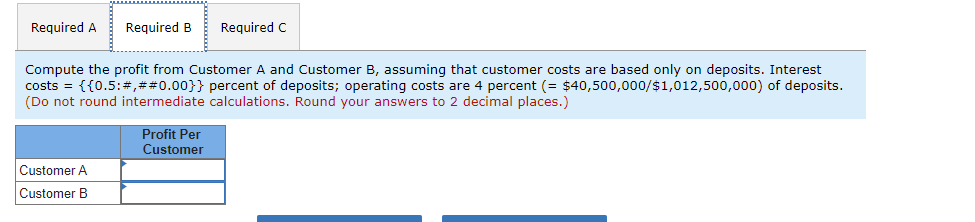

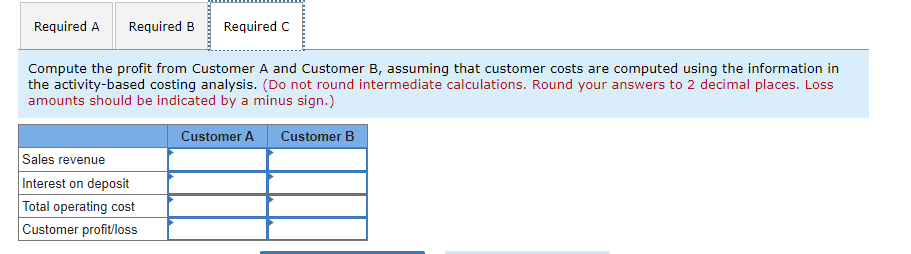

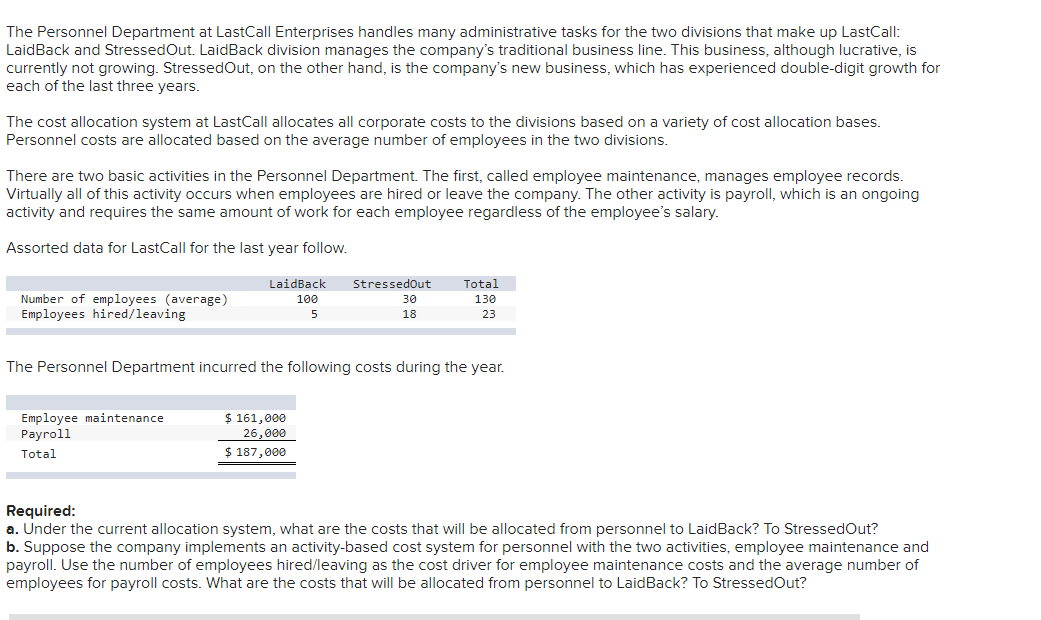

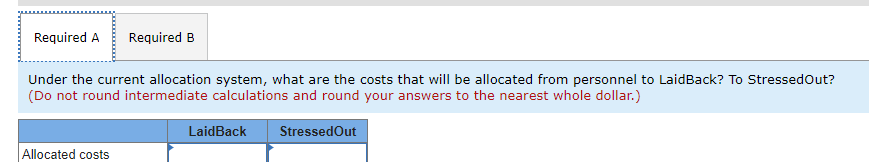

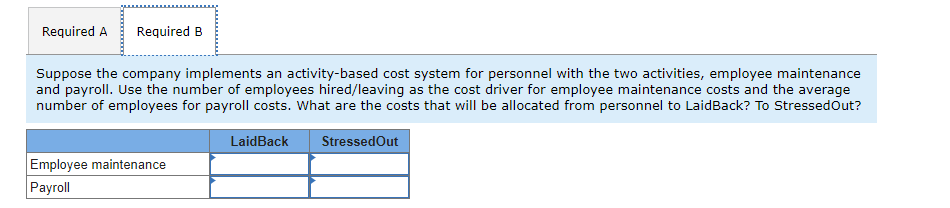

Conlon Enterprises reports the following information about resources. Cost Driver Rate Cost Driver Volume Resources used Setups Clerical $ 375 per run 40 per page 430 runs 2,600 pages typed Resources supplied Setups Clerical $164,500 112,500 Sales revenue totaled $320,000. Required: a. Prepare a traditional income statement. b. Prepare an activity-based income statement. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a traditional income statement. Traditional Income Statement Sales revenue Setup costs Clerical costs 0 Operating profit $ 0 Required A Required B Prepare an activity-based income statement. Activity-Based Income Statement Sales revenue Unused Resources Used Resource Resources Supplied Capacity Costs Volume related - Clerical Batch related - Setups Total costs $ 0 $ 0 $ 0 0 Operating profits $ ! Required information [The following information applies to the questions displayed below.] Kinnear Plastics manufactures various components for the aircraft and marine industry. Kinnear buys plastic from two vendors: Tappan Corporation and Hill Enterprises. Kinnear chooses the vendor based on price. Once the plastic is received, it is inspected to ensure that it is suitable for production. Plastic that is deemed unsuitable is disposed of. The controller at Kinnear collected the following information on purchases for the past year: Total purchases (tons) Tappan 6,000 Hill 10,000 Plastic discarded 120 600 The purchasing manager has just received bids on an order for 290 tons of plastic from both Tappan and Hill. Tappan bid $1,813 and Hill bid $1,786 per ton. Required: 1-a. Assume that the average quality, measured by the amounts discarded from the two companies, will continue as in the past. What is the effective cost per ton for both Tappan and Hill? (Do not round intermediate calculations.) Tappan Hill Effective cost per ton 1-b. Which supplier would you recommend that the purchasing manager select? Tappan O Hill Rock Solid Bank and Trust (RSB&T) offers only checking accounts. Customers can write checks and use a network of automated teller machines. RSB&T earns revenue by investing the money deposited; currently, it averages 6.90 percent annually on its investments of those deposits. To compete with larger banks, RSB&T pays depositors 0.50 percent on all deposits. A recent study classified the bank's annual operating costs into four activities. Activity Using ATM Visiting branch Processing transaction Managing functions Total overhead Cost Driver Number of uses Number of visits Cost $ 4,050,000 2,430,000 Number of transactions 17,820,000 Total deposits Driver Volume 5,400,000 uses 405,000 visits 216,000,000 transactions 16,200,000 $1,012,500,000 in deposits $40,500,000 Data on two representative customers follow. Customer A Customer B ATM uses 100 200 Branch visits 5 20 Number of transactions 40 Average deposit $6,000 1,500 $6,000 Required: a. Compute RSB&T's operating profits. b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.50 percent of deposits; operating costs are 4 percent (= $40,500,000/$1,012,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute RSB&T's operating profits. Operating profit Required A Required B Required C Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = {{0.5: #,##0.00}} percent of deposits; operating costs are 4 percent (= $40,500,000/$1,012,500,000) of deposits. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Customer A Customer B Profit Per Customer Required A Required B Required C Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. (Do not round intermediate calculations. Round your answers to 2 decimal places. Loss amounts should be indicated by a minus sign.) Sales revenue Interest on deposit Total operating cost Customer profit/loss Customer A Customer B The Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and Stressed Out. Laid Back division manages the company's traditional business line. This business, although lucrative, is currently not growing. Stressed Out, on the other hand, is the company's new business, which has experienced double-digit growth for each of the last three years. The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the Personnel Department. The first, called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the employee's salary. Assorted data for LastCall for the last year follow. Number of employees (average) LaidBack 100 Stressed Out 30 Total 130 5 18 23 Employees hired/leaving The Personnel Department incurred the following costs during the year. Employee maintenance Payroll Total $ 161,000 26,000 $ 187,000 Required: a. Under the current allocation system, what are the costs that will be allocated from personnel to Laid Back? To Stressed Out? b. Suppose the company implements an activity-based cost system for personnel with the two activities, employee maintenance and payroll. Use the number of employees hired/leaving as the cost driver for employee maintenance costs and the average number of employees for payroll costs. What are the costs that will be allocated from personnel to Laid Back? To Stressed Out? Required A Required B Under the current allocation system, what are the costs that will be allocated from personnel to Laid Back? To Stressed Out? (Do not round intermediate calculations and round your answers to the nearest whole dollar.) Allocated costs LaidBack Stressed Out Required A Required B Suppose the company implements an activity-based cost system for personnel with the two activities, employee maintenance and payroll. Use the number of employees hired/leaving as the cost driver for employee maintenance costs and the average number of employees for payroll costs. What are the costs that will be allocated from personnel to LaidBack? To Stressed Out? LaidBack Stressed Out Employee maintenance Payroll

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started