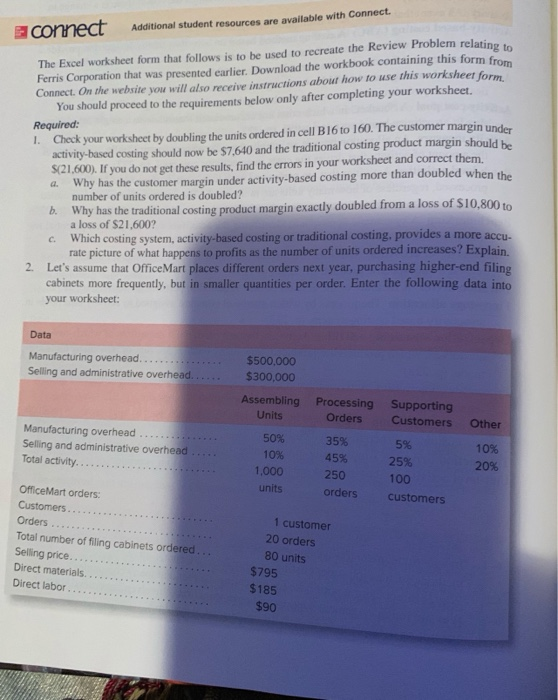

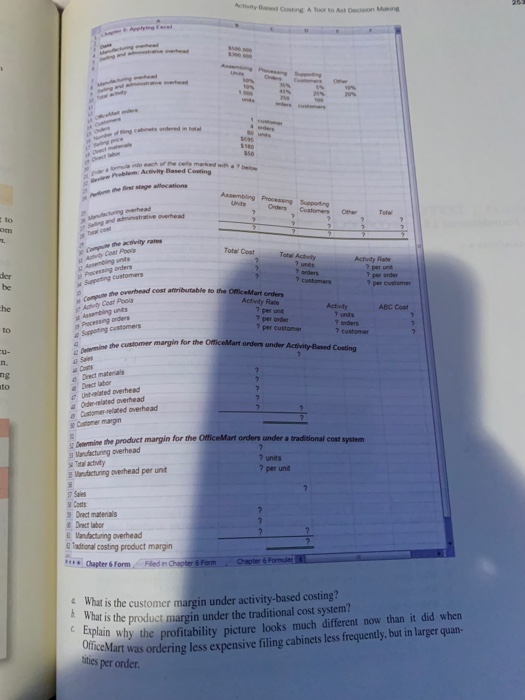

connect Additional student resources are available with Connect The Excel worksheet form that follows is to be used to recreate the Review Problem relating to Ferris Corporation that was presented earlier. Download the workbook containing this form from Connect. On the website you will also receive instructions about how to use this worksheet form. You should proceed to the requirements below only after completing your worksheet. Required: Check your worksheet by doubling the units ordered in cell B16 to 160. The customer margin under activity-based costing should now be $7,640 and the traditional costing product margin should be S(21,600). If you do not get these results, find the errors in your worksheet and correct them. Why has the customer margin under activity-based costing more than doubled when the number of units ordered is doubled? a. b. Why has the traditional costing product margin exactly doubled from a loss of $10,800 to a loss of $21,600? Which costing system, activity-based costing or traditional costing, provides a more accu- rate picture of what happens to profits as the number of units ordered increases? Explain. C. 2. Let's assume that OfficeMart places different orders next year, purchasing higher-end filing cabinets more frequently, but in smaller quantities per order. Enter the following data into your worksheet Data Manufacturing overhead. Selling and administrative overhead...... $500,000 $300,000 Assembling Processing Units Supporting Customers Orders Other Manufacturing overhead .. Selling and administrative overhead Total activity. 50% 35% 5% 10% 10% 45% 25% 20% 1,000 250 100 units orders OfficeMart orders: customers Customers. Orders, Total number of filing cabinets ordered. .. Selling price... Direct materials. 1 customer 20 orders 80 units $795 Direct labor. $185 $90 Activity Baed Cosng A Toot to At Decison Making Arplying ce at ctng etea A ng P n e a Suppotng ve oehead Drhe Sel l atyy 4% 25% s00 20% ees otme a Nmber of ng ca e anded tut r Seng ce a ale S180 r me each of the cella marked wh 7 below a evle Preblem Activity Based Costing he isr stage allocations Assembling Processing Unts sactuing overhead and administrative overhead Supporting Cuatomers Orders Other to Tote om Tal co Campute the acnvity rates Ady Cost Pboar Asembling unts Pocessing orders Suppoting customers Total Cont Total Activity Activity Rate unts 7 arders 7 customers der be per unt per order per customer Compune the overhead cost atributable to the OfficelMart onders Ad Coat Poot a Assembling unts Pacessing orders Activty Rale 7 per unt he Activty units 7 eeders 7 customer ABC Coat per order per customer to e Sapoting customers mine the customer margin for the OfficeMart orders under Activity Based Costing u- e Saes Costs e Drect matenals e Dect lator e Untelated overhead n ng to 4 Oderelated overhead a Customerelated overhead Cstomer margin Demine the product margin for the Manufacturing overhead Tal activity Mandacturing overhead per unit ficeMart orders under a traditional cost system 7 units ? per unit Sales Costs 3 Drect materials Drect labor Vanufacturing overhead @Tadtional costing product margin Fled in Chapter 6 Form Chapter 6 Form Chapter 6 Formund 4What is the customer margin under activity-based costing? What is the product margin under the traditional cost system? Explain why the profitability picture looks much different now than it did when OfficeMart was ities per order. ordering less expensive filing cabinets less frequently, but in larger quan- ie