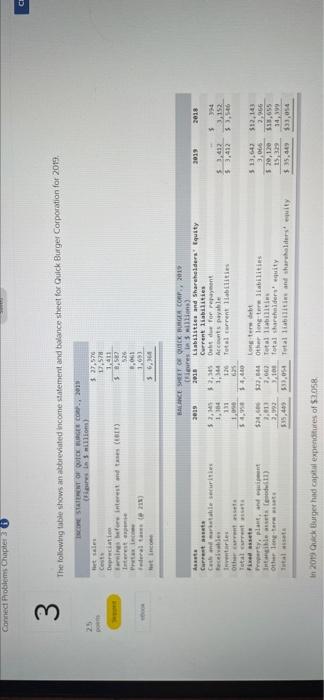

Connect Problems Chapter CE 3 25 The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019 CORE SEEN OF QUICK RECO, 2013 in millions) et ses 27.570 Cest 17.57 Depreciation 1.011 were interest and tans (T) $ 8,5 Interest 525 Prati Federal (21) 1693 ti 36,114 2013 2018 $1,67 $ 3,492 $ 152 53,546 10 ante Cup Charitable securities Receiver Intries he Total current arty Inte) the long ter Totalte INCESTO QUICK BURGER CORP. 2012 He is will 2013 2010 Liabilities and Shareholders Equity Current sites 2.1 $2,5lt for rent 1.164 1,14 Accounts payable 120 Total current liabilities $4,000 Loret $14.00 22.044 Other long reliabilities 2. Total abilitie 12,993 103 fotol suheldere quity 5.402 $57.06 Total time and shareholders wity 7.662 $ 13,647 3,066 $ 20,120 15,3 $ 35,4 2.266 $13,655 $33,054 in 2019 Quick Burger had capital expenditures of $2.058 In 2019 Quick Burger had capital expenditures of $3,058. a. Calculate Quick Burger's free cash flow in 2019. (Enter your answer in millions.) Free cash flow milion b. It Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Aditional tax million c. What would the company's free cash flow have been if it was all-equity financed? (Enter your answer in millions.) Free cash flow Connect Problems Chapter CE 3 25 The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2019 CORE SEEN OF QUICK RECO, 2013 in millions) et ses 27.570 Cest 17.57 Depreciation 1.011 were interest and tans (T) $ 8,5 Interest 525 Prati Federal (21) 1693 ti 36,114 2013 2018 $1,67 $ 3,492 $ 152 53,546 10 ante Cup Charitable securities Receiver Intries he Total current arty Inte) the long ter Totalte INCESTO QUICK BURGER CORP. 2012 He is will 2013 2010 Liabilities and Shareholders Equity Current sites 2.1 $2,5lt for rent 1.164 1,14 Accounts payable 120 Total current liabilities $4,000 Loret $14.00 22.044 Other long reliabilities 2. Total abilitie 12,993 103 fotol suheldere quity 5.402 $57.06 Total time and shareholders wity 7.662 $ 13,647 3,066 $ 20,120 15,3 $ 35,4 2.266 $13,655 $33,054 in 2019 Quick Burger had capital expenditures of $2.058 In 2019 Quick Burger had capital expenditures of $3,058. a. Calculate Quick Burger's free cash flow in 2019. (Enter your answer in millions.) Free cash flow milion b. It Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Aditional tax million c. What would the company's free cash flow have been if it was all-equity financed? (Enter your answer in millions.) Free cash flow