Question

Connington Lid manufactures three products. Simple, Modified, and Custom. Simple is a standard product directed at the mass market and produced in large volumes: Modified

Connington Lid manufactures three products. Simple, Modified, and Custom.

Simple is a standard product directed at the mass market and produced in large volumes: Modified is a vanation of the Simple product, for a smaller segment of the man market. Custom is a fully customised version of the product, lor a speclic market niche. The uni price of the three products is calculated by applying a mark. up lo the hut manutacturing cost per unt. The mark-up applied is 15% lor the Simple product, 25% far the Modified product, and 30% for the Custom product.

The company has traditionally alcaled overheads to the three products based on labour hours. However, its management accountant has recently reviewed the company's costing system and concluded that the current overhead allocation method is ouidated and ikely to distort product costs. He suggested adopling acinty-based costing.

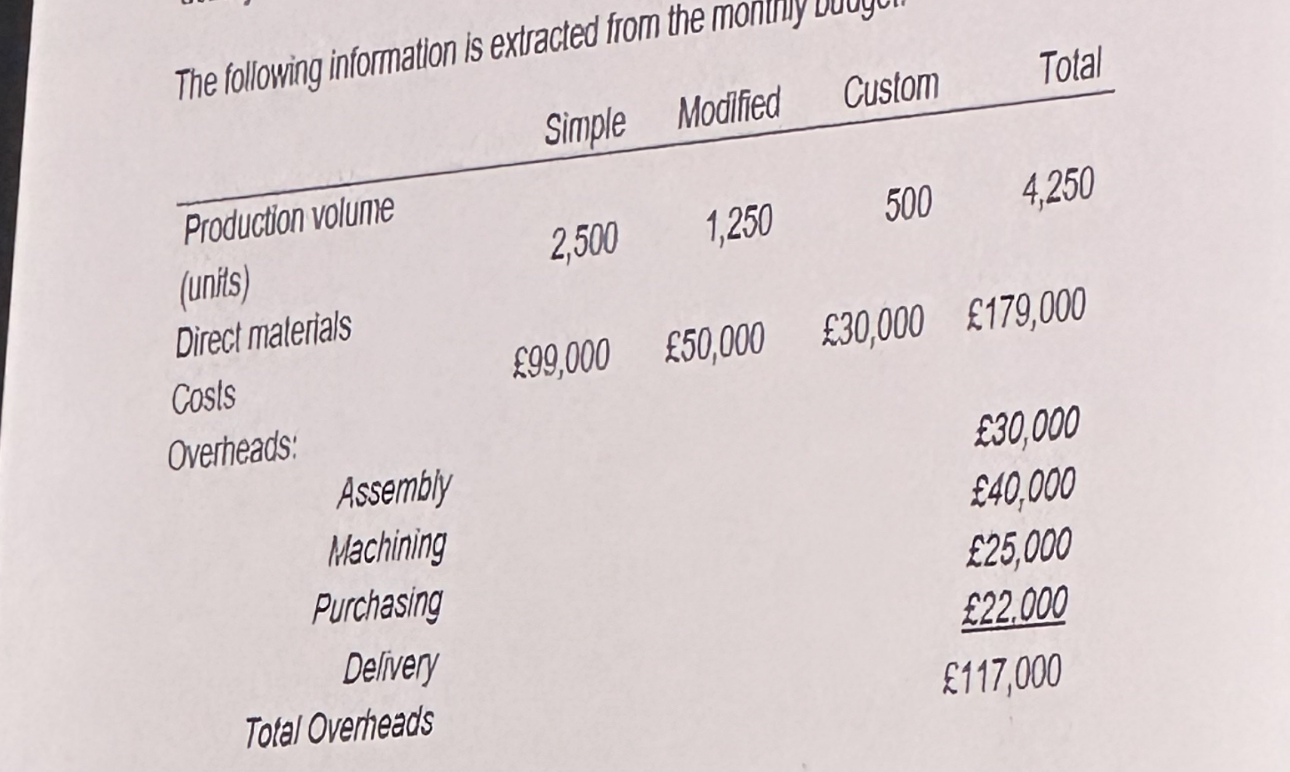

The lolowing information is extracted from the monthly budget:

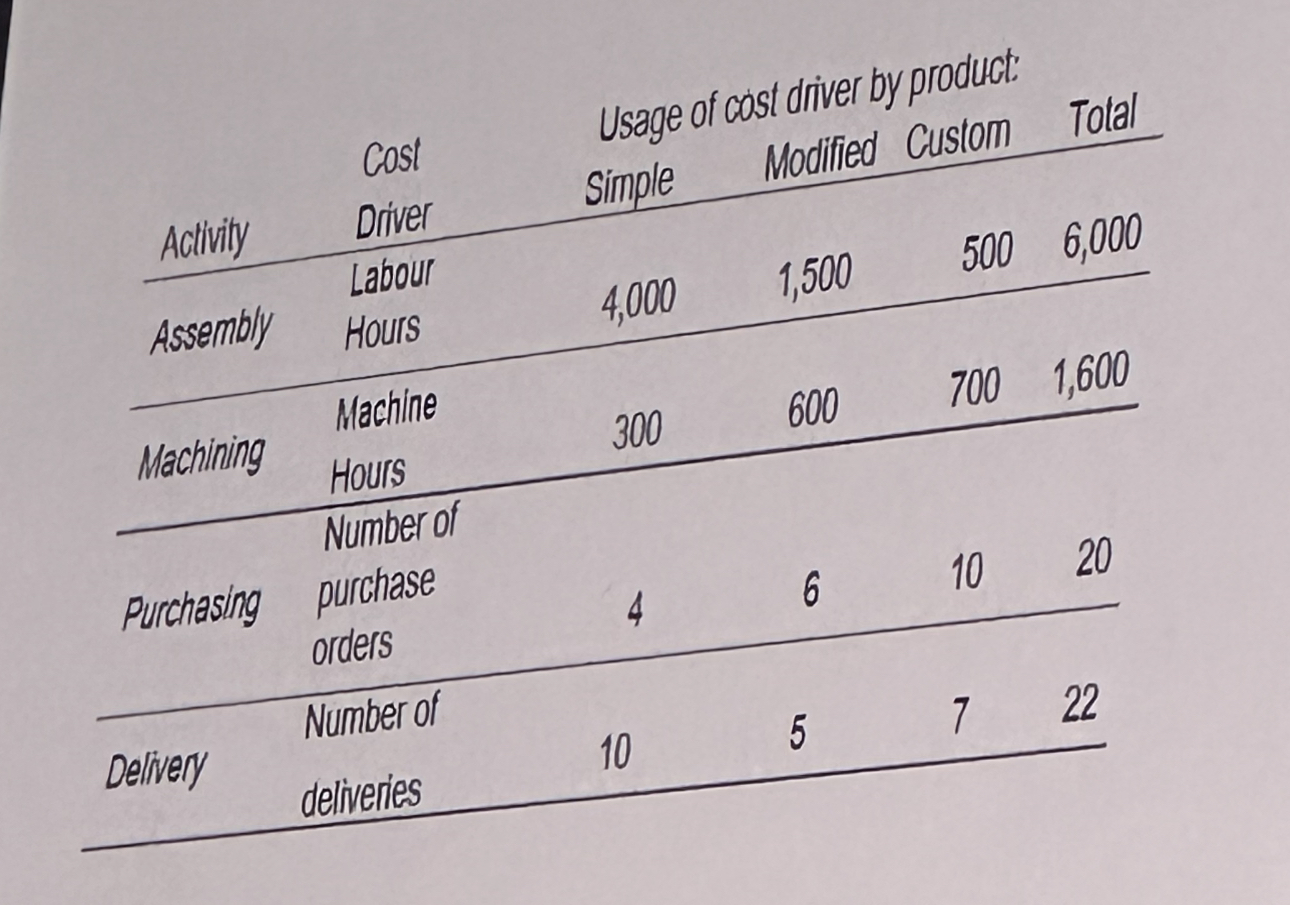

Additionally, the management accountant has produced the following analysis of cost driver usage by type of product:

Required:

a) Calculale the price per unit of Simple, Modifed and Custom under the current casling system

b) Discuss menits and limitations of the current costing system. As part of your discussion, comment on whether the current system is likely to support the marketing of the three products.

c) Calastale the price per unit of Simple, Modified and Custom under activity-based costing.

The following information is extracted from the monilulyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started