Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Connolly Enterprises manufactures tires for the Formula 1 motor racing circuit For August 2017, it budgeted to manufacture and sell 2,900 tires at a variable

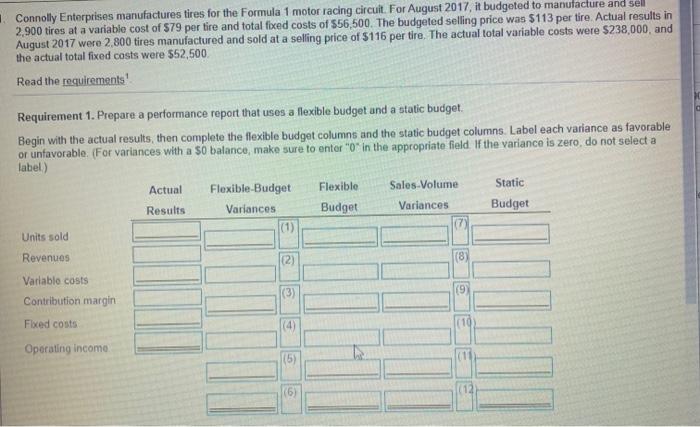

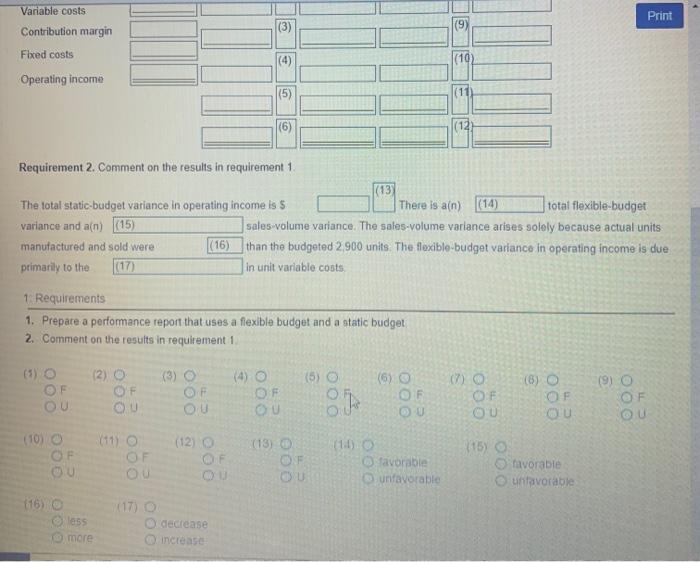

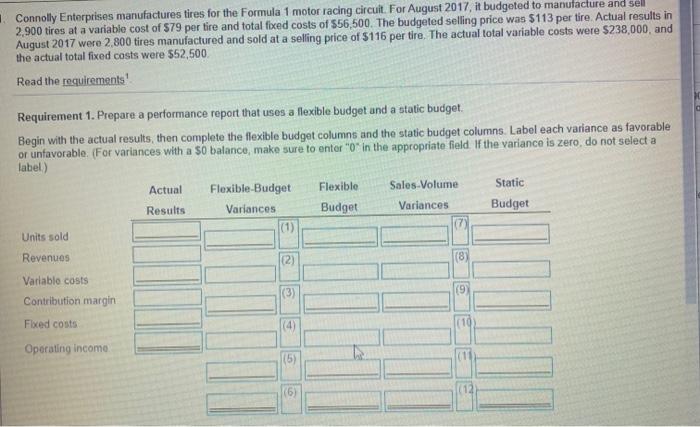

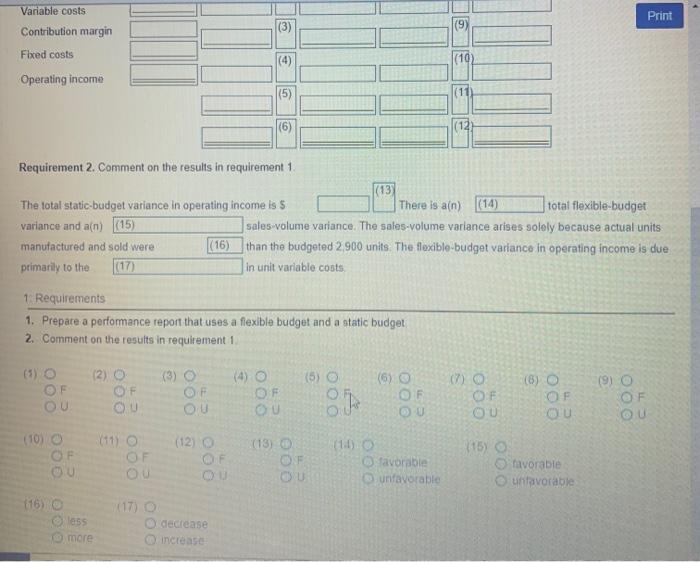

Connolly Enterprises manufactures tires for the Formula 1 motor racing circuit For August 2017, it budgeted to manufacture and sell 2,900 tires at a variable cost of $79 per tire and total fixed costs of $56,500. The budgeted selling price was $113 per tire. Actual results in August 2017 were 2,800 tires manufactured and sold at a selling price of $116 per tire. The actual total variable costs were $238,000, and the actual total fixed costs were $52,500 Read the requirements' Requirement 1. Prepare a performance report that uses a flexible budget and a static budget. Begin with the actual results, then complete the flexible budget columns and the static budget columns Label each variance as favorable or unfavorable. (For variances with a $0 balance, make sure to enter "Oin the appropriate field. If the variance is zero do not select a label) Actual Flexible Budget Flexible Sales Volume Static Results Variances Budget Variances Budget Units sold (1) Revenues (2) (8) Variable costs Contribution margin (3) (9 Fixed costs (4) (10 Operating income (5) CH (6) (12 Print Variable costs Contribution margin (3) (9) Fixed costs (10) Operating income (5) (6) (12 Requirement 2. Comment on the results in requirement 1 |(13) The total static budget variance in operating income is 5 There is an) total flexible-budget variance and a(n) (15) sales volume variance. The sales volume variance arises solely because actual units manufactured and sold were (16) than the budgeted 2 900 units. The flexible budget variance in operating income is due primarily to the in unit variable costs 1. Requirements 1. Prepare a performance report that uses a flexible budget and a static budget 2. Comment on the results in requirement 1. (7) (5) OF OU (2) O OF OU (3) o OF OU OF (6) OF 00 (6) O OF OU OF OU (9) O OF OU OU (13) 115) (10) OF OU OF OU (12) OF OU favorable unfavorable favorable unfavorable (17) 116) less more decrease increase

Connolly Enterprises manufactures tires for the Formula 1 motor racing circuit For August 2017, it budgeted to manufacture and sell 2,900 tires at a variable cost of $79 per tire and total fixed costs of $56,500. The budgeted selling price was $113 per tire. Actual results in August 2017 were 2,800 tires manufactured and sold at a selling price of $116 per tire. The actual total variable costs were $238,000, and the actual total fixed costs were $52,500 Read the requirements' Requirement 1. Prepare a performance report that uses a flexible budget and a static budget. Begin with the actual results, then complete the flexible budget columns and the static budget columns Label each variance as favorable or unfavorable. (For variances with a $0 balance, make sure to enter "Oin the appropriate field. If the variance is zero do not select a label) Actual Flexible Budget Flexible Sales Volume Static Results Variances Budget Variances Budget Units sold (1) Revenues (2) (8) Variable costs Contribution margin (3) (9 Fixed costs (4) (10 Operating income (5) CH (6) (12 Print Variable costs Contribution margin (3) (9) Fixed costs (10) Operating income (5) (6) (12 Requirement 2. Comment on the results in requirement 1 |(13) The total static budget variance in operating income is 5 There is an) total flexible-budget variance and a(n) (15) sales volume variance. The sales volume variance arises solely because actual units manufactured and sold were (16) than the budgeted 2 900 units. The flexible budget variance in operating income is due primarily to the in unit variable costs 1. Requirements 1. Prepare a performance report that uses a flexible budget and a static budget 2. Comment on the results in requirement 1. (7) (5) OF OU (2) O OF OU (3) o OF OU OF (6) OF 00 (6) O OF OU OF OU (9) O OF OU OU (13) 115) (10) OF OU OF OU (12) OF OU favorable unfavorable favorable unfavorable (17) 116) less more decrease increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started