Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In order to increase sales and to motivate customers to buy on credit terms, a company is planning to relax its credit policy of

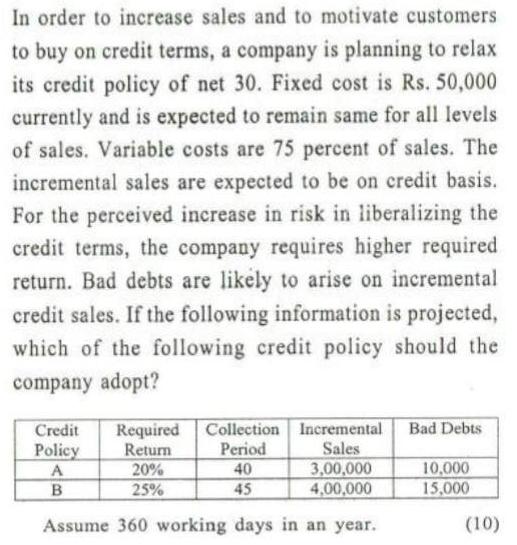

In order to increase sales and to motivate customers to buy on credit terms, a company is planning to relax its credit policy of net 30. Fixed cost is Rs. 50,000 currently and is expected to remain same for all levels of sales. Variable costs are 75 percent of sales. The incremental sales are expected to be on credit basis. For the perceived increase in risk in liberalizing the credit terms, the company requires higher required return. Bad debts are likely to arise on incremental credit sales. If the following information is projected, which of the following credit policy should the company adopt? Credit Policy A B Incremental Sales Required Collection Return Period 20% 40 3,00,000 25% 45 4,00,000 Assume 360 working days in an year. Bad Debts 10,000 15,000 (10)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The company should adopt policy B The company should adopt policy B since it has the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started