Answered step by step

Verified Expert Solution

Question

1 Approved Answer

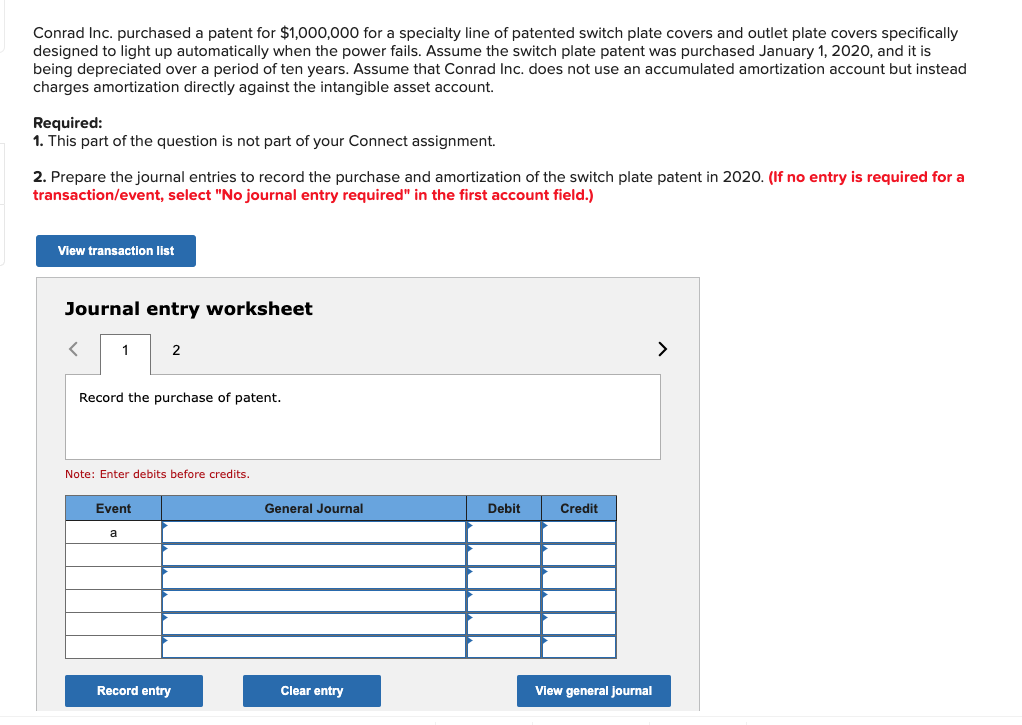

Conrad Inc. purchased a patent for $ 1 , 0 0 0 , 0 0 0 for a specialty line of patented switch plate covers

Conrad Inc. purchased a patent for $ for a specialty line of patented switch plate covers and outlet plate covers specifically

designed to light up automatically when the power fails. Assume the switch plate patent was purchased January and it is

being depreciated over a period of ten years. Assume that Conrad Inc. does not use an accumulated amortization account but instead

charges amortization directly against the intangible asset account.

Required:

This part of the question is not part of your Connect assignment.

Prepare the journal entries to record the purchase and amortization of the switch plate patent in If no entry is required for a

transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the purchase of patent.

Note: Enter debits before credits.

After a year of unsuccessful attempts to manufacture the switch plate covers, Conrad Inc. determined the patent was significantly impaired and its book value on January was written off. Prepare the journal entry to record the impairment. If no entry is required for a transactionevent select No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started