Answered step by step

Verified Expert Solution

Question

1 Approved Answer

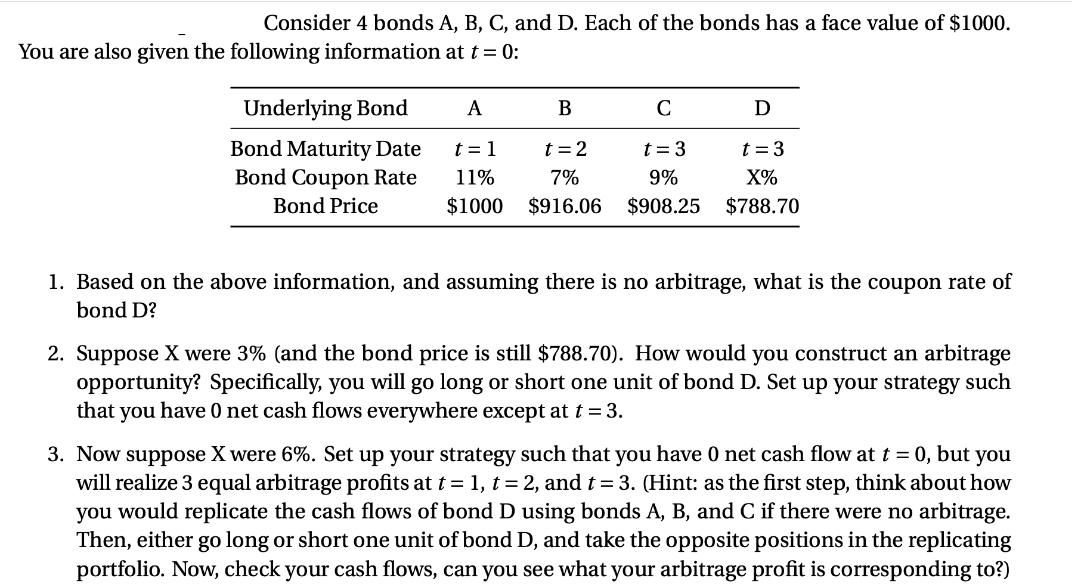

Consider 4 bonds A, B, C, and D. Each of the bonds has a face value of $1000. You are also given the following

Consider 4 bonds A, B, C, and D. Each of the bonds has a face value of $1000. You are also given the following information at t = 0: Underlying Bond Bond Maturity Date Bond Coupon Rate Bond Price A B t = 1 t=2 11% 7% $1000 $916.06 C t = 3 9% $908.25 D t = 3 X% $788.70 1. Based on the above information, and assuming there is no arbitrage, what is the coupon rate of bond D? 2. Suppose X were 3% (and the bond price is still $788.70). How would you construct an arbitrage opportunity? Specifically, you will go long or short one unit of bond D. Set up your strategy such that you have 0 net cash flows everywhere except at t = 3. 3. Now suppose X were 6%. Set up your strategy such that you have 0 net cash flow at t = 0, but you will realize 3 equal arbitrage profits at t = 1, t = 2, and t = 3. (Hint: as the first step, think about how you would replicate the cash flows of bond D using bonds A, B, and C if there were no arbitrage. Then, either go long or short one unit of bond D, and take the opposite positions in the replicating portfolio. Now, check your cash flows, can you see what your arbitrage profit is corresponding to?)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 To find the coupon rate of bond D we can use the given bond price at t 1 and t 2 to calculate the cash flows We know the face value is 1000 and the cash flows at t 1 and t 2 are given as 91606 and 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started