Answered step by step

Verified Expert Solution

Question

1 Approved Answer

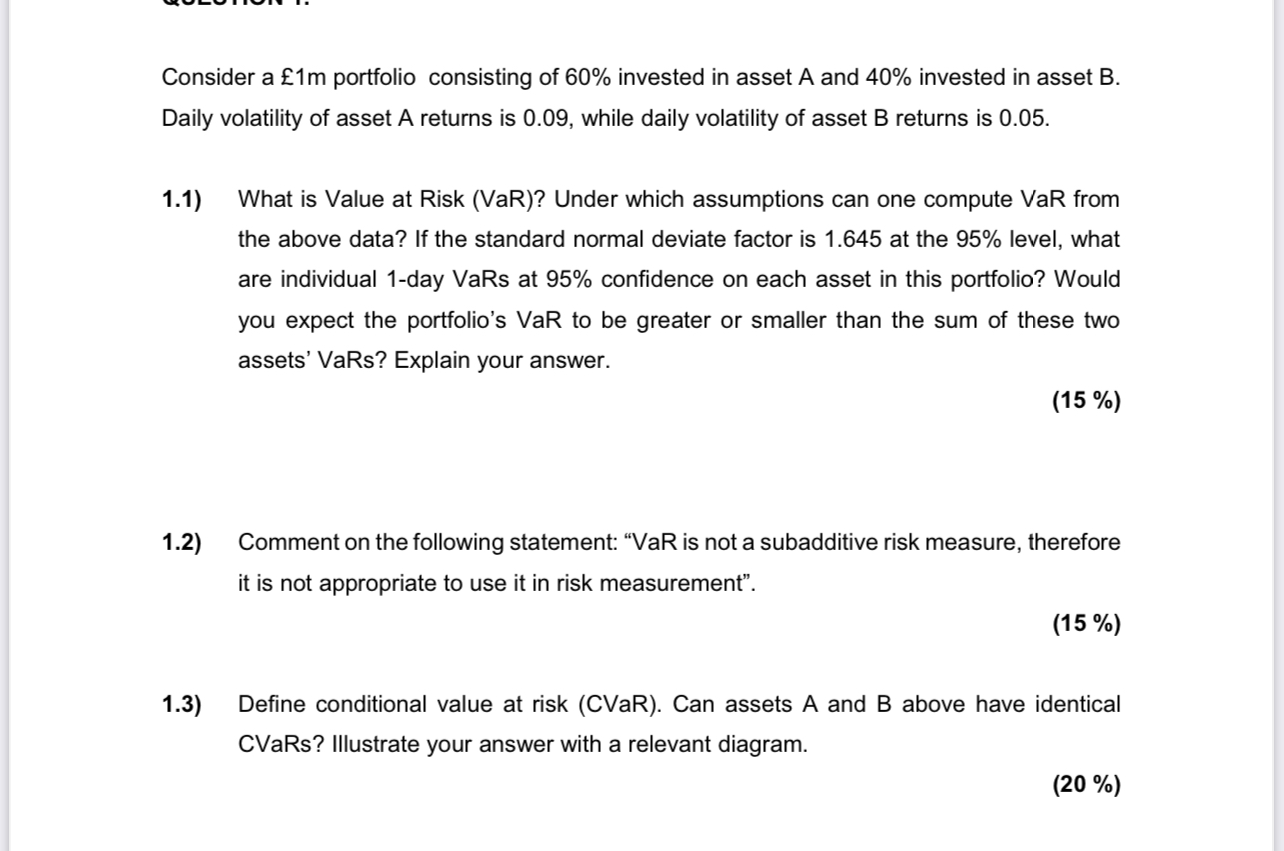

Consider a 1 m portfolio consisting of 6 0 % invested in asset A and 4 0 % invested in asset B . Daily volatility

Consider a portfolio consisting of invested in asset A and invested in asset B Daily volatility of asset A returns is while daily volatility of asset returns is

What is Value at Risk VaR Under which assumptions can one compute VaR from the above data? If the standard normal deviate factor is at the level, what are individual day VaRs at confidence on each asset in this portfolio? Would you expect the portfolio's VaR to be greater or smaller than the sum of these two assets' VaRs? Explain your answer.

Comment on the following statement: "VaR is not a subadditive risk measure, therefore it is not appropriate to use it in risk measurement".

Define conditional value at risk CVaR Can assets A and above have identical CVaRs? Illustrate your answer with a relevant diagram.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started