Question

Consider a 3-month put (European) on a stock with K = $20. Over the next 3 months the stock is expected to either rise

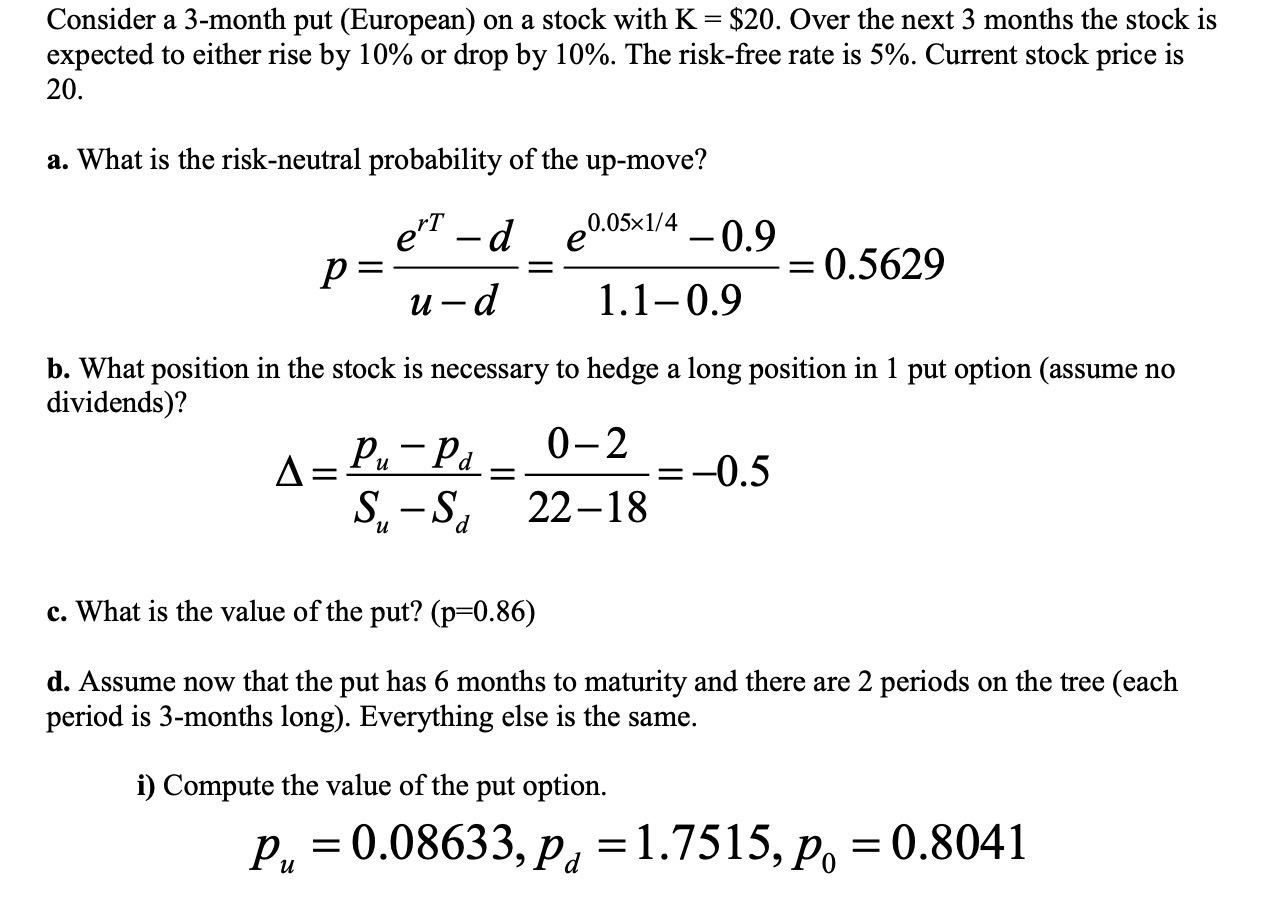

Consider a 3-month put (European) on a stock with K = $20. Over the next 3 months the stock is expected to either rise by 10% or drop by 10%. The risk-free rate is 5%. Current stock price is 20. a. What is the risk-neutral probability of the up-move? p e'T -d u-d 0.051/4 -0.9 = 0.5629 1.1-0.9 b. What position in the stock is necessary to hedge a long position in 1 put option (assume no dividends)? A = Pu-Pa 0-2 = = = -0.5 S-Sa 22-18 c. What is the value of the put? (p=0.86) d. Assume now that the put has 6 months to maturity and there are 2 periods on the tree (each period is 3-months long). Everything else is the same. i) Compute the value of the put option. P = 0.08633, Pa = 1.7515, p = 0.8041 Pu

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Finance Evaluating Opportunities Costs and Risks of Operations

Authors: Kirt C. Butler

5th edition

1118270126, 978-1118285169, 1118285166, 978-1-119-2034, 978-1118270127

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App