Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a 3-year semi-annual coupon paying bond issued on January 1, 2022 with a coupon rate of 5%. Further, assume that the market interest

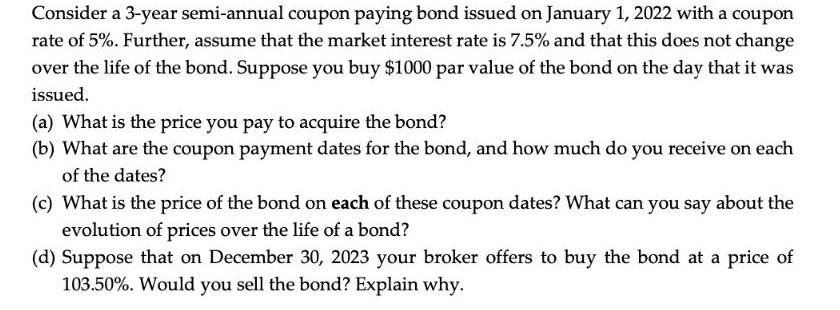

Consider a 3-year semi-annual coupon paying bond issued on January 1, 2022 with a coupon rate of 5%. Further, assume that the market interest rate is 7.5% and that this does not change over the life of the bond. Suppose you buy $1000 par value of the bond on the day that it was issued. (a) What is the price you pay to acquire the bond? (b) What are the coupon payment dates for the bond, and how much do you receive on each of the dates? (c) What is the price of the bond on each of these coupon dates? What can you say about the evolution of prices over the life of a bond? (d) Suppose that on December 30, 2023 your broker offers to buy the bond at a price of 103.50%. Would you sell the bond? Explain why.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price you pay to acquire the bond you need to calculate the present value of its future cash flows including both the coupon paymen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started