Question

Consider a 5 1/2 (annualized coupon rate) note maturing 2/15/04, trading at y=2% (semi-annual periodic rate) for settlement 2/15/03 (M=100,000). The bond is used as

Consider a 5 1/2 (annualized coupon rate) note maturing 2/15/04, trading at y=2% (semi-annual periodic rate) for settlement 2/15/03 (M=100,000). The bond is used as collateral in a six-month repo, for settlement 2/15/03. The amount of bonds being repoed is $10,000,000, with a 5% haircut. Assume that the party doing the reverse sells the bonds on 2/15/03 to repurchase them on 8/15/03, and that on 8/15/03 the yield on the coupon bond is unchanged. Assume the repo rate is 1% (on an MMY basis). Calculate the cash flow generated by the reverse repo on 2/15/03 and 8/15/03. (There are 181 days between 2/15/03 and 8/15/03)

The answer given is:

Can you please provide a step by step to get this? Also, is there an easier way to get this solution?

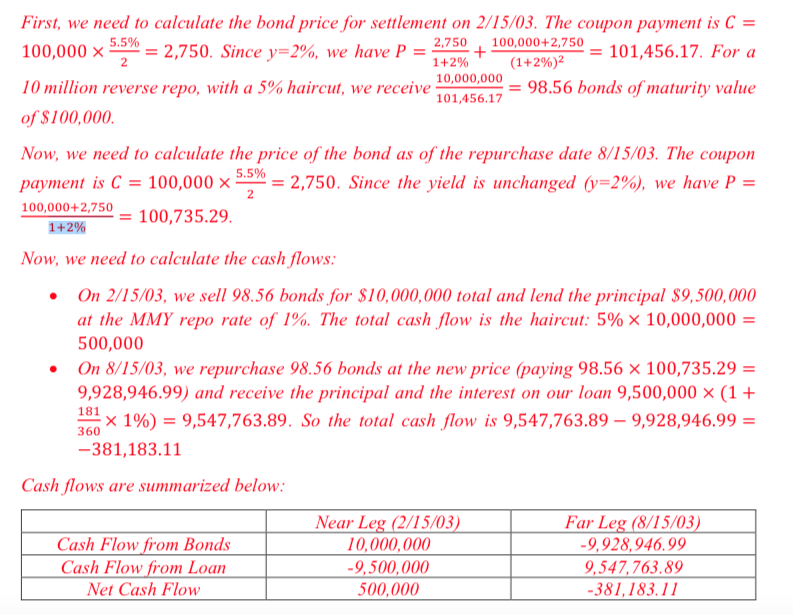

First, we need to calculate the bond price for settlement on 2/15/03. The coupon payment is C 100,000 5.5% 10 million reverse repo, with a 5% haircut, we receive of S100,000 Now, we need to calculate the price of the bond as of the repurchase date 8/15/03. The coupon payment is C = 100,000 -= 2,750. Since the yield is unchanged (y=2%), we have P = 100,000 + 2,750 = 10073529 = 2,750. Since y-296, we have P-1+296 + 2750100,000+2750 101,456.17. For a (1+296)2 10,000,000 101,456.17 98.56 bonds of maturity value 5.5% 1+2% Now, we need to calculate the cash flows On 2/15/03, we sell 98.56 bonds for $10,000,000 total and lend the principal $9,500,000 at the MMY repo rate of 1%. The total cash flow is the haircut: 5%10,000,000 = 500,000 On 8/15/03, we repurchase 98.56 bonds at the new price (paying 98.56 10073529- 9,928,946.99) and receive the principal and the interest on our loan 9,500,000 (1 + 181 360 1%) = 9,547,763.89. So the total cash flow is 9,547,763.89-9,928,946.99 = 381,183.11 Cash flows are summarized below Cash Flow from Bonds Cash Flow from Loan Net Cash Flow Near Leg (2/15/03 10,000,000 9,500,000 500,000 Far Leg (8/15/03 9,928,946.99 9,547,763.89 -381,183.11Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started