Answered step by step

Verified Expert Solution

Question

1 Approved Answer

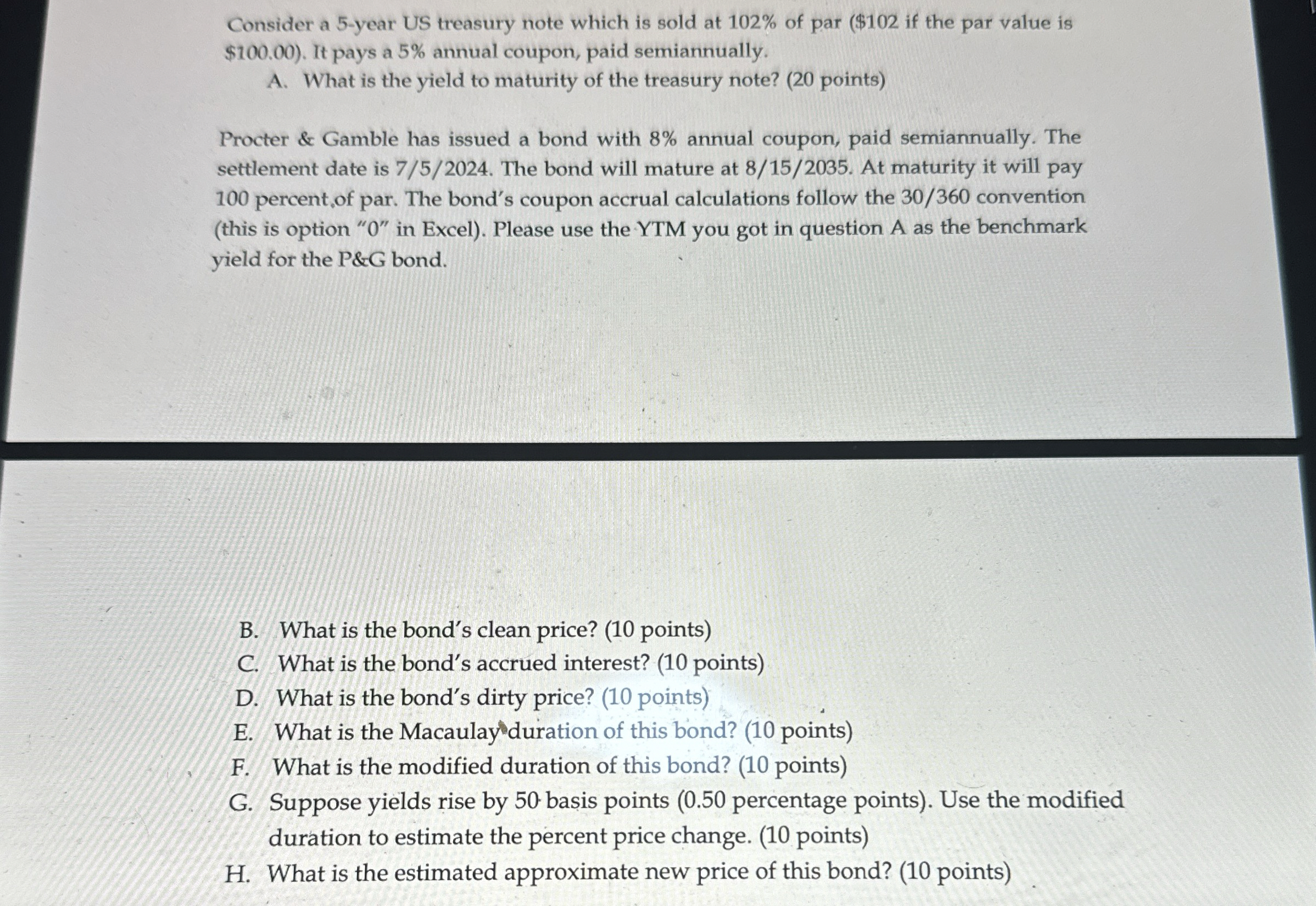

Consider a 5 - year US treasury note which is sold at 1 0 2 % of par ( $ 1 0 2 if the

Consider a year US treasury note which is sold at of par $ if the par value is $ It pays a annual coupon, paid semiannually.

A What is the yield to maturity of the treasury note? points

Procter & Gamble has issued a bond with annual coupon, paid semiannually. The settlement date is The bond will mature at At maturity it will pay percent, of par. The bond's coupon accrual calculations follow the convention this is option in Excel Please use the YTM you got in question A as the benchmark yield for the P&G bond.

B What is the bond's clean price? points

C What is the bond's accrued interest? points

D What is the bond's dirty price? points

E What is the Macaulay duration of this bond? points

F What is the modified duration of this bond? points

G Suppose yields rise by basis points percentage points Use the modified duration to estimate the percent price change. points

H What is the estimated approximate new price of this bond? points

Do it in excel please!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started