Question

Consider a 5-year maturity put option with a strike price of $100 on a 2.5s coupon bond of ten-year maturity from now. Let the

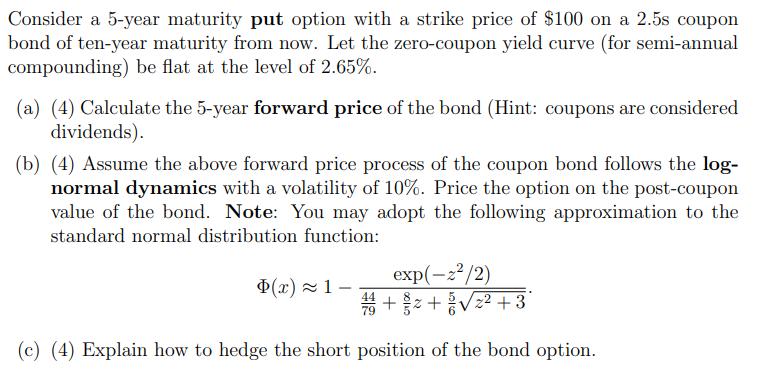

Consider a 5-year maturity put option with a strike price of $100 on a 2.5s coupon bond of ten-year maturity from now. Let the zero-coupon yield curve (for semi-annual compounding) be flat at the level of 2.65%. (a) (4) Calculate the 5-year forward price of the bond (Hint: coupons are considered dividends). (b) (4) Assume the above forward price process of the coupon bond follows the log- normal dynamics with a volatility of 10%. Price the option on the post-coupon value of the bond. Note: You may adopt the following approximation to the standard normal distribution function: exp(-2/2) 4+2++3 (c) (4) Explain how to hedge the short position of the bond option. (x) 1-

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER GIVEN THAT a 5year maturit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Management Science

Authors: Wayne L. Winston, Christian Albright

5th Edition

1305631540, 1305631544, 1305250907, 978-1305250901

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App