Answered step by step

Verified Expert Solution

Question

1 Approved Answer

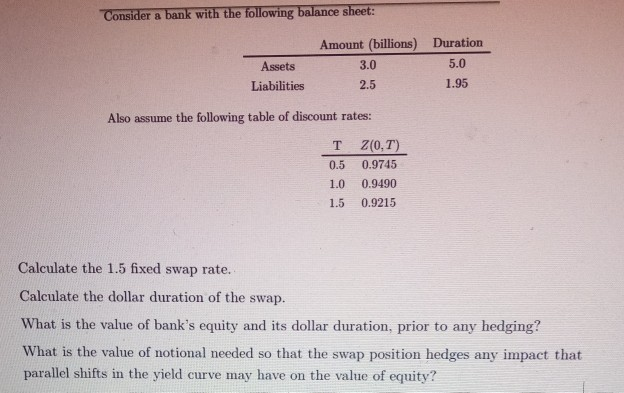

Consider a bank with the following balance sheet: Amount (billions) Duration 3.0 5.0 Assets Liabilities 2.5 1.95 Also assume the following table of discount rates:

Consider a bank with the following balance sheet: Amount (billions) Duration 3.0 5.0 Assets Liabilities 2.5 1.95 Also assume the following table of discount rates: T 0.5 Z(0,7) 0.9745 0.9490 1.0 1.5 0.9215 Calculate the 1.5 fixed swap rate. Calculate the dollar duration of the swap. What is the value of bank's equity and its dollar duration, prior to any hedging? What is the value of notional needed so that the swap position hedges any impact that parallel shifts in the yield curve may have on the value of equity? Consider a bank with the following balance sheet: Amount (billions) Duration 3.0 5.0 Assets Liabilities 2.5 1.95 Also assume the following table of discount rates: T 0.5 Z(0,7) 0.9745 0.9490 1.0 1.5 0.9215 Calculate the 1.5 fixed swap rate. Calculate the dollar duration of the swap. What is the value of bank's equity and its dollar duration, prior to any hedging? What is the value of notional needed so that the swap position hedges any impact that parallel shifts in the yield curve may have on the value of equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started