Question

Consider a binomial model for a stock that pays a random dividend at each node. Specifically: . The starting date is t = 0

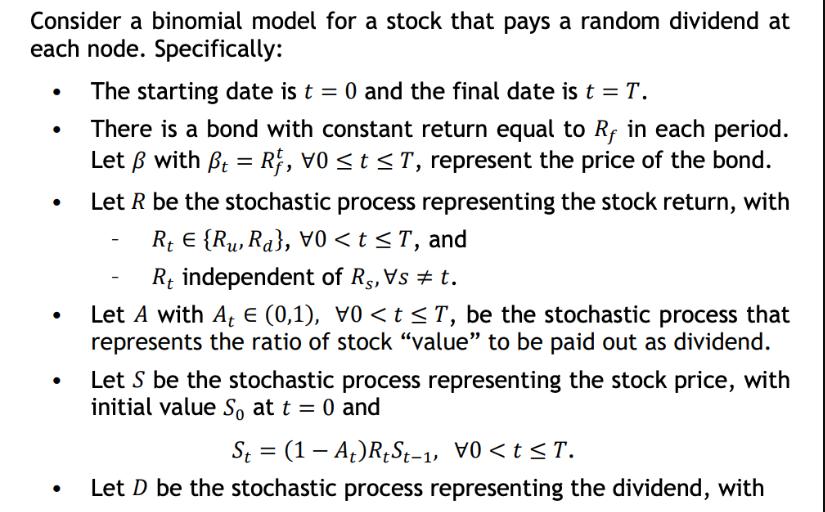

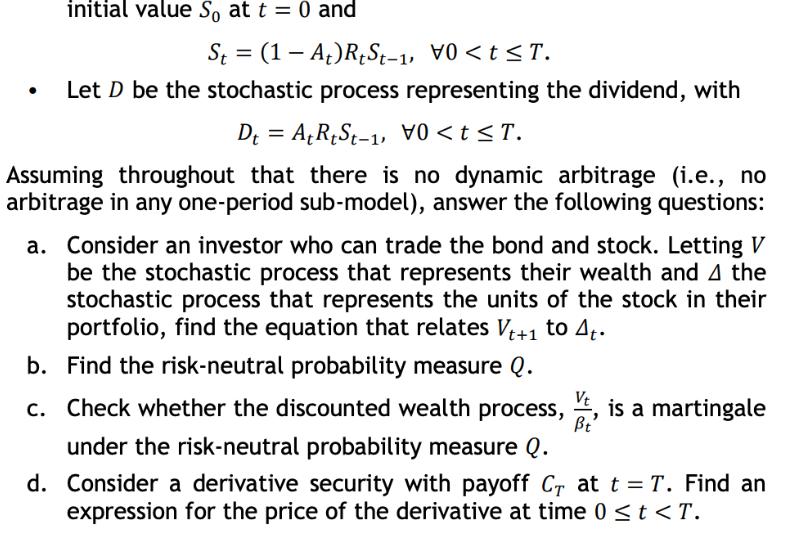

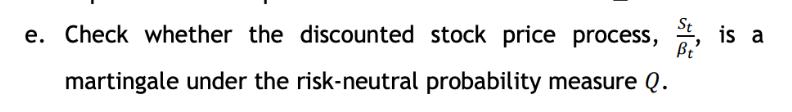

Consider a binomial model for a stock that pays a random dividend at each node. Specifically: . The starting date is t = 0 and the final date is t = T. There is a bond with constant return equal to R in each period. Let with Bt = R, V0 t T, represent the price of the bond. Let R be the stochastic process representing the stock return, with - - Rt E {Ru, Ra}, VO < t initial value So at t = 0 and St (1-At)RtSt-1, VO St Bt' 515 e. Check whether the discounted stock price process, martingale under the risk-neutral probability measure Q. is a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Organic Chemistry

Authors: Robert Thornton Morrison, Robert Neilson Boyd

6th Edition

8120307208, 978-8120307209

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App