Question

Consider a CDO made up of six corporate bonds with par value of $100. Assume that the bonds offer no recovery value in default

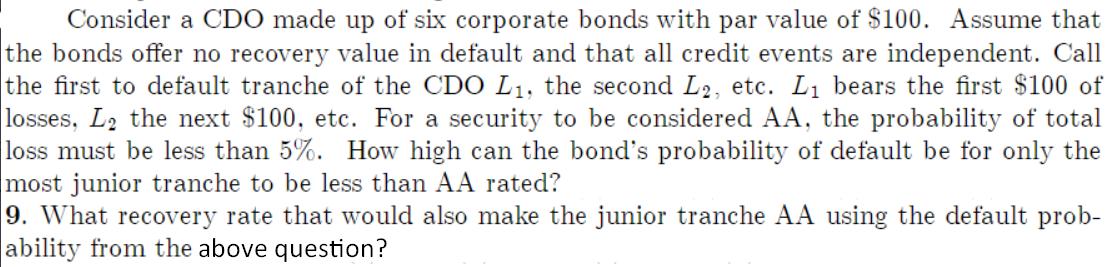

Consider a CDO made up of six corporate bonds with par value of $100. Assume that the bonds offer no recovery value in default and that all credit events are independent. Call the first to default tranche of the CDO L, the second L2, etc. L bears the first $100 of losses, L the next $100, etc. For a security to be considered AA, the probability of total loss must be less than 5%. How high can the bond's probability of default be for only the most junior tranche to be less than AA rated? 9. What recovery rate that would also make the junior tranche AA using the default prob- ability from the above question?

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The image contains a question regarding a Collateralized Debt Obligation CDO made up of six corporate bonds each with a par value of 100 The question ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Engineers And Scientists

Authors: William Navidi

3rd Edition

73376345, 978-0077417581, 77417585, 73376337, 978-0073376332

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App