Answered step by step

Verified Expert Solution

Question

1 Approved Answer

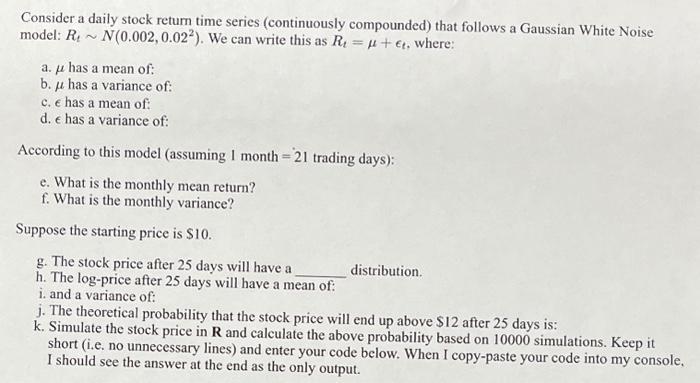

Consider a daily stock return time series (continuously compounded) that follows a Gaussian White Noise model: R~ N(0.002, 0.022). We can write this as

Consider a daily stock return time series (continuously compounded) that follows a Gaussian White Noise model: R~ N(0.002, 0.022). We can write this as R = u + et, where: a. has a mean of: b. has a variance of: c. e has a mean of: d. e has a variance of: According to this model (assuming I month=21 trading days): e. What is the monthly mean return? f. What is the monthly variance? Suppose the starting price is $10. g. The stock price after 25 days will have a h. The log-price after 25 days will have a mean of: i. and a variance of: distribution. j. The theoretical probability that the stock price will end up above $12 after 25 days is: k. Simulate the stock price in R and calculate the above probability based on 10000 simulations. Keep it short (i.e. no unnecessary lines) and enter your code below. When I copy-paste your code into my console, I should see the answer at the end as the only output.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a 0002 b 0022 c 0 d 0022 e 0002 f 0022 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started