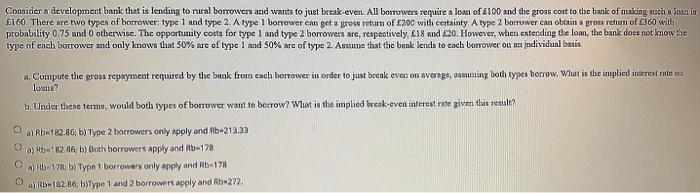

Consider a development bank that is lending to rural borrowers and wants to just break-even. All borrowers require a loan of C100 and the gross cost to the bank of making such a loan is 1100. There are two types of borrower: type 1 and type 2. A type 1 borrower can get a gross return of 200 with certainty. A type 2 bonower can obtain a gross return of 360 with probability 0.75 and otherwise. The opportunity costs for type 1 and type 2 borrowers are respectively, 18 and 20. However, when extending the low, the bank does not know the type of each borrower and only know that 50% are of type 1 and 50% are of type 2. Assume that the bank lends to each borrower on an individual basis Compute the pro repayment required by the bank from each borrower in order to juit break even on average, souming both types borrow. What is the implied interest rate on b. Under these terms. would both types of borrower want to borrow? What is the implied break-even interest rate given this result? 1206 Type 2 borrowers only apply and R-1333 12. list borrowers apply and 178 Consider a development bank that is lending to rural borrowers and wants to just break-even. All borrowers require a loan of 100 and the gross cost to the bank of making such a Joan is 160. There are two types of borrower: type 1 and type 2. A type 1 borrower can get a gross return of 200 with certainty. A type 2 borrower can obtain a grosiretum of 360 with probability 0.75 and otherwise. The opportunity costs for type I and type 2 borrowers are respectively, .18 and 220. However, whico extending the loa, the bank does not know the type of each borrower and only knows that 50% are of type 1 and 50% are of type 2 Assume that the bank lerods to each borrower on an individual basis Compute the grou repayment required by the book from each borrower in order to just been even on average, assuming both types borrow. What is the implied interest rate a loadi? b. Under these terms, would both types of borrower want to borrow? Wat is the implied break-even interest rate given that result OdyRb-182.80 by Type 2 borrowers only apply and Rb213.23 a) b2.86 b) Both borrowers apply and Rb-178 17b Type 1 borrowers only apply and Rb-178 a) R 162.86bType 1 and 2 borrowers apply and Rb-272 Consider a development bank that is lending to rural borrowers and wants to just break-even. All borrowers require a loan of C100 and the gross cost to the bank of making such a loan is 1100. There are two types of borrower: type 1 and type 2. A type 1 borrower can get a gross return of 200 with certainty. A type 2 bonower can obtain a gross return of 360 with probability 0.75 and otherwise. The opportunity costs for type 1 and type 2 borrowers are respectively, 18 and 20. However, when extending the low, the bank does not know the type of each borrower and only know that 50% are of type 1 and 50% are of type 2. Assume that the bank lends to each borrower on an individual basis Compute the pro repayment required by the bank from each borrower in order to juit break even on average, souming both types borrow. What is the implied interest rate on b. Under these terms. would both types of borrower want to borrow? What is the implied break-even interest rate given this result? 1206 Type 2 borrowers only apply and R-1333 12. list borrowers apply and 178 Consider a development bank that is lending to rural borrowers and wants to just break-even. All borrowers require a loan of 100 and the gross cost to the bank of making such a Joan is 160. There are two types of borrower: type 1 and type 2. A type 1 borrower can get a gross return of 200 with certainty. A type 2 borrower can obtain a grosiretum of 360 with probability 0.75 and otherwise. The opportunity costs for type I and type 2 borrowers are respectively, .18 and 220. However, whico extending the loa, the bank does not know the type of each borrower and only knows that 50% are of type 1 and 50% are of type 2 Assume that the bank lerods to each borrower on an individual basis Compute the grou repayment required by the book from each borrower in order to just been even on average, assuming both types borrow. What is the implied interest rate a loadi? b. Under these terms, would both types of borrower want to borrow? Wat is the implied break-even interest rate given that result OdyRb-182.80 by Type 2 borrowers only apply and Rb213.23 a) b2.86 b) Both borrowers apply and Rb-178 17b Type 1 borrowers only apply and Rb-178 a) R 162.86bType 1 and 2 borrowers apply and Rb-272