Answered step by step

Verified Expert Solution

Question

1 Approved Answer

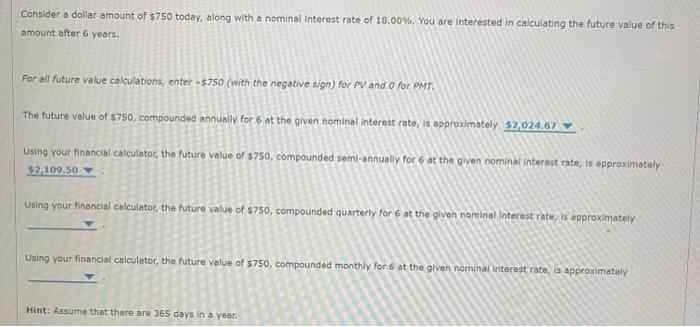

Consider a dollar amount of $750 today, along with a nominal interest rate of 18.00%. You are interested in calculating the future value of this

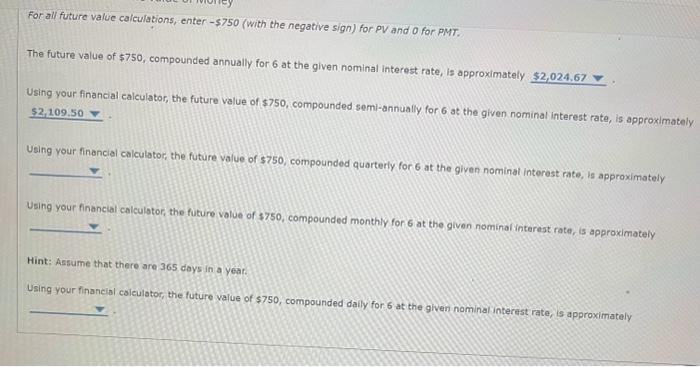

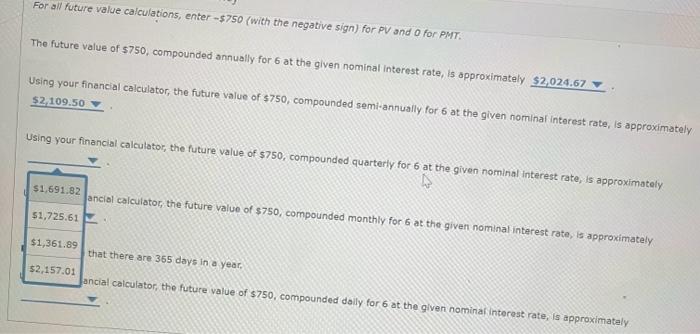

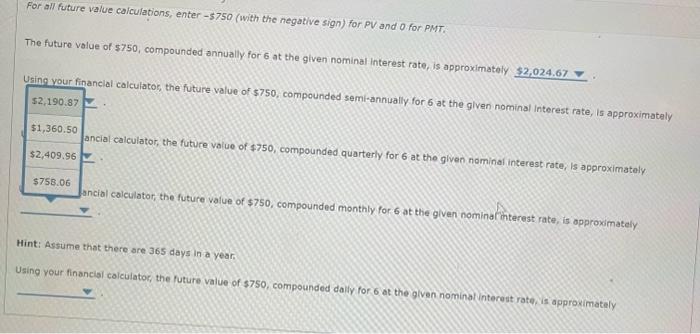

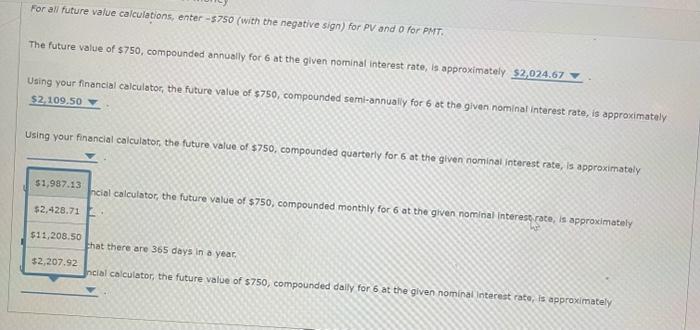

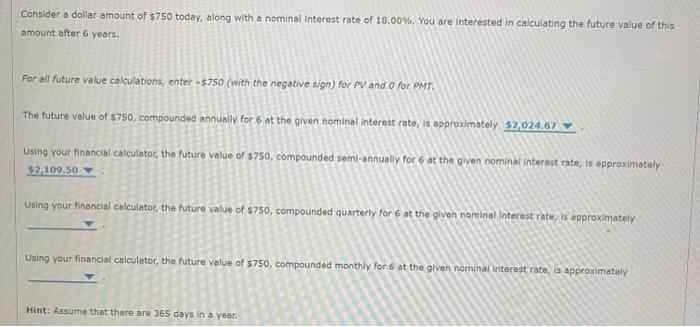

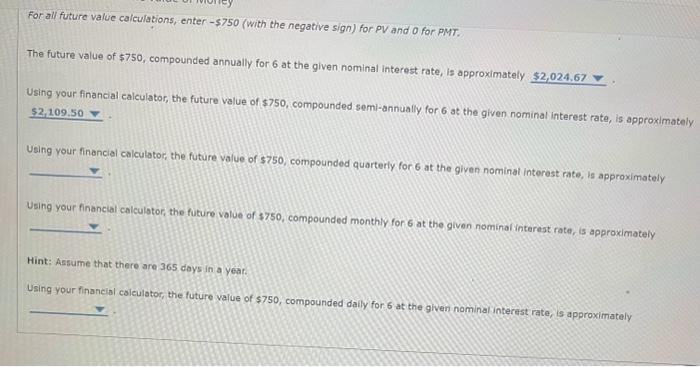

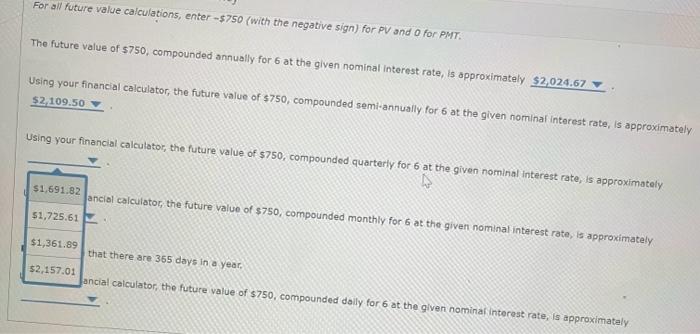

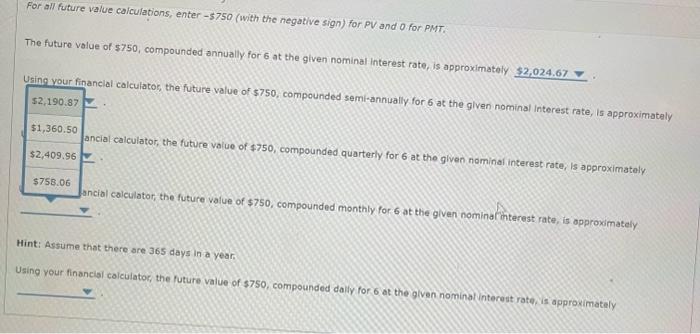

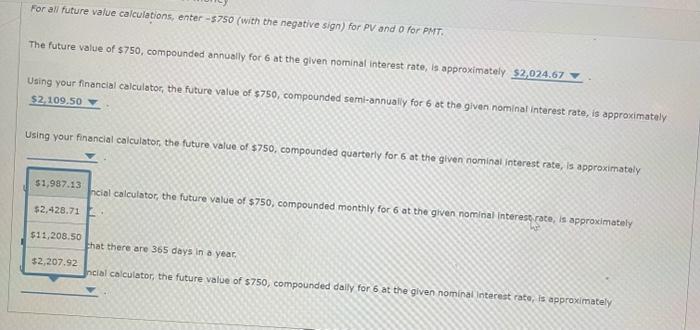

Consider a dollar amount of $750 today, along with a nominal interest rate of 18.00%. You are interested in calculating the future value of this amount after 6 years. For all future value calculations, enter 5750 (with the negative sign) for PV and o for PMT. The future volue of $750, compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 ot the given nominal interest rate, is opproximately Using your financial calculator, the future value of 5750 , compounded monthly for 6 at the given nominal interest rate, is approximately Hint: Assume that there are 365 days in o year. For all future value calculations, enter $750 (with the negative sign) for PV and of for PMT. The future value of $750, compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 at the given nominat interest rate, is approximately Ueing your finencieli Using your financial calculotor, the future volue of $750, compounded monthly for 6 at the given nominal interest rate, is approximately Hint: Assume that there are 365 doys in a yeat. Using your financial calculator, the future value of $750, compounded daily for 6 at the given nominal interast rate, is approximately For all future value calculations, enter $750 (with the negative sign) for PV and O for PMT. The future value of 5750 , compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 at the given nominal interest rate, is approximately $1,361,89 that there are 365 days in a year, $2,157.01 ancial calculator, the future value of $750, compounded dolly for 6 at the given nominal interest rate, is approximataly For all future value calculations, enter 5750 (with the negative sign) for PV and O for PMT. The future value of 5750 , compounded annually for 6 at the given nominal interest rate, is approximately. Usine vour financial calculator, the future value of 5750 , compounded semi-annually for 6 at the given nominal interest rate, is approximately -.. sial calculator, the future value of $750, compounded quarterly for 6 at the gliven nominal interest rate, ls approximately cial calculator, the future value of $750, compounded monthly for 6 at the given nominafiterest rate, is opproximately Hint: Assume that there are 365 days in a year. Using vour financiel calculator, the future value of 3750 , compounded dally for 6 at the given nominal (intecest rate. is approvimately For all future value calculations, enter 5750 (with the negative sign) for PVand o for PMT. The future value of $750, compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 at the glven nominal interest rate, is approximately 1at there are 365 days in a year, cial calculator, the future value of $750, compounded daily for 6 at the given nominal interest rate, is approximately

Consider a dollar amount of $750 today, along with a nominal interest rate of 18.00%. You are interested in calculating the future value of this amount after 6 years. For all future value calculations, enter 5750 (with the negative sign) for PV and o for PMT. The future volue of $750, compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 ot the given nominal interest rate, is opproximately Using your financial calculator, the future value of 5750 , compounded monthly for 6 at the given nominal interest rate, is approximately Hint: Assume that there are 365 days in o year. For all future value calculations, enter $750 (with the negative sign) for PV and of for PMT. The future value of $750, compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 at the given nominat interest rate, is approximately Ueing your finencieli Using your financial calculotor, the future volue of $750, compounded monthly for 6 at the given nominal interest rate, is approximately Hint: Assume that there are 365 doys in a yeat. Using your financial calculator, the future value of $750, compounded daily for 6 at the given nominal interast rate, is approximately For all future value calculations, enter $750 (with the negative sign) for PV and O for PMT. The future value of 5750 , compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 at the given nominal interest rate, is approximately $1,361,89 that there are 365 days in a year, $2,157.01 ancial calculator, the future value of $750, compounded dolly for 6 at the given nominal interest rate, is approximataly For all future value calculations, enter 5750 (with the negative sign) for PV and O for PMT. The future value of 5750 , compounded annually for 6 at the given nominal interest rate, is approximately. Usine vour financial calculator, the future value of 5750 , compounded semi-annually for 6 at the given nominal interest rate, is approximately -.. sial calculator, the future value of $750, compounded quarterly for 6 at the gliven nominal interest rate, ls approximately cial calculator, the future value of $750, compounded monthly for 6 at the given nominafiterest rate, is opproximately Hint: Assume that there are 365 days in a year. Using vour financiel calculator, the future value of 3750 , compounded dally for 6 at the given nominal (intecest rate. is approvimately For all future value calculations, enter 5750 (with the negative sign) for PVand o for PMT. The future value of $750, compounded annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $750, compounded quarterly for 6 at the glven nominal interest rate, is approximately 1at there are 365 days in a year, cial calculator, the future value of $750, compounded daily for 6 at the given nominal interest rate, is approximately

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started