Question

Consider a finance economy with T = 1, J = 3, and S = 3, where the security payoff matrix is given by 100

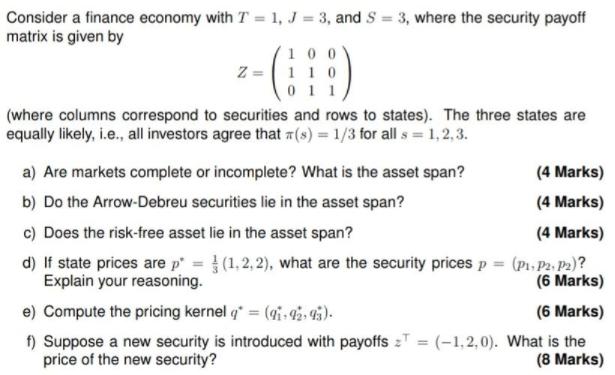

Consider a finance economy with T = 1, J = 3, and S = 3, where the security payoff matrix is given by 100 Z= 1 1 0 011 (where columns correspond to securities and rows to states). The three states are equally likely, i.e., all investors agree that (s) = 1/3 for all s = 1,2,3. a) Are markets complete or incomplete? What is the asset span? b) Do the Arrow-Debreu securities lie in the asset span? c) Does the risk-free asset lie in the asset span? (4 Marks) d) If state prices are p = (1,2,2), what are the security prices p = (P, P2, P2)? Explain your reasoning. (6 Marks) e) Compute the pricing kernel q = (91-92-93). (6 Marks) f) Suppose a new security is introduced with payoffs T = (-1,2,0). What is the price of the new security? (8 Marks) (4 Marks) (4 Marks)

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Engineering Mathematics

Authors: ERWIN KREYSZIG

9th Edition

0471488852, 978-0471488859

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App