Question

Consider a firm financed with an initial investment of $100 million in February 2006. In exactly one year it must decide whether to go

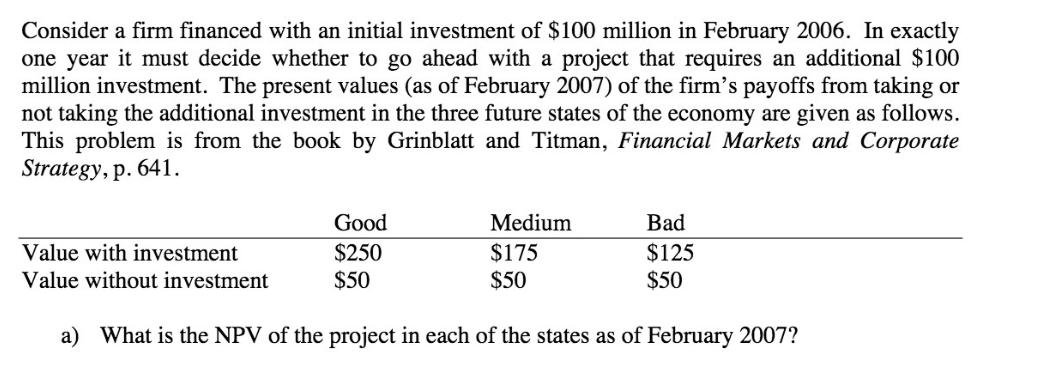

Consider a firm financed with an initial investment of $100 million in February 2006. In exactly one year it must decide whether to go ahead with a project that requires an additional $100 million investment. The present values (as of February 2007) of the firm's payoffs from taking or not taking the additional investment in the three future states of the economy are given as follows. This problem is from the book by Grinblatt and Titman, Financial Markets and Corporate Strategy, p. 641. Good $250 $50 Value with investment Value without investment Medium $175 $50 a) What is the NPV of the project in each of the states as of February 2007? Bad $125 $50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the NPV of the project in each of the states we need to find the present value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Core Principles and Applications

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford

3rd edition

978-0077971304, 77971302, 978-0073530680, 73530689, 978-0071221160, 71221166, 978-0077905200

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App