Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a firm whose only asset is a plot of vacant land, and whose only liability is debt of $14.7 million due in one

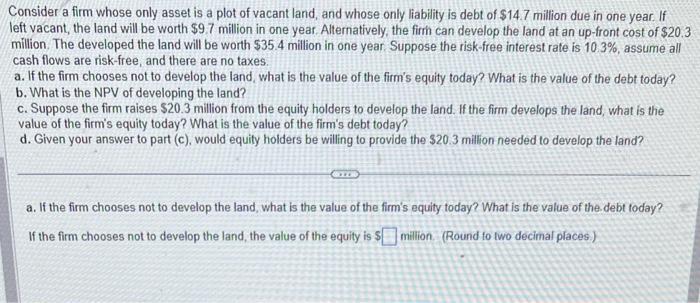

Consider a firm whose only asset is a plot of vacant land, and whose only liability is debt of $14.7 million due in one year. If left vacant, the land will be worth $9.7 million in one year. Alternatively, the firmh can develop the land at an up-front cost of $20.3 million. The developed the land will be worth $35.4 million in one year. Suppose the risk-free interest rate is 10.3%, assume all cash flows are risk-free, and there are no taxes. a. If the firm chooses not to develop the land, what is the value of the firm's equity today? What is the value of the debt today? b. What is the NPV of developing the land? c. Suppose the firm raises $20.3 million from the equity holders to develop the land. If the firm develops the land, what is the value of the firm's equity today? What is the value of the firm's debt today? d. Given your answer to part (c), would equity holders be willing to provide the $20.3 million needed to develop the land? COTT a. If the firm chooses not to develop the land, what is the value of the firm's equity today? What is the value of the debt today? If the firm chooses not to develop the land, the value of the equity is $ million (Round to two decimal places)

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the firms ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started