Answered step by step

Verified Expert Solution

Question

1 Approved Answer

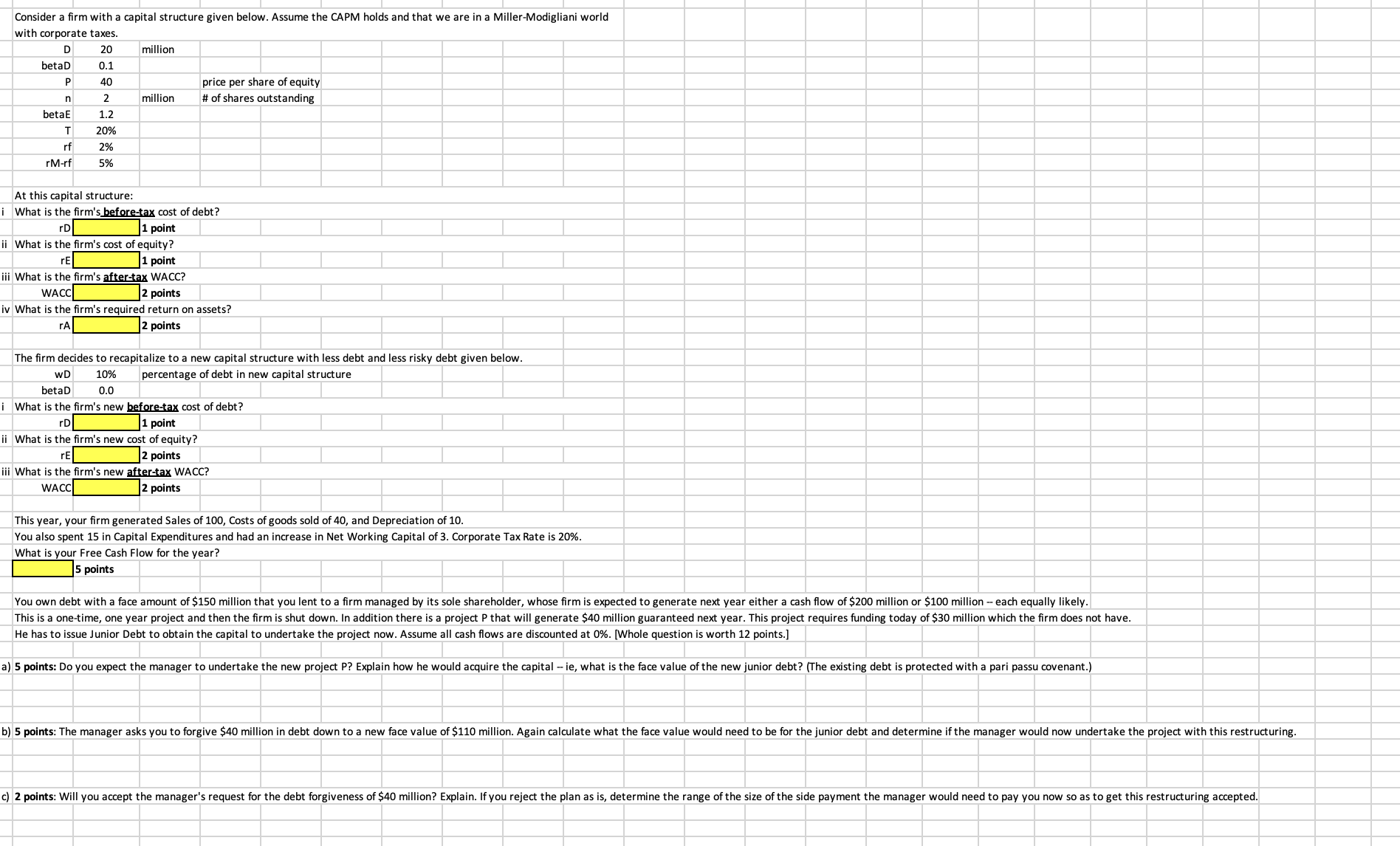

Consider a firm with a capital structure given below. Assume the CAPM holds and that we are in a Miller - Modigliani world with corporate

Consider a firm with a capital structure given below. Assume the CAPM holds and that we are in a MillerModigliani world

with corporate taxes.

At this capital structure:

i What is the firm's beforetax cost of debt?

rD

point

ii What is the firm's cost of equity?

r

I

II

I

II

I

int

T

I

ts

iii What is the firm's aftertax WACC

iv What is the firm's required return on assets?

points

The firm decides to recapitalize to a new capital structure with less debt and less risky debt given below.

This year, your firm generated Sales of Costs of goods sold of and Depreciation of

You also spent in Capital Expenditures and had an increase in Net Working Capital of Corporate Tax Rate is

What is your Free Cash Flow for the year?

points

He has to issue Junior Debt to obtain the capital to undertake the project now. Assume all cash flows are discounted at Whole question is worth points.

nt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started