Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a firm with a contract to sell an asset for $145,000 four years from now. The asset costs $91,700 to produce today. a.

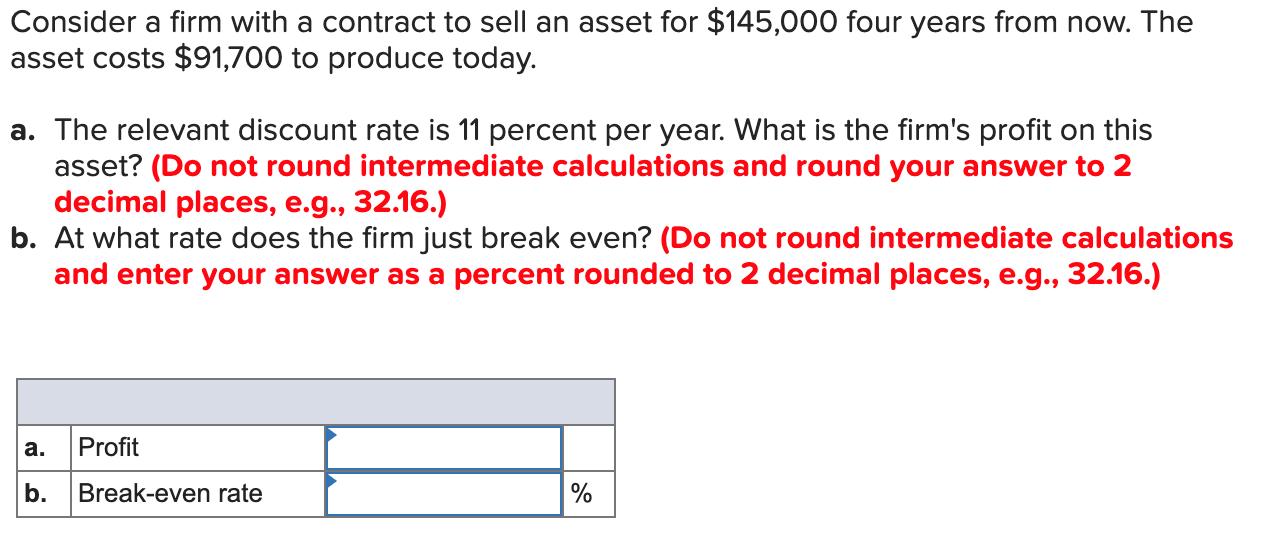

Consider a firm with a contract to sell an asset for $145,000 four years from now. The asset costs $91,700 to produce today. a. The relevant discount rate is 11 percent per year. What is the firm's profit on this asset? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At what rate does the firm just break even? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Profit b. Break-even rate % Suppose an investment offers to triple your money in 12 months (don't believe it). What rate of return per quarter are you being offered? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Rate of return %

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1a PV FV 1 r n 145000 1 011 4 145000 15181 9551599 Profit PV of Sales Price Cost price of Asset 9551...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started