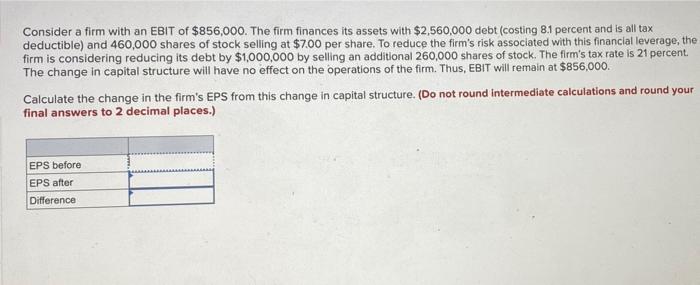

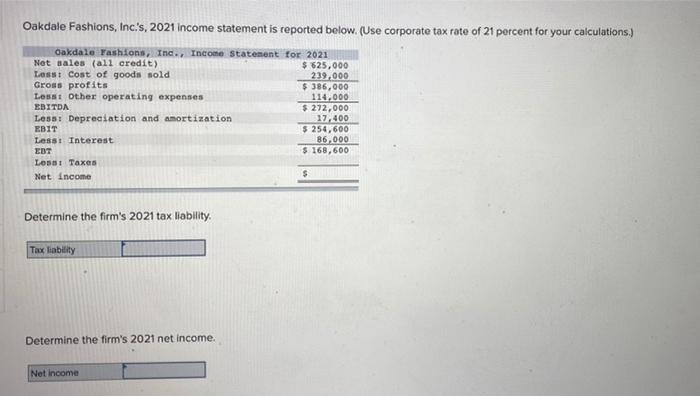

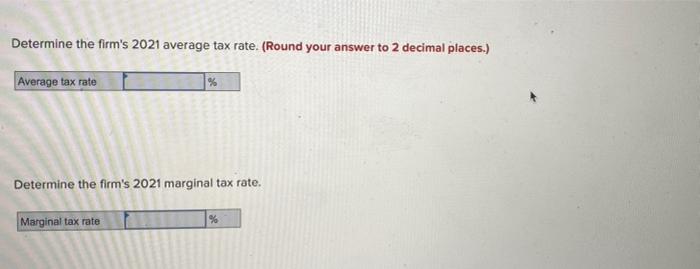

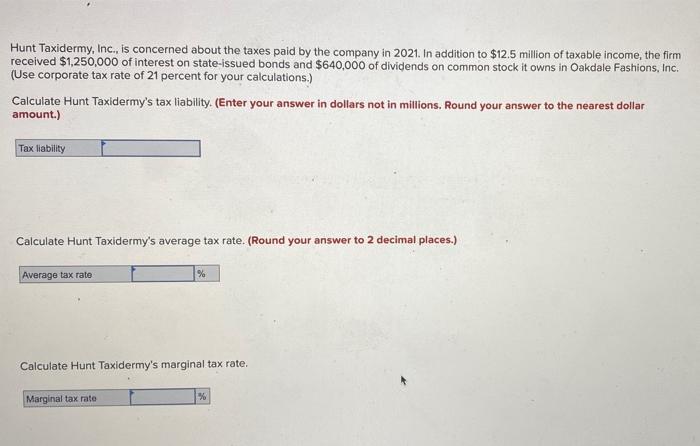

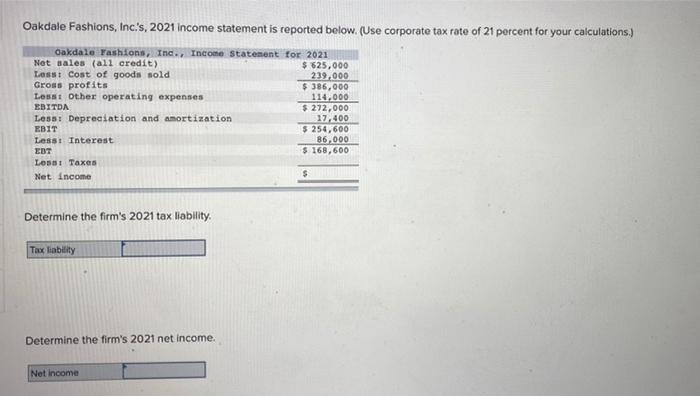

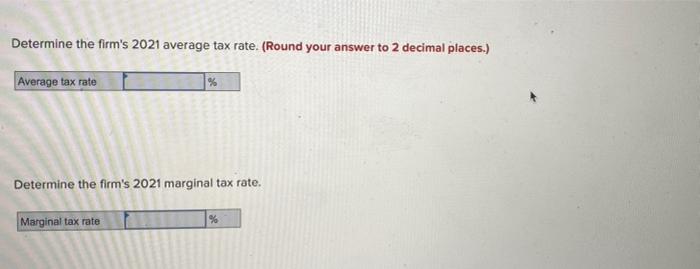

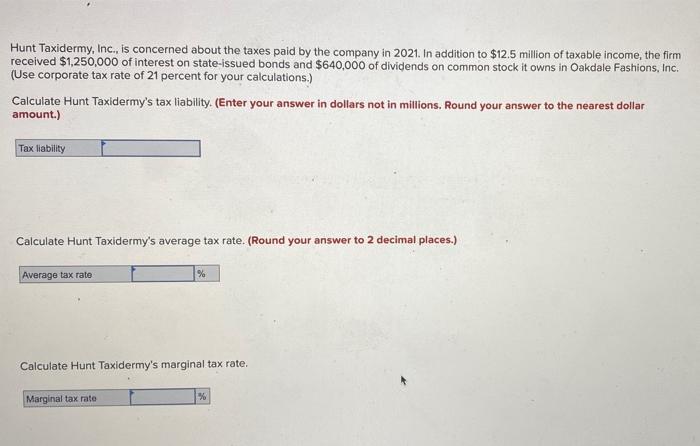

Consider a firm with an EBIT of $856,000. The firm finances its assets with $2,560,000 debt (costing 8.1 percent and is all tax deductible) and 460,000 shares of stock selling at $7.00 per share. To reduce the firm's risk associated with this financial leverage, the firm is considering reducing its debt by $1,000,000 by selling an additional 260,000 shares of stock. The firm's tax rate is 21 percent The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain at $856,000. Calculate the change in the firm's EPS from this change in capital structure. (Do not round intermediate calculations and round your final answers to 2 decimal places.) EPS before EPS after Difference Oakdale Fashions, Inc.'s, 2021 income statement is reported below. (Use corporate tax rate of 21 percent for your calculations.) Oakdale Fashions, Inc., Income Statement for 2021 Net sales (all credit) $ 625,000 Less: Cost of goods sold 239,000 Gross profits $ 386,000 Les Other operating expenses 114.000 EBITDA $ 272,000 Less: Depreciation and amortization 17,400 EBIT $ 254,600 Less! Interest B6,000 EDT $ 168,600 Lost Taxes $ Net Income Determine the firm's 2021 tax liability Tax liability Determine the firm's 2021 net income. Net Income Determine the firm's 2021 average tax rate. (Round your answer to 2 decimal places.) Average tax rate % Determine the firm's 2021 marginal tax rate. Marginal tax rate Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $12.5 million of taxable income, the firm received $1,250,000 of interest on state-issued bonds and $640,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use corporate tax rate of 21 percent for your calculations.) Calculate Hunt Taxidermy's tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Tax liability Calculate Hunt Taxidermy's average tax rate. (Round your answer to 2 decimal places.) Average tax rate % Calculate Hunt Taxidermy's marginal tax rate. Marginal tax rate %