Question

Consider a firm with zero NWC right now (t=0). The firm has the following projected accounting information for next year (t=1): The firm's EBIT

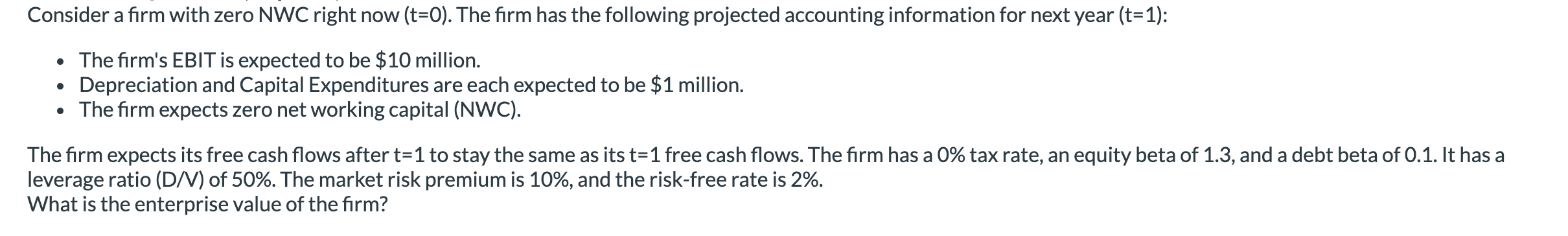

Consider a firm with zero NWC right now (t=0). The firm has the following projected accounting information for next year (t=1): The firm's EBIT is expected to be $10 million. Depreciation and Capital Expenditures are each expected to be $1 million. The firm expects zero net working capital (NWC). The firm expects its free cash flows after t=1 to stay the same as its t=1 free cash flows. The firm has a 0% tax rate, an equity beta of 1.3, and a debt beta of 0.1. It has a leverage ratio (D/V) of 50%. The market risk premium is 10%, and the risk-free rate is 2%. What is the enterprise value of the firm?

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate the enterprise value EV of the firm 1 Calculate the firms free cash flow FCF ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Auditing and Other Assurance Services

Authors: Ray Whittington, Kurt Pany

19th edition

978-0077804770, 78025613, 77804775, 978-0078025617

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App