Answered step by step

Verified Expert Solution

Question

1 Approved Answer

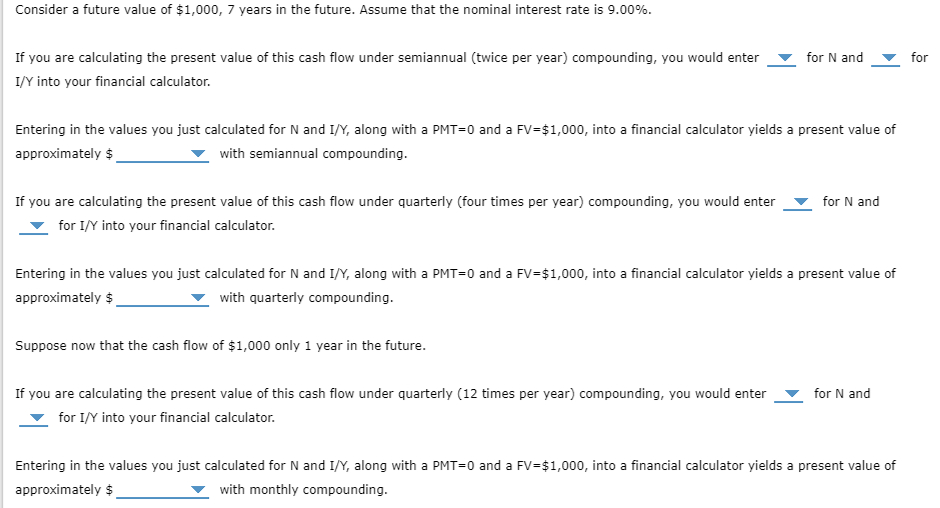

Consider a future value of $ 1 , 0 0 0 , 7 years in the future. Assume that the nominal interest rate is 9

Consider a future value of $ years in the future. Assume that the nominal interest rate is

If you are calculating the present value of this cash flow under semiannual twice per year compounding, you would enter

for and

for

into your financial calculator.

Entering in the values you just calculated for and along with a PMT and a $ into a financial calculator yields a present value of

approximately $

with semiannual compounding.

If you are calculating the present value of this cash flow under quarterly four times per year compounding, you would enter

for and

for into your financial calculator.

Entering in the values you just calculated for and along with a PMT and a $ into a financial calculator yields a present value of

approximately $

with quarterly compounding.

Suppose now that the cash flow of $ only year in the future.

If you are calculating the present value of this cash flow under quarterly times per year compounding, you would enter

for and

for into your financial calculator.

Entering in the values you just calculated for and along with a PMT and a $ into a financial calculator yields a present value of

approximately $

with monthly compounding.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started