Consider a market in which two agents, A and B, are making optimal investment decisions over one period (dates t=0 and 1). Their utility functions have a negative potential.

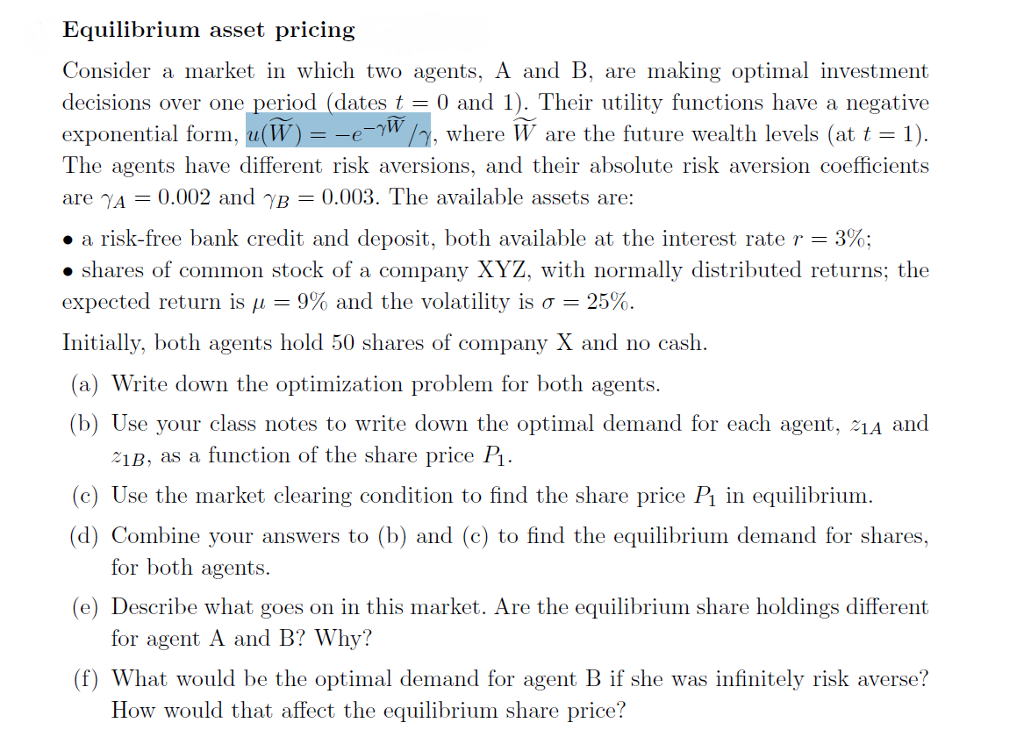

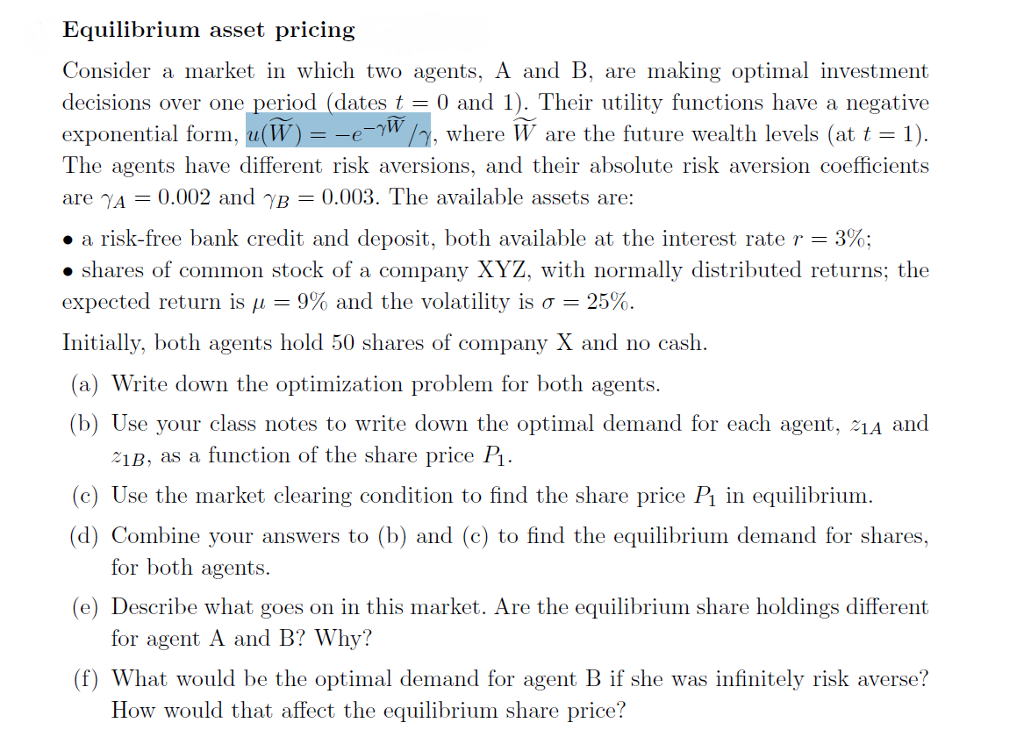

Equilibrium asset pricing Consider a market in which two agents, A and B, are making optimal investment decisions over one period (datest0 and 1). Their utility functions have a negative exponential form, u(W)ewhere W are the future wealth levels (at t-1) The agents have different risk aversions, and their absolute risk aversion coefficients are A-0.002 and 7B-0.003. The available assets are: a risk-free bank credit and deposit, both available at the interest rate = 3%; shares of common stock of a company XYZ. with normally distributed returns. the expected return is = 9% and the volatility is = 25%. Initially, both agents hold 50 shares of company X and no cash. a) Write down the optimization problem for both agents (b) Use your class notes to write down the optimal demand for each agent, 21A and 21B, as a function of the share price Pi. (c) Use the market clearing condition to find the share price Pi in equilibrium. (d) Combine your answers to (b) and (c) to find the equilibrium demand for shares, (e) Describe what goes on in this market. Are the equilibrium share holdings different (f) What would be the optimal demand for agent B if she was infinitely risk averse? for both agents. for agent A and B? Why? How would that affect the equilibrium share price? Equilibrium asset pricing Consider a market in which two agents, A and B, are making optimal investment decisions over one period (datest0 and 1). Their utility functions have a negative exponential form, u(W)ewhere W are the future wealth levels (at t-1) The agents have different risk aversions, and their absolute risk aversion coefficients are A-0.002 and 7B-0.003. The available assets are: a risk-free bank credit and deposit, both available at the interest rate = 3%; shares of common stock of a company XYZ. with normally distributed returns. the expected return is = 9% and the volatility is = 25%. Initially, both agents hold 50 shares of company X and no cash. a) Write down the optimization problem for both agents (b) Use your class notes to write down the optimal demand for each agent, 21A and 21B, as a function of the share price Pi. (c) Use the market clearing condition to find the share price Pi in equilibrium. (d) Combine your answers to (b) and (c) to find the equilibrium demand for shares, (e) Describe what goes on in this market. Are the equilibrium share holdings different (f) What would be the optimal demand for agent B if she was infinitely risk averse? for both agents. for agent A and B? Why? How would that affect the equilibrium share price