Answered step by step

Verified Expert Solution

Question

1 Approved Answer

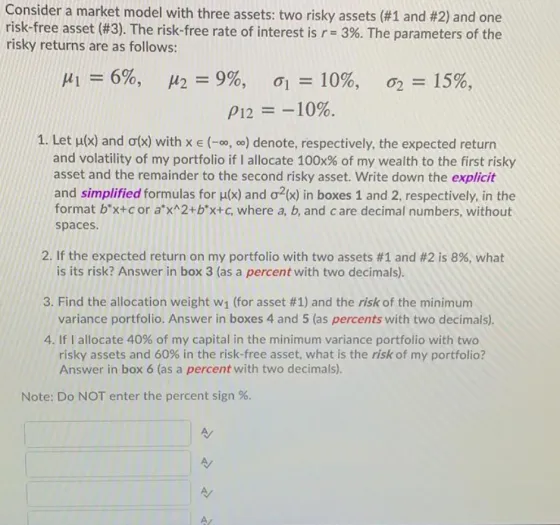

Consider a market model with three assets: two risky assets (#1 and #2) and one risk-free asset (#3). The risk-free rate of interest is

Consider a market model with three assets: two risky assets (#1 and #2) and one risk-free asset (#3). The risk-free rate of interest is r=3%. The parameters of the risky returns are as follows: = 6%, M2 = 9%, = 10%, P12 = -10%. 02 = 15%, 1. Let u(x) and (x) with x = (-0, ) denote, respectively, the expected return and volatility of my portfolio if I allocate 100x % of my wealth to the first risky asset and the remainder to the second risky asset. Write down the explicit and simplified formulas for u(x) and a2(x) in boxes 1 and 2, respectively, in the format b*x+c or a*x^2+b*x+c, where a, b, and care decimal numbers, without spaces. 2. If the expected return on my portfolio with two assets #1 and #2 is 8 %, what is its risk? Answer in box 3 (as a percent with two decimals). 3. Find the allocation weight w (for asset #1) and the risk of the minimum variance portfolio. Answer in boxes 4 and 5 (as percents with two decimals). 4. If I allocate 40% of my capital in the minimum variance portfolio with two risky assets and 60% in the risk-free asset, what is the risk of my portfolio? Answer in box 6 (as a percent with two decimals). Note: Do NOT enter the percent sign %. AL

Step by Step Solution

★★★★★

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 x 003 006x 0091x 006x 003 x 01x 0151x 201015 001x 00225 2 Risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started