Answered step by step

Verified Expert Solution

Question

1 Approved Answer

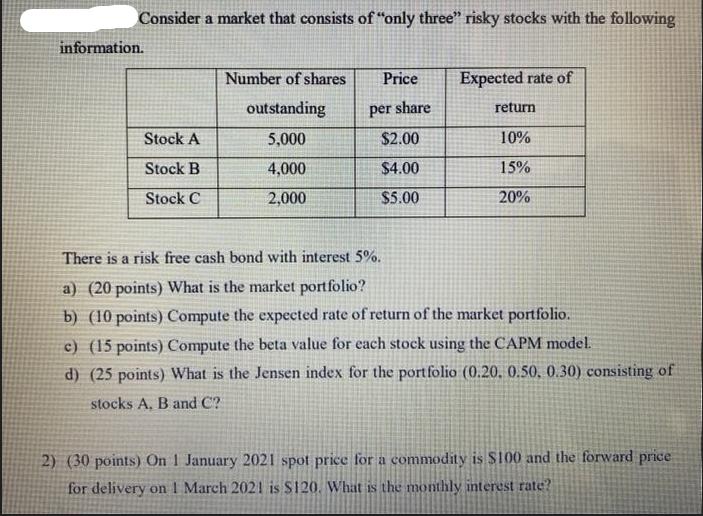

Consider a market that consists of only three risky stocks with the following information. Number of shares Price Expected rate of outstanding per share

Consider a market that consists of "only three" risky stocks with the following information. Number of shares Price Expected rate of outstanding per share return Stock A 5,000 $2.00 10% Stock B 4,000 $4.00 15% Stock C 2,000 $5.00 20% There is a risk free cash bond with interest 5%. a) (20 points) What is the market portfolio? b) (10 points) Compute the expected rate of return of the market portfolio. c) (15 points) Compute the beta value for each stock using the CAPM model. d) (25 points) What is the Jensen index for the portfolio (0.20, 0.50, 0.30) consisting of stocks A, B and C? 2) (30 points) On 1 January 2021 spot price for a commodity is $100 and the forward price for delivery on 1 March 2021 is $120. What is the monthly interest rate?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The market portfolio is a portfolio that represents the entire market and has a riskfree return In this case the market portfolio can be constructed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started