Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a market where the risk-free rate is 0.04 and the market portfolio has an expected return of 0.12 and a return variance of 0.04.

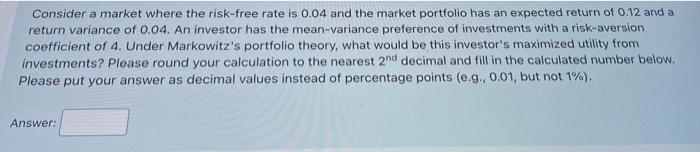

Consider a market where the risk-free rate is 0.04 and the market portfolio has an expected return of 0.12 and a return variance of 0.04. An investor has the mean-variance preference of investments with a risk-aversion coefficient of 4. Under Markowitz's portfolio theory, what would be this investor's maximized utility from investments? Please round your calculation to the nearest 2nd decimal and fill in the calculated number below. Please put your answer as decimal values instead of percentage points (e.g., 0.01, but not 1%)

Consider a market where the risk-free rate is 0.04 and the market portfolio has an expected return of 0.12 and a return variance of 0.04. An investor has the mean-variance preference of investments with a risk-aversion coefficient of 4. Under Markowitz's portfolio theory, what would be this investor's maximized utility from investments? Please round your calculation to the nearest 2nd decimal and fill in the calculated number below. Please put your answer as decimal values instead of percentage points (e.g., 0.01, but not 1%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started